A tender offer in business occurs when a company or an investor proposes to buy shares from existing shareholders at a specified price, often exceeding the market value. For example, in 2016, the pharmaceutical company Valeant Pharmaceuticals made a tender offer to acquire Allergan by offering shareholders $48.30 per share, aiming to gain majority control. This strategic move allowed Valeant to increase its stake without going through a prolonged merger negotiation process. Another notable example of a tender offer is Microsoft's 2018 bid to acquire a significant portion of LinkedIn shares prior to completing the full acquisition. Microsoft extended a tender offer directly to LinkedIn shareholders at $196 per share, enabling quick accumulation of shares. This approach helped Microsoft accelerate the purchase timeline and secure shareholder approval efficiently.

Table of Comparison

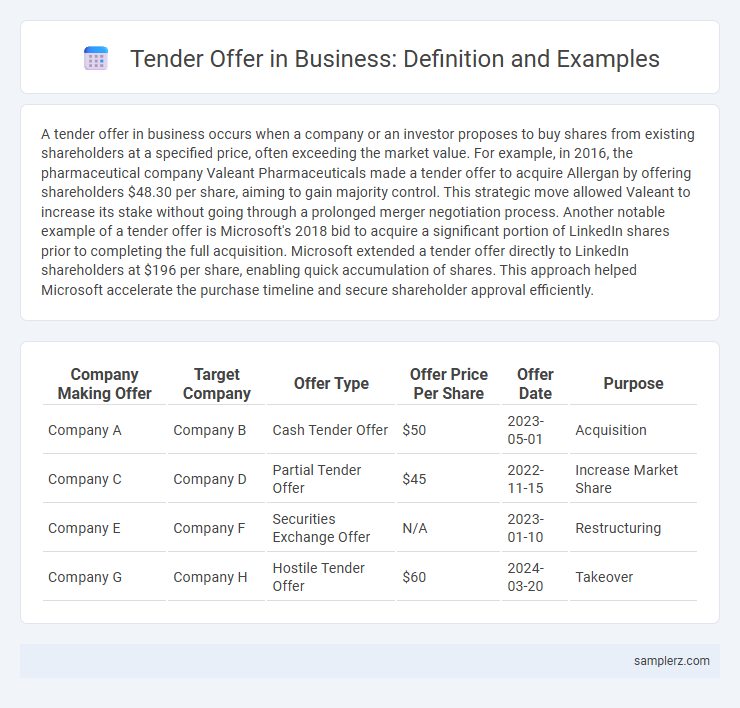

| Company Making Offer | Target Company | Offer Type | Offer Price Per Share | Offer Date | Purpose |

|---|---|---|---|---|---|

| Company A | Company B | Cash Tender Offer | $50 | 2023-05-01 | Acquisition |

| Company C | Company D | Partial Tender Offer | $45 | 2022-11-15 | Increase Market Share |

| Company E | Company F | Securities Exchange Offer | N/A | 2023-01-10 | Restructuring |

| Company G | Company H | Hostile Tender Offer | $60 | 2024-03-20 | Takeover |

Understanding Tender Offers in Business

A tender offer in business involves a public proposal by an individual or company to purchase a significant portion of a target company's shares at a specified price, often at a premium to the market value. This strategy is frequently used in mergers and acquisitions to gain controlling interest quickly and efficiently. Key examples include corporate takeovers where firms like Berkshire Hathaway have made tender offers to acquire substantial stakes in other companies.

Key Features of Tender Offers

Tender offers in business involve a public, open bid by an acquirer to purchase a substantial number of shares from existing shareholders at a specified price, often above market value, to gain control or significant influence over the target company. Key features include the offer price, which must be attractive enough to incentivize shareholders to sell, the tender period during which shareholders can accept the offer, and regulatory requirements ensuring transparency and fairness. The acquirer typically sets minimum and maximum offer thresholds, addressing the number of shares to be bought while providing shareholders with the right to withdraw their tendered shares until the offer's expiration.

Types of Tender Offers in the Market

Tender offers in the business market typically include friendly and hostile types, where friendly offers involve negotiations with the target company's management, and hostile offers bypass management to appeal directly to shareholders. Cash tender offers are common, providing shareholders immediate liquidity, while stock tender offers exchange shares, allowing acquirers to use equity instead of cash. Partial tender offers target a specific percentage of shares, often to gain controlling interest without acquiring the entire company.

Real-World Example: Hostile Tender Offer

A notable example of a hostile tender offer in business is Carl Icahn's 1985 bid for TWA (Trans World Airlines), where he offered shareholders a premium price to gain control despite management's opposition. Hostile tender offers typically involve acquiring a controlling stake directly from shareholders, bypassing company executives. Such offers often trigger defensive measures like poison pills or shareholder rights plans to prevent unwanted takeovers.

Case Study: Friendly Tender Offer Scenario

In a friendly tender offer, Company A proposes to buy shares directly from Company B's shareholders at a premium price, creating a mutually beneficial acquisition strategy. An example is when Company A offers $50 per share, which is 20% above Company B's current market price of $42, encouraging shareholders to sell without resistance. This tactic ensures a smooth takeover process with cooperation from Company B's management and stakeholders.

Notable Tender Offers in Mergers and Acquisitions

The hostile tender offer by Carl Icahn for TWA in 1985 stands as a notable example in mergers and acquisitions, where strategic bidding reshaped company control. Another prominent case is Vodafone's $183 billion takeover of Mannesmann in 2000, marking one of the largest tender offers in corporate history. These transactions demonstrate the impact of tender offers in accelerating ownership consolidation and restructuring within competitive markets.

Legal Considerations in Tender Offers

Legal considerations in tender offers include compliance with securities laws such as the Securities Exchange Act of 1934, which mandates detailed disclosures to protect investors. Tender offer regulations require the acquiring company to file Schedule TO with the SEC, ensuring transparency about the terms and conditions of the offer. Antitrust laws must also be evaluated to prevent market monopolization, and failure to adhere can result in significant legal penalties and the invalidation of the offer.

Impact of Tender Offers on Shareholders

Tender offers in business often lead to significant changes in shareholder value by providing an opportunity to sell shares at a premium price compared to the current market value. Shareholders experience liquidity benefits and potential capital gains, especially when the offer price exceeds their acquisition cost. However, tender offers can also introduce uncertainty and influence stock price volatility as investors react to takeover prospects and strategic shifts.

Strategies Companies Use in Tender Offers

Companies often employ aggressive acquisition strategies in tender offers, such as offering a premium price to persuade shareholders to sell their shares quickly. Targeted communication and confidentiality are crucial to minimize market speculation and maintain a competitive advantage during the tender offer period. Leveraging financial analysis and market conditions allows firms to structure offers that maximize shareholder value while mitigating risks of hostile takeovers.

Lessons Learned from Famous Tender Offer Cases

The acquisition attempt by Carl Icahn for TWA in 1985 demonstrates the importance of aggressive negotiation tactics and the risk of overpaying during tender offers. Lessons from Heinz's 2013 tender offer highlight the necessity of clear regulatory strategies and the impact of antitrust considerations on deal completion. The hostile bid by Sanofi for Genzyme reveals the significance of stakeholder communication and managing public perception to win shareholder support in contested offers.

example of tender offer in business Infographic

samplerz.com

samplerz.com