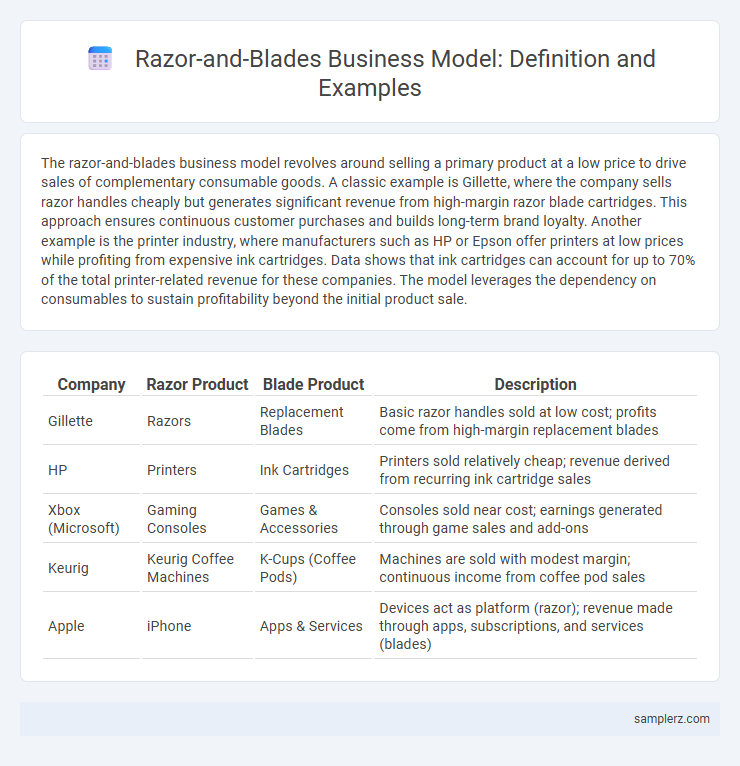

The razor-and-blades business model revolves around selling a primary product at a low price to drive sales of complementary consumable goods. A classic example is Gillette, where the company sells razor handles cheaply but generates significant revenue from high-margin razor blade cartridges. This approach ensures continuous customer purchases and builds long-term brand loyalty. Another example is the printer industry, where manufacturers such as HP or Epson offer printers at low prices while profiting from expensive ink cartridges. Data shows that ink cartridges can account for up to 70% of the total printer-related revenue for these companies. The model leverages the dependency on consumables to sustain profitability beyond the initial product sale.

Table of Comparison

| Company | Razor Product | Blade Product | Description |

|---|---|---|---|

| Gillette | Razors | Replacement Blades | Basic razor handles sold at low cost; profits come from high-margin replacement blades |

| HP | Printers | Ink Cartridges | Printers sold relatively cheap; revenue derived from recurring ink cartridge sales |

| Xbox (Microsoft) | Gaming Consoles | Games & Accessories | Consoles sold near cost; earnings generated through game sales and add-ons |

| Keurig | Keurig Coffee Machines | K-Cups (Coffee Pods) | Machines are sold with modest margin; continuous income from coffee pod sales |

| Apple | iPhone | Apps & Services | Devices act as platform (razor); revenue made through apps, subscriptions, and services (blades) |

Introduction to the Razor-and-Blades Business Model

The razor-and-blades business model exemplifies a strategy where companies sell a primary product at a low price or even at a loss, and generate profits through the high-margin sale of complementary consumables or accessories. Classic examples include Gillette selling affordable razors while profiting significantly from the ongoing sales of replacement blades. This model leverages customer dependency on consumables to drive sustained revenue and build long-term brand loyalty in competitive markets.

Key Characteristics of the Razor-and-Blades Strategy

The razor-and-blades strategy centers on selling a primary product at a low price or even at a loss, while generating significant profits through the continuous sale of complementary consumables or accessories. Key characteristics include a high dependency on repeat purchases, strong customer lock-in due to the necessity of compatible consumables, and a focus on long-term revenue streams driven by consumable sales rather than the initial hardware. This model is prominently used in industries such as printers and ink cartridges, gaming consoles and games, or electric shavers and replacement blades.

Historical Origins: Gillette Razor Case Study

Gillette pioneered the razor-and-blades business model in the early 20th century by selling affordable razors at low prices while generating recurring revenue from replacement blades. This strategy capitalized on customer lock-in, creating a steady demand for consumable blades that ensured long-term profitability. Gillette's success influenced numerous industries to adopt similar models, emphasizing initial product affordability paired with ongoing consumable sales.

Gaming Consoles: Revenue from Games and Accessories

Gaming consoles generate primary revenue through hardware sales, while substantial profits stem from the razor-and-blades model by selling high-margin games and accessories. Titles like Fortnite and Call of Duty boost recurring income via downloadable content, in-game purchases, and expansion packs. Accessories such as controllers, headsets, and VR gear further enhance revenue streams by complementing the console ecosystem.

Inkjet Printers: Low-Cost Hardware, High-Cost Cartridges

Inkjet printers exemplify the razor-and-blades business model by offering low-cost hardware while generating significant revenue through high-priced replacement ink cartridges. Manufacturers often sell printers at minimal profit or loss, incentivizing customers to purchase costly cartridges that are essential for continued use. This strategy maximizes long-term profitability by creating a recurring revenue stream from consumable supplies.

Coffee Machines and Coffee Pods: Locked-In Consumable Sales

Coffee machine manufacturers frequently utilize the razor-and-blades model by selling coffee pods compatible exclusively with their devices, ensuring ongoing revenue through locked-in consumable sales. This approach establishes a captive market where consumers must purchase branded pods at a premium, boosting profit margins on consumables rather than on the machines themselves. The strategy enhances customer retention and enables companies like Keurig and Nespresso to dominate the single-serve coffee segment through proprietary pod ecosystems.

Electric Toothbrushes and Replacement Heads

Electric toothbrushes exemplify the razor-and-blades business model by selling the main device at a competitive price while generating ongoing revenue through replacement brush heads. Brands like Oral-B and Philips Sonicare capitalize on this strategy by offering proprietary brush heads essential for optimal performance, encouraging repeat purchases. This model drives continuous customer engagement and steady profit growth in the oral care market.

Digital Cameras and Proprietary Batteries

Digital camera manufacturers often use the razor-and-blades business model by selling the camera bodies at competitive prices while generating ongoing revenue through proprietary batteries and accessories that are compatible only with their specific models. This strategy ensures consistent customer dependence on branded batteries, which are essential for camera operation and typically priced higher than generic alternatives. Such a model drives continuous sales and enhances brand loyalty within the digital imaging market.

Mobile Devices and App Ecosystems

Mobile device manufacturers often adopt the razor-and-blades model by selling smartphones at competitive prices while generating substantial revenue through app ecosystems and in-app purchases. Companies like Apple leverage the App Store to monetize applications, subscriptions, and digital content, creating a steady income stream beyond the initial hardware sale. This strategy enhances customer retention and maximizes lifetime value through continuous engagement within the mobile platform.

Lessons Learned: Razor-and-Blades Model Success Factors

Successful razor-and-blades business models hinge on initial product pricing that encourages widespread adoption, such as printers sold at low cost paired with profitable, high-margin ink cartridges. Essential factors include maintaining consistent product compatibility to foster customer loyalty and ensuring a reliable supply chain to meet ongoing demand for consumables. Data-driven insights into consumer usage patterns aid in optimizing pricing strategies and inventory management, which are critical for sustaining long-term profitability.

example of razor-and-blades in model Infographic

samplerz.com

samplerz.com