Greenmail in business mergers occurs when a company buys a substantial block of another company's shares and threatens a hostile takeover. The target company then repurchases the shares at a premium to prevent the takeover, resulting in a financial gain for the initial shareholder. This tactic creates a significant financial burden on the target firm and can affect shareholder value. An illustrative example of greenmail involved the 1980s merger battles, including the case of Gulf Oil. Investors purchased large shares of Gulf Oil, prompting the company to buy back the shares at a high premium to avoid a hostile takeover. This situation highlights how greenmail can serve as a defensive strategy but also raises concerns about corporate governance and shareholder interests.

Table of Comparison

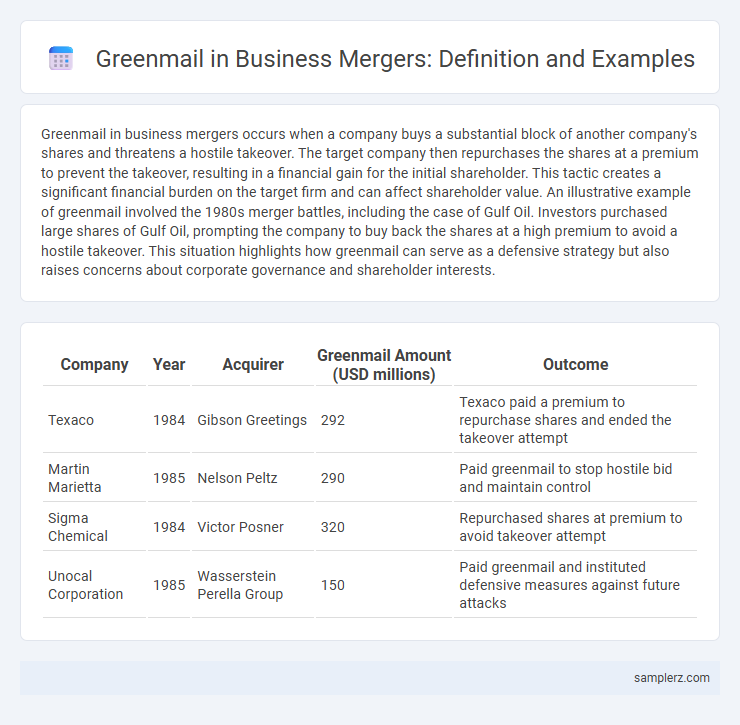

| Company | Year | Acquirer | Greenmail Amount (USD millions) | Outcome |

|---|---|---|---|---|

| Texaco | 1984 | Gibson Greetings | 292 | Texaco paid a premium to repurchase shares and ended the takeover attempt |

| Martin Marietta | 1985 | Nelson Peltz | 290 | Paid greenmail to stop hostile bid and maintain control |

| Sigma Chemical | 1984 | Victor Posner | 320 | Repurchased shares at premium to avoid takeover attempt |

| Unocal Corporation | 1985 | Wasserstein Perella Group | 150 | Paid greenmail and instituted defensive measures against future attacks |

Defining Greenmail in the Context of Mergers

Greenmail in mergers refers to a situation where an acquiring company or investor purchases a substantial stake in a target firm and threatens a hostile takeover, prompting the target company to buy back the shares at a premium to prevent the takeover. This tactic exploits the threat of a merger or acquisition to extract a financial gain without proceeding with a full takeover. Greenmail often disrupts merger negotiations and can lead to increased costs and strategic setbacks for the targeted business.

Historical Overview: Famous Greenmail Cases

Historical greenmail cases feature prominent mergers such as the 1980s battle between T. Boone Pickens and Gulf Oil, where Pickens acquired a large stake to pressure a buyback at a premium. Another notable instance includes the takeover attempt by Sir James Goldsmith targeting the Goodyear Tire & Rubber Company, resulting in a lucrative greenmail settlement. These examples highlight the strategic use of greenmail as a defensive tactic during hostile takeovers in corporate mergers.

