A drag-along right in a shareholder agreement allows majority shareholders to compel minority shareholders to join in the sale of a company. For example, if shareholders holding 75% of the shares agree to sell the business to a third party, the remaining 25% shareholders must also sell their shares under the same terms. This provision helps facilitate smooth transactions by ensuring potential buyers acquire 100% ownership without minority holdouts. In practice, a drag-along right might trigger when a startup's lead investors decide to exit through acquisition. The investor holding the majority decides to sell 80% of the business to a larger corporation. Minority shareholders are obligated to sell their shares at the determined price, aligning all parties for a unified transaction and preventing deal disruptions.

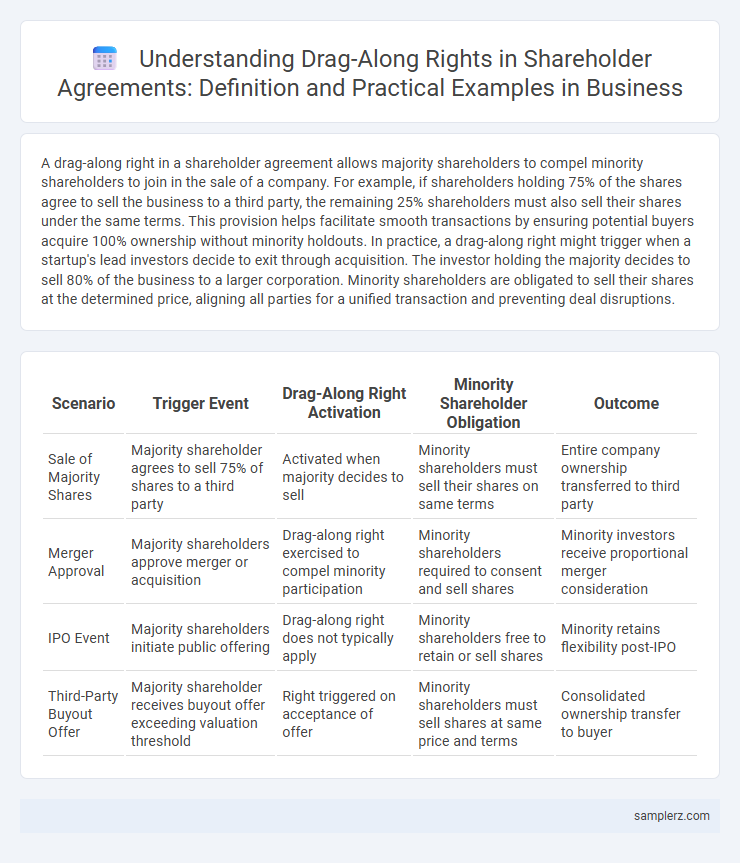

Table of Comparison

| Scenario | Trigger Event | Drag-Along Right Activation | Minority Shareholder Obligation | Outcome |

|---|---|---|---|---|

| Sale of Majority Shares | Majority shareholder agrees to sell 75% of shares to a third party | Activated when majority decides to sell | Minority shareholders must sell their shares on same terms | Entire company ownership transferred to third party |

| Merger Approval | Majority shareholders approve merger or acquisition | Drag-along right exercised to compel minority participation | Minority shareholders required to consent and sell shares | Minority investors receive proportional merger consideration |

| IPO Event | Majority shareholders initiate public offering | Drag-along right does not typically apply | Minority shareholders free to retain or sell shares | Minority retains flexibility post-IPO |

| Third-Party Buyout Offer | Majority shareholder receives buyout offer exceeding valuation threshold | Right triggered on acceptance of offer | Minority shareholders must sell shares at same price and terms | Consolidated ownership transfer to buyer |

Understanding Drag-Along Rights in Shareholder Agreements

Drag-along rights in shareholder agreements enable majority shareholders to compel minority shareholders to join in the sale of a company, ensuring a smooth transaction with full ownership transfer. These rights are commonly exercised when a majority investor finds a buyer for their shares and wants to prevent minority holdouts from blocking the deal. This provision protects the interests of majority shareholders by facilitating exit strategies and maintaining transaction efficiency in mergers and acquisitions.

