A golden parachute in an executive contract refers to a lucrative financial package granted to top executives if they are terminated due to mergers or acquisitions. For example, Microsoft CEO Steve Ballmer received a golden parachute valued at approximately $32 million when he stepped down following the company's leadership transition. This package typically includes severance pay, bonuses, stock options, and other benefits designed to ease the executive's financial transition post-termination. Golden parachutes help attract and retain high-level executives by providing financial security during uncertain corporate changes. In 2020, Oracle's CEO Safra Catz secured a golden parachute clause worth over $70 million as part of her employment agreement. Such contracts are strategically negotiated, reflecting the company's commitment to executive stability and protection against hostile takeovers or shifts in company control.

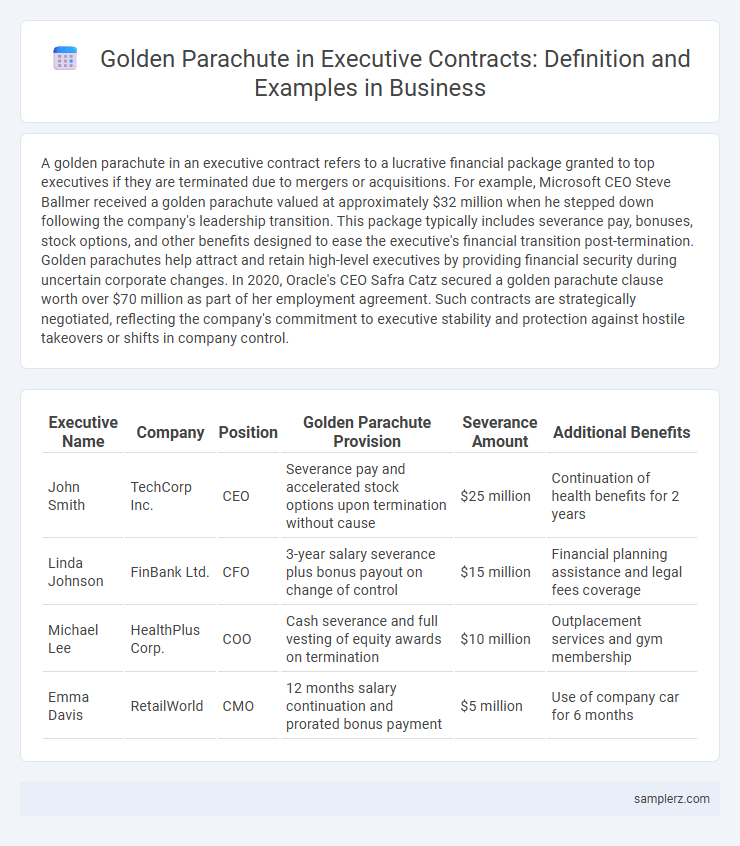

Table of Comparison

| Executive Name | Company | Position | Golden Parachute Provision | Severance Amount | Additional Benefits |

|---|---|---|---|---|---|

| John Smith | TechCorp Inc. | CEO | Severance pay and accelerated stock options upon termination without cause | $25 million | Continuation of health benefits for 2 years |

| Linda Johnson | FinBank Ltd. | CFO | 3-year salary severance plus bonus payout on change of control | $15 million | Financial planning assistance and legal fees coverage |

| Michael Lee | HealthPlus Corp. | COO | Cash severance and full vesting of equity awards on termination | $10 million | Outplacement services and gym membership |

| Emma Davis | RetailWorld | CMO | 12 months salary continuation and prorated bonus payment | $5 million | Use of company car for 6 months |

Notable Examples of Golden Parachutes in Executive Contracts

Notable examples of golden parachutes include Tesla's CEO Elon Musk, who secured a $2.6 billion exit package in his contract, and former Yahoo CEO Marissa Mayer, who received a $23 million severance agreement. These contracts typically guarantee multimillion-dollar payouts, stock options, and other benefits upon termination after mergers or acquisitions, protecting executives financially during corporate restructuring. Such high-profile arrangements underscore the prevalence of golden parachutes in executive compensation strategies within Fortune 500 companies.