How Greenmail Tactics Are Used in M&A Transactions

Greenmail tactics in M&A transactions involve a potential acquirer purchasing a significant stake in the target company and threatening a hostile takeover to force the target to buy back shares at a premium. This strategy pressures the target's management to pay a substantial greenmail premium to the acquirer, protecting themselves from unwanted acquisition attempts. Companies often implement defensive measures like poison pills or shareholder rights plans to counteract greenmail threats during merger negotiations.

Notable Examples of Greenmail in Corporate Mergers

Notable examples of greenmail in corporate mergers include the 1980s case of Gulf Oil, where investor T. Boone Pickens purchased a significant stake and pressured the company to repurchase shares at a premium, profiting substantially. Another prominent incident involved Nabisco in the 1980s, where investor Sir James Goldsmith used greenmail tactics to force the company into a buyback arrangement. These cases highlight how greenmail can impact merger negotiations by leveraging large shareholdings to extract financial concessions.

High-Profile Greenmailers: Key Players in Merger Scenarios

High-profile greenmailers like Carl Icahn and T. Boone Pickens have significantly influenced merger scenarios by acquiring substantial shares in target companies and threatening hostile takeovers to demand hefty premiums on their stock repurchases. Their strategic stock accumulation often forces acquiring firms to reconsider deal valuations, impacting shareholder outcomes and merger dynamics. These key players leverage greenmail tactics to extract substantial financial gains while reshaping corporate control landscapes during mergers.

Legal and Ethical Implications of Greenmail during Mergers

Greenmail in mergers involves a target company repurchasing its own shares at a premium to prevent a hostile takeover, raising significant legal concerns surrounding shareholder rights and fair market practices. Ethically, greenmail can undermine investor confidence by prioritizing short-term management protection over long-term shareholder value and company stability. Regulatory scrutiny often intensifies as greenmail tactics may violate securities laws designed to prevent market manipulation and promote transparent mergers.

Corporate Defense Strategies Against Greenmail

Corporate defense strategies against greenmail in mergers often include poison pills, which dilute the value of shares to discourage hostile takeovers. Companies may also implement shareholder rights plans that allow existing investors to purchase additional shares at a discount, making greenmail less attractive. Another common tactic involves accelerating the issuance of stock options to management, increasing insider control and complicating buyout attempts.

The Financial Impact of Greenmail on Merging Companies

Greenmail in mergers often results in substantial financial losses for acquiring companies due to the premium paid to repurchase shares from the greenmailer, typically exceeding market value by 20% to 50%. This practice drains corporate resources, reducing available capital for strategic investments and operational growth, ultimately diminishing shareholder value. Studies show that firms targeted by greenmail experience an average drop in stock price by 5% to 10% following the transaction, reflecting investor concerns about management decisions and financial stability.

Regulatory Responses to Greenmail in M&A Activities

Regulatory responses to greenmail in M&A activities include the implementation of anti-greenmail provisions under the Williams Act and the enactment of state-level poison pill measures that deter hostile bidding tactics. The SEC enforces disclosure requirements to increase transparency around shareholder accumulation and potential greenmail payments, reducing market manipulation risks. Courts have upheld fiduciary duties that prevent directors from approving greenmail payments that do not serve shareholder interests, reinforcing regulatory deterrence.

Lessons Learned: Preventing Greenmail in Future Mergers

Implementing robust shareholder rights plans and conducting thorough due diligence can effectively prevent greenmail in mergers by deterring hostile takeovers and reducing vulnerabilities to greenmailers. Companies that establish clear communication channels and maintain transparent negotiation strategies often avoid costly greenmail payouts, preserving shareholder value and ensuring smoother merger processes. Lessons learned from past greenmail incidents emphasize the importance of proactive corporate governance and strategic defensive measures to safeguard against exploitative tactics.

example of greenmail in merger Infographic

samplerz.com

samplerz.com