Pink sheet stocks refer to securities traded over-the-counter (OTC) and listed on the Pink Open Market, which is operated by OTC Markets Group. These stocks are typically from smaller companies that do not meet the requirements for listing on major exchanges such as the NYSE or NASDAQ. An example of a pink sheet stock is The9 Limited (Ticker: NCTY), a Chinese online gaming company whose shares trade OTC due to its smaller market capitalization and regulatory conditions. Investors often engage with pink sheet stocks to find opportunities in emerging or niche markets where companies have limited public exposure. Data on pink sheets can be less transparent compared to exchange-listed stocks, making due diligence crucial. Entities like OTC Markets provide pricing data, trading volumes, and financial statements to support investor decisions in the pink sheet market.

Table of Comparison

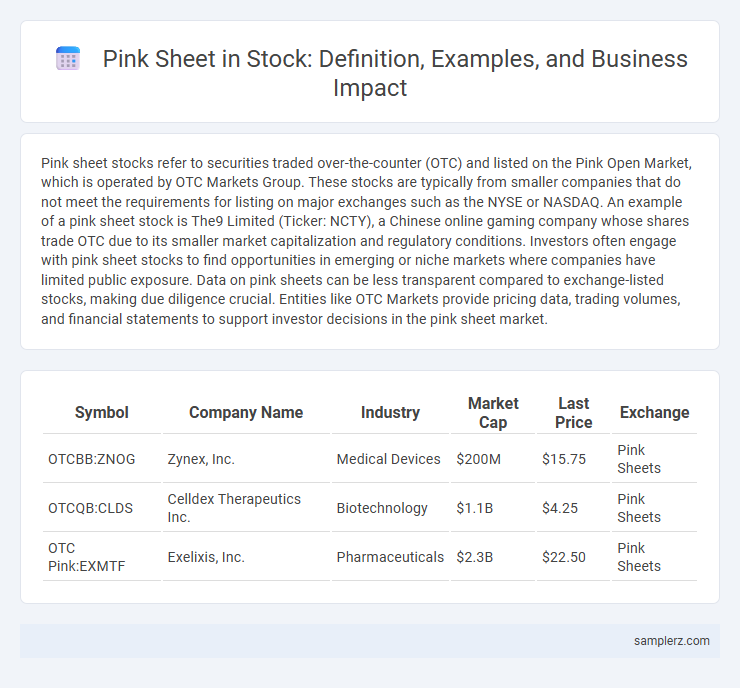

| Symbol | Company Name | Industry | Market Cap | Last Price | Exchange |

|---|---|---|---|---|---|

| OTCBB:ZNOG | Zynex, Inc. | Medical Devices | $200M | $15.75 | Pink Sheets |

| OTCQB:CLDS | Celldex Therapeutics Inc. | Biotechnology | $1.1B | $4.25 | Pink Sheets |

| OTC Pink:EXMTF | Exelixis, Inc. | Pharmaceuticals | $2.3B | $22.50 | Pink Sheets |

Understanding Pink Sheet Stocks: A Brief Overview

Pink sheet stocks refer to shares traded over-the-counter (OTC) instead of on formal exchanges like the NYSE or NASDAQ, often involving smaller, less regulated companies. These stocks are listed on the OTC Markets Group's Pink Open Market, which provides limited financial reporting and transparency requirements. Investors should approach pink sheet stocks with caution due to higher volatility and risks associated with low market capitalization and scarce market information.

Key Features of Pink Sheet Stocks

Pink sheet stocks are traded over-the-counter (OTC) rather than on major exchanges, often featuring low market capitalization and limited liquidity. These stocks typically have less stringent reporting requirements, resulting in reduced transparency and higher risk for investors. Despite volatility, pink sheet stocks can offer opportunities for speculative gains due to their accessibility to smaller companies and emerging markets.

How to Identify Pink Sheet Companies

Pink sheet companies are identified by their listing on the OTC Pink marketplace, which includes stocks not registered with the SEC and often lacks extensive financial reporting. Investors should examine the OTC Markets Group website for the Pink Sheets directory, review the company's disclosure level, and verify trading volumes to assess liquidity and legitimacy. Key indicators include limited or no audited financial statements, low market capitalization, and frequent price volatility.

Real-Life Example: Company Profile on the Pink Sheets

Over-the-counter stocks listed on the Pink Sheets often include smaller or emerging companies such as Zomedica Pharmaceuticals Corp. (ZOM), a veterinary health company focused on diagnostic and pharmaceutical products. Zomedica's Pink Sheet listing provides investors with access to its trading despite lacking a major exchange listing, reflecting the challenges and opportunities for companies in niche markets. The company's profile highlights its ongoing clinical development efforts and market potential within the veterinary sector.

Case Study: Success Story of a Pink Sheet Stock

Over-the-counter stock BrightTech Innovations soared from $0.15 to $4.50 per share within 18 months, demonstrating a textbook success story of a pink sheet stock. Strategic partnerships and aggressive product development propelled revenue from $2 million to $20 million annually, attracting institutional investors. The company's listing on the OTC Pink Market highlighted how transparency and innovation can transform penny stocks into legitimate growth opportunities.

Risks Associated with Investing in Pink Sheet Stocks

Pink sheet stocks are traded over-the-counter with limited regulatory oversight, posing significant risks such as low liquidity, high volatility, and lack of transparent financial information. Investors often face difficulties in obtaining reliable data, increasing the potential for fraud and market manipulation. These characteristics make pink sheet stocks highly speculative and suitable only for risk-tolerant investors prepared for possible significant losses.

Compliance and Reporting: Pink Sheet Stock Requirements

Pink sheet stocks require strict compliance with SEC regulations despite being traded over-the-counter, emphasizing transparency in financial reporting. Companies must submit audited financial statements and disclose material information regularly to maintain investor trust and meet regulatory standards. Failure to adhere to these reporting requirements can result in delisting or trading restrictions, impacting liquidity and market reputation.

Comparing Pink Sheets vs. Major Stock Exchanges

Pink sheets represent over-the-counter (OTC) stocks traded via electronic quotation systems, often featuring smaller or less-regulated companies compared to major stock exchanges like the NYSE or NASDAQ. Unlike these exchanges, pink sheets lack stringent listing requirements, resulting in lower transparency, higher volatility, and increased risk for investors. Investors typically consider liquidity and regulatory oversight when comparing pink sheets, which often appeal to speculative traders rather than institutional investors.

How to Trade Pink Sheet Stocks: Step-by-Step Guide

Trading Pink Sheet stocks involves researching companies listed on the OTC Markets, known for less stringent reporting requirements and higher volatility. Investors should start by identifying a Pink Sheet stock through platforms like OTC Markets Group, then analyze financials, market trends, and news using reliable financial tools. Executing trades requires using a brokerage account that supports OTC trading, placing limit orders to control price volatility, and continuously monitoring the stock due to its higher risk profile.

Investor Insights: Why Pink Sheet Stocks May Attract Attention

Pink sheet stocks often represent smaller, less established companies that trade over-the-counter (OTC), attracting investors seeking high-risk, high-reward opportunities. These stocks typically offer lower liquidity and higher volatility, which can result in significant price swings benefiting speculative investors. Understanding the unique market dynamics and thorough research on pink sheet companies is essential for investors aiming to capitalize on potential growth while managing risks effectively.

example of pink sheet in stock Infographic

samplerz.com

samplerz.com