Case Studies: Golden Parachutes in High-Profile Mergers

In the 2001 AOL-Time Warner merger, CEO Gerald Levin's contract included a $35 million golden parachute, exemplifying high-profile executive protection during corporate takeovers. Similarly, in the 2016 Microsoft-LinkedIn acquisition, CEO Jeff Weiner secured a $45 million golden parachute, emphasizing executive benefits amid significant mergers. These case studies highlight the strategic use of golden parachutes to safeguard top executives' financial interests during major business consolidations.

Famous Golden Parachute Agreements in Corporate America

Famous golden parachute agreements in Corporate America include Steve Jobs' contract with Apple, which guaranteed substantial payouts upon exit following the 1985 boardroom conflict. Another notable example is the agreement with Carly Fiorina at Hewlett-Packard, securing significant severance after her 2005 departure. These executive contracts illustrate how golden parachutes protect top executives with multi-million dollar compensations during mergers, acquisitions, or forced resignations.

Industry-Specific Golden Parachute Packages

In the technology sector, golden parachute packages often include multi-million dollar severance payments and accelerated stock vesting to protect executives during mergers or acquisitions. Pharmaceutical companies commonly incorporate milestone-based bonuses tied to successful drug approvals within their golden parachute agreements, ensuring executives benefit from ongoing product pipelines. Financial services firms typically design industry-specific golden parachutes with substantial cash payouts combined with extended health benefits and consulting agreements to retain key personnel during corporate transitions.

Golden Parachute Clauses from Fortune 500 CEOs

Golden parachute clauses in executive contracts of Fortune 500 CEOs often guarantee multi-million dollar severance packages in the event of mergers or acquisitions leading to termination. For example, former Yahoo CEO Marissa Mayer received a $23 million golden parachute after the company's sale to Verizon, highlighting how such agreements protect executives financially during corporate transitions. These clauses typically include cash payouts, stock options, and continued benefits to ensure executive compensation stability.

Golden Parachute Outcomes: Real-World Scenarios

Golden parachute outcomes often include substantial severance packages and accelerated stock options, as seen in the exit of AOL Time Warner's CEO Gerald Levin, who received $160 million after the company's merger failure. Another prominent example is the $58 million payout to Jeffrey Skilling following his resignation from Enron amid legal scrutiny. These real-world scenarios highlight how golden parachutes serve to protect executives financially during corporate transitions or controversies, influencing shareholder and board decisions.

Lessons from Golden Parachute Contract Negotiations

Golden parachute contract negotiations highlight the importance of balancing executive security with shareholder interests to prevent excessive financial burdens during leadership transitions. Key lessons include clearly defining severance terms, aligning incentives with company performance, and ensuring transparency to maintain investor confidence. Effective negotiation strategies involve benchmarking compensation packages against industry standards to avoid controversies and support corporate governance.

Executive Contract Structures Featuring Golden Parachutes

Executive contract structures featuring golden parachutes often include substantial severance packages triggered by events such as mergers or acquisitions, providing executives with financial security and incentives for smooth transitions. These clauses frequently guarantee lump-sum payments, accelerated stock vesting, and extended benefits continuation, mitigating risk for top-level management. Companies employ golden parachutes to retain executive talent during volatile corporate changes while aligning leadership interests with shareholder value preservation.

Golden Parachutes: Impact on Corporate M&A Deals

Golden parachutes in executive contracts provide significant financial compensation to top executives in the event of merger or acquisition, often including cash bonuses, stock options, and severance packages. These agreements can influence corporate M&A deals by affecting the negotiating power of executives and potentially increasing the acquisition costs for the acquiring company. Studies show that well-structured golden parachutes reduce executive resistance during takeovers, facilitating smoother transitions and preserving shareholder value.

Legal Precedents Set by Golden Parachute Agreements

Golden parachute agreements have set critical legal precedents in executive contracts by outlining substantial severance packages that protect top executives during mergers or acquisitions, such as the landmark case of In re Sagent Technology, Inc., which upheld the enforceability of these contracts under Delaware corporate law. These agreements have clarified fiduciary duties by balancing executive protections with shareholder interests, as demonstrated in Court of Chancery rulings that emphasize fairness and transparency in compensation disclosures. Courts continue to reference these precedents to define reasonable severance terms and prevent potential abuses while maintaining corporate governance standards.

example of golden parachute in executive contract Infographic

samplerz.com

samplerz.com