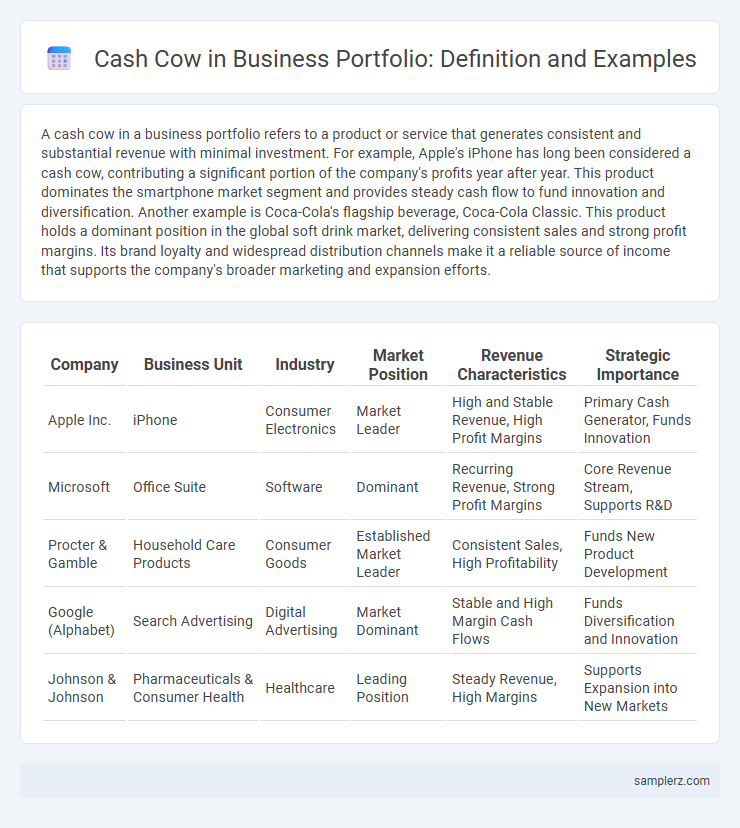

A cash cow in a business portfolio refers to a product or service that generates consistent and substantial revenue with minimal investment. For example, Apple's iPhone has long been considered a cash cow, contributing a significant portion of the company's profits year after year. This product dominates the smartphone market segment and provides steady cash flow to fund innovation and diversification. Another example is Coca-Cola's flagship beverage, Coca-Cola Classic. This product holds a dominant position in the global soft drink market, delivering consistent sales and strong profit margins. Its brand loyalty and widespread distribution channels make it a reliable source of income that supports the company's broader marketing and expansion efforts.

Table of Comparison

| Company | Business Unit | Industry | Market Position | Revenue Characteristics | Strategic Importance |

|---|---|---|---|---|---|

| Apple Inc. | iPhone | Consumer Electronics | Market Leader | High and Stable Revenue, High Profit Margins | Primary Cash Generator, Funds Innovation |

| Microsoft | Office Suite | Software | Dominant | Recurring Revenue, Strong Profit Margins | Core Revenue Stream, Supports R&D |

| Procter & Gamble | Household Care Products | Consumer Goods | Established Market Leader | Consistent Sales, High Profitability | Funds New Product Development |

| Google (Alphabet) | Search Advertising | Digital Advertising | Market Dominant | Stable and High Margin Cash Flows | Funds Diversification and Innovation |

| Johnson & Johnson | Pharmaceuticals & Consumer Health | Healthcare | Leading Position | Steady Revenue, High Margins | Supports Expansion into New Markets |

Understanding the Cash Cow Concept in Business Portfolios

A classic example of a cash cow in a business portfolio is Apple's iPhone, which consistently generates substantial revenue with relatively low investment due to its strong market position and brand loyalty. Cash cows provide steady cash flow that funds other segments and supports company growth without requiring significant capital infusion. Companies strategically manage these mature products to maximize profitability while minimizing new development costs.

Key Characteristics of Cash Cow Products

Cash cow products exhibit high market share within a mature, slow-growth industry, generating consistent and substantial cash flow with minimal investment. These products typically have established brand loyalty, low production costs, and stable demand, ensuring profitability and funding for other business areas. Their key characteristics include strong competitive advantage, predictable revenue streams, and the ability to finance innovation and market expansion.

Classic Examples of Cash Cows in Leading Companies

Apple's iPhone serves as a prime cash cow, generating substantial revenue and profit that fund innovation and new product development. Microsoft's Office Suite maintains consistent demand and high-margin sales, providing reliable cash flow within its product portfolio. Procter & Gamble's Tide detergent exemplifies a cash cow, sustaining market leadership and steady profits amid competitive consumer goods markets.

How Cash Cows Drive Business Stability and Growth

A cash cow in a business portfolio often refers to a mature product or service that generates consistent, high cash flow with minimal investment, such as Apple's iPhone legacy models or Coca-Cola's flagship beverages. These reliable revenue streams fund innovation and expansion initiatives, ensuring business stability even during market fluctuations. By leveraging cash cows effectively, companies can reinvest profits into emerging opportunities, driving sustained growth and competitive advantage.

Case Study: Apple’s iPhone as a Cash Cow

Apple's iPhone exemplifies a cash cow within its product portfolio, consistently generating substantial revenue and high profit margins since its 2007 launch. Dominating the global smartphone market with over 250 million units sold annually, the iPhone leverages strong brand loyalty and an integrated ecosystem to sustain steady cash flow. This reliable income enables Apple to invest heavily in innovation and diversify its offerings, securing long-term financial stability.

Cash Cows vs. Stars: Portfolio Management Insights

A classic example of a cash cow in portfolio management is Apple's iPhone, which generates consistent and substantial revenue with minimal investment. In contrast, stars like Tesla's electric vehicles demand significant funding to sustain rapid growth despite their strong market position. Effective portfolio management balances cash cows' steady cash flow to fuel stars' ambitious expansion strategies.

Cash Flow Impact of Cash Cows on Overall Strategy

Cash cows, such as Apple's iPhone product line, generate strong and consistent cash flow that supports investment in higher-risk ventures within a diversified portfolio. The steady revenue from these mature assets funds research and development initiatives and marketing efforts, enhancing overall competitive advantage. Efficient cash flow management from cash cows ensures sustainable growth and financial stability in the company's strategic planning.

Lifecycle of a Cash Cow Product

A cash cow product typically resides in the maturity stage of its lifecycle, characterized by steady sales and high market share with minimal investment required. Companies leverage these products to generate consistent cash flow, often funding other business units or innovation projects. Over time, maintaining competitive advantage and managing market saturation become critical to sustaining profitability.

Leveraging Cash Cows for Strategic Investments

Leveraging cash cows like Apple's iPhone product line enables companies to generate consistent high cash flow that funds research and development in emerging markets. These profitable business units provide stable revenue streams, allowing firms to invest strategically in innovation and diversification without risking financial instability. By capitalizing on cash cows, organizations can maintain competitive advantage while exploring new growth opportunities.

Best Practices for Managing Cash Cows in a Portfolio

A classic example of a cash cow in a business portfolio is Apple's iPhone product line, which consistently generates substantial revenue with high market share in a mature market. Best practices for managing cash cows include reinvesting profits to sustain competitive advantage, maintaining operational efficiency to maximize cash flow, and allocating surplus funds to support growth opportunities in other portfolio areas. Regular market analysis ensures the cash cow remains profitable while adapting to evolving consumer demands.

example of cash cow in portfolio Infographic

samplerz.com

samplerz.com