Dry powder in business refers to the cash reserves or liquid assets that a company or investor keeps on hand to take advantage of investment opportunities or navigate financial challenges. Private equity firms often maintain significant dry powder to quickly acquire undervalued companies or assets during market downturns. Corporations also hold dry powder as a strategic reserve to fund innovation, expansion, or emergency expenses without needing immediate financing. In venture capital, dry powder represents unallocated funds from limited partners that can be invested in promising startups. Having dry powder enables investors to act swiftly when competitive deals arise, ensuring they can support high-potential businesses. This financial flexibility is critical for maintaining a competitive edge and sustaining growth in dynamic business environments.

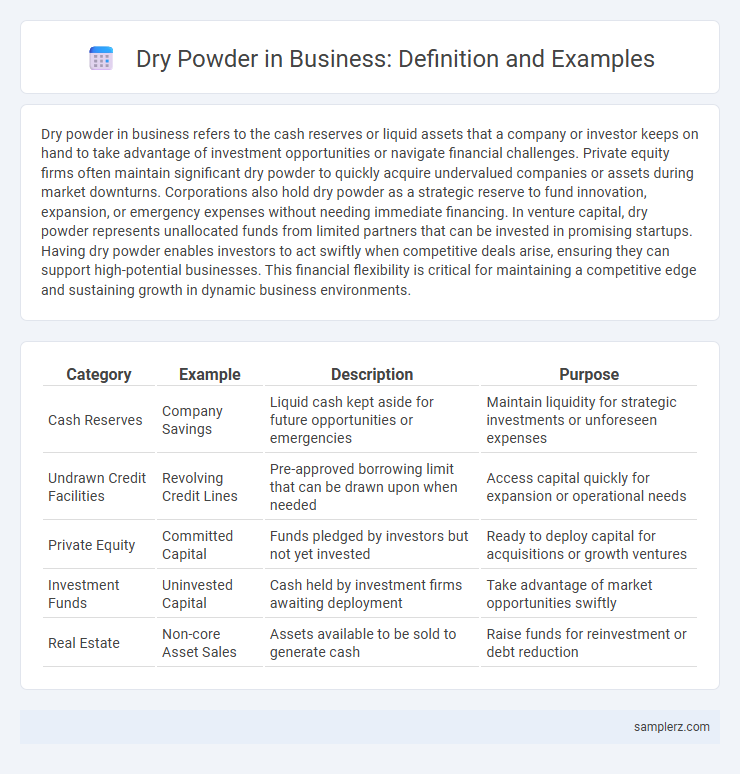

Table of Comparison

| Category | Example | Description | Purpose |

|---|---|---|---|

| Cash Reserves | Company Savings | Liquid cash kept aside for future opportunities or emergencies | Maintain liquidity for strategic investments or unforeseen expenses |

| Undrawn Credit Facilities | Revolving Credit Lines | Pre-approved borrowing limit that can be drawn upon when needed | Access capital quickly for expansion or operational needs |

| Private Equity | Committed Capital | Funds pledged by investors but not yet invested | Ready to deploy capital for acquisitions or growth ventures |

| Investment Funds | Uninvested Capital | Cash held by investment firms awaiting deployment | Take advantage of market opportunities swiftly |

| Real Estate | Non-core Asset Sales | Assets available to be sold to generate cash | Raise funds for reinvestment or debt reduction |

Understanding Dry Powder in Business Context

Dry powder in business refers to the cash reserves or liquid assets that companies or investors keep available for strategic opportunities or emergencies. Private equity firms often maintain significant dry powder to quickly capitalize on market downturns or promising acquisitions. This financial flexibility allows businesses to act decisively without relying on external financing, enhancing competitive advantage during economic uncertainty.

Real-Life Examples of Dry Powder Utilization

Private equity firms like Blackstone and KKR frequently deploy dry powder to acquire undervalued assets during market downturns, capitalizing on discounted valuations. Venture capital funds reserve dry powder to invest in high-potential startups during funding gaps, ensuring agility and rapid response to emerging opportunities. Sovereign wealth funds such as Norway's Government Pension Fund utilize dry powder strategically to stabilize portfolios and invest in distressed sectors during economic uncertainty.

Private Equity Firms and Dry Powder Reserves

Private equity firms maintain substantial dry powder reserves, often exceeding $1 trillion globally, to quickly capitalize on undervalued assets during market downturns. These reserves enable firms to deploy capital efficiently in buyouts, acquisitions, and distressed investments without relying on immediate fundraising. The strategic management of dry powder supports sustained competitive advantage and agility in dynamic financial environments.

Mergers & Acquisitions Fueled by Dry Powder

Dry powder in business often refers to the liquid assets or readily available capital that companies or investment firms hold to seize acquisition opportunities quickly. In mergers and acquisitions, private equity firms amass significant dry powder to strategically target undervalued or high-potential companies, enabling swift deal closures and competitive bidding. This reserve of capital enhances their ability to influence market dynamics, negotiate favorable terms, and drive growth through strategic acquisitions.

How Venture Capitalists Manage Dry Powder

Venture capitalists strategically allocate dry powder--uninvested capital reserved for future opportunities--to maintain flexibility in volatile markets and capitalize on high-growth startups. They balance deploying funds during market downturns to secure favorable valuations while preserving reserves for follow-on investments and unexpected prospects. Effective dry powder management enhances returns and sustains competitive advantage across investment cycles.

Corporate Cash Reserves as Dry Powder

Corporate cash reserves exemplify dry powder by providing companies with readily accessible capital to seize strategic opportunities, such as acquisitions or market expansions. These cash reserves enhance financial flexibility, allowing businesses to respond swiftly to economic downturns or competitive pressures while minimizing reliance on external financing. Maintaining substantial cash reserves as dry powder supports long-term growth and stability by ensuring liquidity during periods of market uncertainty.

Dry Powder Strategies During Economic Downturns

During economic downturns, companies employ dry powder strategies by maintaining substantial cash reserves and liquid assets to capitalize on distressed assets and investment opportunities. Private equity firms often increase their dry powder, ensuring they have the necessary capital to acquire undervalued businesses or support portfolio companies through financial hardships. This strategic allocation of dry powder enhances financial flexibility and competitive advantage when market conditions improve.

Dry Powder in Startup Investment Scenarios

Dry powder in startup investment scenarios refers to the capital that venture capital firms or investors reserve for future funding rounds, ensuring liquidity to support portfolio companies during growth or unforeseen challenges. This reserved capital enables investors to capitalize on market opportunities, sustain competitive advantage, and back startups through scaling phases or economic downturns. Maintaining sufficient dry powder is critical for maximizing returns and managing investment risk effectively in dynamic startup ecosystems.

The Role of Dry Powder in Strategic Business Growth

Dry powder in business refers to reserved capital or liquid assets kept available for strategic investments, acquisitions, or unexpected opportunities. Companies with substantial dry powder can quickly capitalize on market disruptions, fund innovation, or expand operations without relying on external financing. This financial flexibility supports sustained growth and competitive advantage by enabling timely decision-making in dynamic market conditions.

Lessons Learned from Not Using Dry Powder Efficiently

Inefficient use of dry powder in business often results in missed investment opportunities and reduced competitive advantage during market downturns. Companies that hoard cash without strategic deployment face stagnation and may lose out to more agile competitors who leverage their reserves effectively. Lessons learned emphasize the importance of timely and calculated investment to maximize growth and resilience.

example of dry powder in business Infographic

samplerz.com

samplerz.com