Key Components of a Drag-Along Right Clause

A drag-along right clause in a shareholder agreement typically includes key components such as the triggering events that activate the right, the minimum percentage of shareholders required to initiate the sale, and the obligation for minority shareholders to sell their shares on the same terms and conditions. It also specifies the notice period for the proposed sale, the process for valuation and payment, and protections ensuring fair treatment of all shareholders. These elements ensure that majority shareholders can compel minority shareholders to join in a sale, facilitating smoother exit strategies and maximizing value for all parties involved.

Example Scenario: Enforcing Drag-Along Rights

In a shareholder agreement, drag-along rights allow majority shareholders to compel minority shareholders to join in the sale of the company under the same terms, ensuring a unified exit strategy. For instance, when a majority shareholder secures a lucrative acquisition deal, they can enforce drag-along rights to obligate all minority shareholders to sell their shares, preventing holdouts that could jeopardize the transaction. This mechanism safeguards the selling party's ability to maximize value and facilitates smoother, more efficient deal closures.

Typical Terms of Drag-Along Provisions

Drag-along rights typically require minority shareholders to sell their shares if a majority shareholder accepts a third-party offer, ensuring unified sale terms and maximizing the value of the transaction. These provisions often specify the percentage of shareholders needed to trigger the right, the notice period before the sale, and the requirement that all shares be sold on the same terms and conditions. The aim is to prevent minority shareholders from blocking a lucrative offer, facilitating smoother exits and enhancing investor confidence in the shareholder agreement.

Legal Implications for Minority Shareholders

A drag-along right in a shareholder agreement enables majority shareholders to compel minority shareholders to join in the sale of a company, potentially limiting minority shareholders' control over the timing and terms of a sale. This legal mechanism may force minority shareholders to sell their shares on terms negotiated by the majority, raising concerns about valuation fairness and equitable treatment. Courts often scrutinize such clauses to ensure that minority shareholders receive fair compensation and that their rights are not unduly compromised during the transaction.

Case Study: Drag-Along Right in Startup Acquisition

In a startup acquisition, a drag-along right allowed majority shareholders to compel minority investors to join the sale of the company to a strategic buyer at a valuation of $50 million, ensuring a smooth exit process. This provision protected the majority by preventing holdouts from blocking the deal, thereby facilitating a unified transaction. The shareholder agreement clearly outlined the conditions triggering the drag-along right, including notification periods and sale terms, which streamlined the acquisition and maximized shareholder value.

Negotiation Strategies for Drag-Along Clauses

In shareholder agreements, negotiation strategies for drag-along clauses often involve clearly defining triggering events, such as the sale of a majority stake or change of control, to protect minority shareholders while enabling majority shareholders to maximize exit value. Careful consideration of valuation methods and notice periods ensures fairness and reduces disputes during forced sales. Including specific carve-outs or exceptions can provide minority stakeholders with limited protection without undermining the strategic purpose of the drag-along right.

Differences Between Drag-Along and Tag-Along Rights

Drag-along rights allow majority shareholders to compel minority shareholders to join in the sale of a company, ensuring the sale proceeds smoothly without holdouts, whereas tag-along rights protect minority shareholders by providing them the option to sell their shares alongside majority shareholders. In a shareholder agreement, drag-along rights are triggered when the majority decides to sell, forcing others to sell under the same terms, while tag-along rights are optional for minority owners to participate in a sale without obligation. The key difference lies in enforcement: drag-along rights are mandatory for minority shareholders, whereas tag-along rights offer protective, voluntary participation.

Drafting Tips for Drag-Along Provisions

Drafting effective drag-along provisions in shareholder agreements requires clear definitions of triggering events and the scope of obligations for minority shareholders. Specify the terms under which majority shareholders can compel minority shareholders to join a sale, including price, payment terms, and notice periods, to prevent future disputes. Incorporating precise language on exit scenarios and valuation methods ensures enforceability and aligns shareholder interests during acquisition processes.

Preventing Disputes: Best Practices for Drag-Along Rights

Including clear and precise language in drag-along rights clauses within shareholder agreements significantly reduces the risk of disputes by defining triggering events and notice requirements. Specifying fair valuation methods and outlining minority shareholders' obligations ensures transparency and protects all parties involved. Regularly reviewing and updating these provisions aligns them with evolving business conditions and legal standards, fostering smoother transaction outcomes.

example of drag-along right in shareholder agreement Infographic

samplerz.com

samplerz.com