A prominent example of a shark in venture capital is Mark Cuban, known for his aggressive investment style and keen eye for promising startups. As a billionaire entrepreneur and investor, Cuban has backed numerous companies through his role on the television show Shark Tank, providing both capital and mentorship. His investments often target innovative technologies and consumer products with high growth potential. Another notable venture shark is Barbara Corcoran, who transformed her real estate business into a successful empire before becoming a key investor on Shark Tank. Corcoran leverages her industry expertise and business acumen to identify startups with scalable models and strong market demand. Her strategic investments focus on consumer-facing businesses, particularly those related to lifestyle, food, and fashion sectors.

Table of Comparison

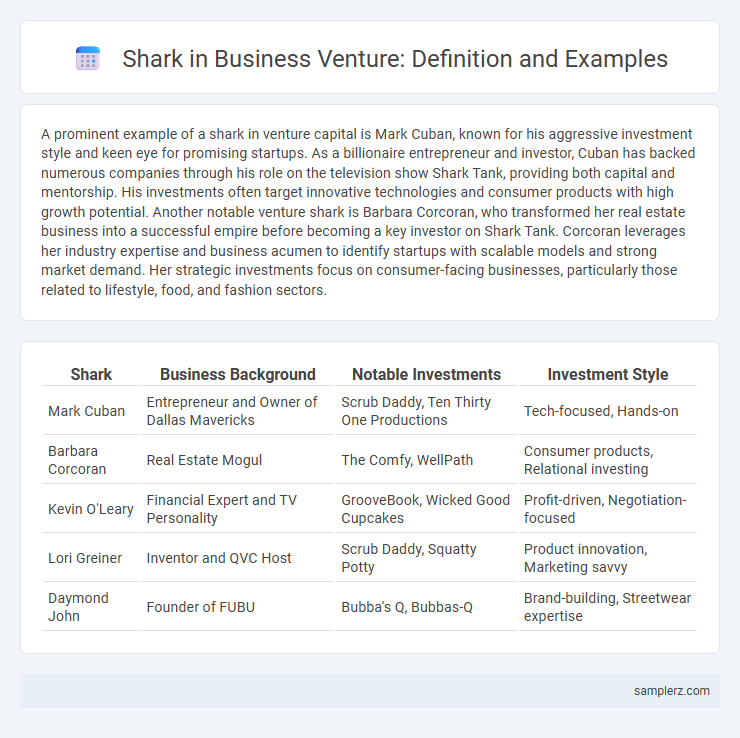

| Shark | Business Background | Notable Investments | Investment Style |

|---|---|---|---|

| Mark Cuban | Entrepreneur and Owner of Dallas Mavericks | Scrub Daddy, Ten Thirty One Productions | Tech-focused, Hands-on |

| Barbara Corcoran | Real Estate Mogul | The Comfy, WellPath | Consumer products, Relational investing |

| Kevin O'Leary | Financial Expert and TV Personality | GrooveBook, Wicked Good Cupcakes | Profit-driven, Negotiation-focused |

| Lori Greiner | Inventor and QVC Host | Scrub Daddy, Squatty Potty | Product innovation, Marketing savvy |

| Daymond John | Founder of FUBU | Bubba's Q, Bubbas-Q | Brand-building, Streetwear expertise |

Defining Shark Investors in Venture Capital

Shark investors in venture capital are aggressive financiers known for taking significant equity stakes in early-stage startups with high growth potential. These individuals leverage deep industry expertise, strategic networks, and assertive negotiation tactics to secure favorable terms and influence company direction. Their investments often drive rapid scaling, making them critical catalysts in the venture ecosystem.

Key Characteristics of Venture Sharks

Venture sharks are known for their aggressive investment style, demonstrating a high tolerance for risk and a keen ability to identify scalable startups with disruptive potential. They prioritize equity stakes and exert significant control over company decisions to drive rapid growth and maximize returns. Their expertise includes sharp negotiation tactics, deep industry knowledge, and a robust network that accelerates business development and access to capital.

Famous Examples of Shark Investors

Famous shark investors like Mark Cuban, Barbara Corcoran, and Kevin O'Leary have become synonymous with venture success through their strategic investments on Shark Tank. Mark Cuban's stakes in companies such as Cyber Dust and Ten Thirty One Productions highlight his keen eye for tech and entertainment startups. Barbara Corcoran's early backing of The Comfy and Kevin O'Leary's investment in Wicked Good Cupcakes demonstrate their ability to identify promising consumer brands with high growth potential.

High-Profile Shark Deals in Startups

High-profile shark deals in startups exemplify strategic investments where experienced venture capitalists infuse significant capital and expertise to scale emerging companies rapidly. Deals like Mark Cuban's investment in cybersecurity firm Tenable and Lori Greiner's backing of innovative consumer product brand Scrub Daddy highlight the transformative impact of shark involvement. These partnerships not only provide financial resources but also crucial mentorship, accelerating growth trajectories and market penetration.

Advantages of Having a Shark in Your Corner

Having a shark in your corner during venture capital negotiations provides unmatched access to extensive industry networks and strategic guidance, accelerating business growth and market entry. Their seasoned expertise in scaling startups ensures smarter decision-making and resource allocation, reducing risks and maximizing ROI. This partnership often opens doors to subsequent funding rounds and valuable mentorship, creating a competitive edge in the entrepreneurial landscape.

Risks and Drawbacks of Shark Investments

Shark investments often involve aggressive financing strategies that can lead to significant equity dilution for founders, undermining their control over the company. These investors may impose stringent terms, such as high-interest rates or rigid exit timelines, increasing financial and operational pressures. The confrontational negotiation style typical of shark investors can create conflicts, disrupting team dynamics and long-term strategic vision.

What Attracts Sharks to a Venture

Sharks in venture capital are attracted to startups with scalable business models, strong market potential, and innovative solutions addressing pressing industry challenges. They look for ventures demonstrating clear traction, a competitive edge, and capable leadership teams with a proven track record. Financial metrics such as revenue growth, customer acquisition, and profitability projections play crucial roles in capturing shark investors' interest.

Negotiation Tactics Used by Venture Sharks

Venture sharks typically leverage aggressive negotiation tactics such as leveraging their industry connections to evaluate startup valuations critically and demanding equity stakes that secure significant control. They exploit information asymmetry by thoroughly analyzing financial statements and market potential to intimidate founders into accepting lower valuations. Strategic use of time pressure and conditional offers often forces startups to make quick decisions favorable to the investor's long-term interests.

Lessons Learned from Shark-Backed Startups

Shark-backed startups frequently demonstrate agile pivoting and disciplined capital management as key factors in their growth trajectory. Successful ventures emphasize clear alignment with investors' expertise, leveraging mentorship to refine product-market fit and scale operations effectively. Common lessons include the importance of transparent communication, rigorous financial oversight, and strategic partnerships to navigate competitive markets.

How to Approach and Pitch to a Shark Investor

When approaching a shark investor, research their investment portfolio and interests to tailor your pitch effectively. Highlight a clear value proposition, demonstrate strong market potential with quantifiable data, and present a scalable business model. Engage with concise storytelling, backed by financial projections, while anticipating tough questions to build credibility and trust.

example of shark in venture Infographic

samplerz.com

samplerz.com