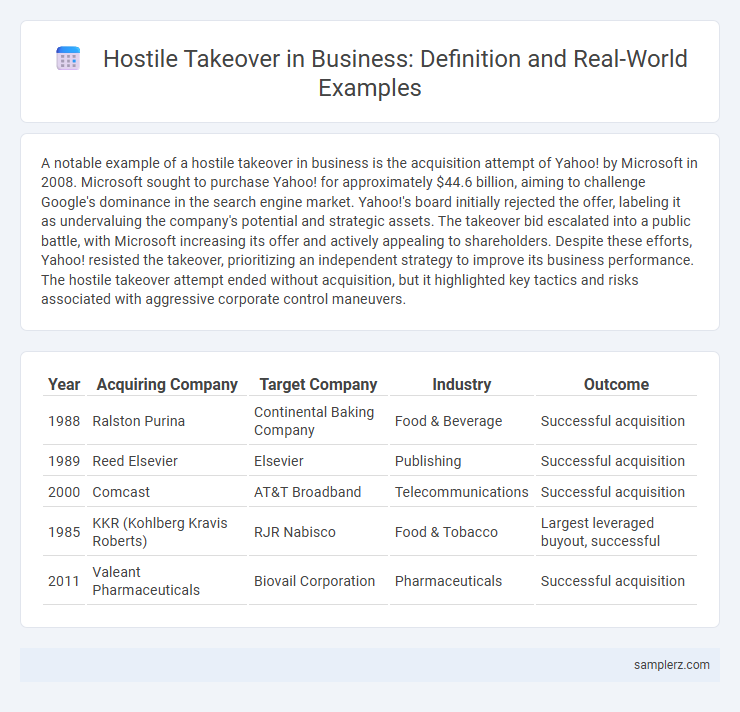

A notable example of a hostile takeover in business is the acquisition attempt of Yahoo! by Microsoft in 2008. Microsoft sought to purchase Yahoo! for approximately $44.6 billion, aiming to challenge Google's dominance in the search engine market. Yahoo!'s board initially rejected the offer, labeling it as undervaluing the company's potential and strategic assets. The takeover bid escalated into a public battle, with Microsoft increasing its offer and actively appealing to shareholders. Despite these efforts, Yahoo! resisted the takeover, prioritizing an independent strategy to improve its business performance. The hostile takeover attempt ended without acquisition, but it highlighted key tactics and risks associated with aggressive corporate control maneuvers.

Table of Comparison

| Year | Acquiring Company | Target Company | Industry | Outcome |

|---|---|---|---|---|

| 1988 | Ralston Purina | Continental Baking Company | Food & Beverage | Successful acquisition |

| 1989 | Reed Elsevier | Elsevier | Publishing | Successful acquisition |

| 2000 | Comcast | AT&T Broadband | Telecommunications | Successful acquisition |

| 1985 | KKR (Kohlberg Kravis Roberts) | RJR Nabisco | Food & Tobacco | Largest leveraged buyout, successful |

| 2011 | Valeant Pharmaceuticals | Biovail Corporation | Pharmaceuticals | Successful acquisition |

Defining Hostile Takeover in Business

A hostile takeover in business occurs when one company attempts to acquire another without the consent of its management, often by directly purchasing shares from existing shareholders or launching a proxy fight to replace board members. Notable examples include the 1988 acquisition of RJR Nabisco by Kohlberg Kravis Roberts & Co., which showcased aggressive bidding and resistance from the target company's leadership. This type of takeover strategy highlights the challenges in corporate governance and shareholder control during mergers and acquisitions.

Key Characteristics of Hostile Takeovers

Hostile takeovers involve acquiring a company without the consent of its management, often through a direct offer to shareholders or a proxy fight. Key characteristics include aggressive bidding above market value, bypassing the target company's board, and leveraging a significant accumulation of shares to gain control. These takeovers frequently result in leadership changes and strategic realignments to increase shareholder value.

Famous Hostile Takeover Examples Worldwide

The 1988 hostile takeover of RJR Nabisco by Kohlberg Kravis Roberts & Co. remains one of the most famous examples globally, valued at $31 billion. Another significant instance is the 2005 bid by Vodafone to acquire Mannesmann, marking the largest hostile takeover in European history worth approximately $183 billion. These landmark deals illustrate aggressive acquisition strategies where the target company's management strongly opposes the offer.

Notable Hostile Takeover: RJR Nabisco and KKR

The 1988 hostile takeover of RJR Nabisco by Kohlberg Kravis Roberts & Co. (KKR) remains one of the largest and most iconic leveraged buyouts, valued at $25 billion. This high-profile acquisition highlighted aggressive bidding strategies and complex financial maneuvering, reshaping corporate control dynamics. The RJR Nabisco deal set a precedent in private equity, influencing future hostile takeovers and leveraged buyouts in the business world.

Oracle’s Takeover of PeopleSoft: A Landmark Battle

Oracle's takeover of PeopleSoft in 2003 stands as a landmark hostile takeover in business history, with Oracle launching a $5.1 billion bid despite fierce resistance. The prolonged legal and corporate battle highlighted the aggressive strategies used in hostile acquisitions, including proxy fights and litigation. This takeover reshaped the ERP software industry, consolidating Oracle's market position and setting precedents for future hostile bids.

Kraft Foods’ Hostile Acquisition of Cadbury

Kraft Foods' hostile takeover of Cadbury in 2010 exemplifies aggressive acquisition strategies in business, where Kraft bypassed initial resistance by Cadbury's management and launched a direct bid supported by shareholders. This $19 billion deal highlighted the complexities of cross-border mergers and acquisitions, reflecting on regulatory challenges and cultural integration issues. The acquisition significantly reshaped the global confectionery market, demonstrating how hostile takeovers can rapidly alter competitive dynamics.

Vodafone’s Hostile Bid for Mannesmann Explained

Vodafone's hostile bid for Mannesmann in 1999 stands as one of the largest and most significant takeovers in business history, valued at approximately $183 billion. The aggressive acquisition strategy involved circumventing Mannesmann's management resistance, ultimately enabling Vodafone to dominate the European telecommunications market. This hostile takeover reshaped industry dynamics by consolidating Vodafone's position as a global telecom giant.

Unilever’s Defense Against Kraft Heinz: A Failed Hostile Takeover

Kraft Heinz's attempt to acquire Unilever in 2017 exemplifies a high-profile failed hostile takeover in the business world. Unilever's leadership rejected Kraft Heinz's $143 billion offer, emphasizing the bid's undervaluation and strategic misalignment with Unilever's long-term goals. This defensive stance, supported by robust shareholder backing and a clear communication strategy, ultimately preserved Unilever's independence and market position.

Strategies Used in Successful Hostile Takeovers

Successful hostile takeovers often rely on aggressive strategies such as tender offers, where the acquiring company proposes to buy shares directly from shareholders at a premium to bypass management resistance. Proxy battles are also common, enabling the acquirer to gain control by persuading shareholders to vote out existing directors. Another critical tactic involves accumulating shares quietly to build a significant stake before launching the takeover bid, as seen in landmark cases like Carl Icahn's acquisition attempts.

Lessons Learned from Hostile Takeover Cases

Hostile takeovers in business often reveal critical lessons about corporate governance and defensive strategies. The hostile acquisition of RJR Nabisco by Kohlberg Kravis Roberts highlighted the importance of strong shareholder relations and the use of poison pill tactics to deter aggressive bids. Companies must prioritize transparent communication and proactive risk management to safeguard against unwanted mergers and maintain control during takeover attempts.

example of hostile takeover in business Infographic

samplerz.com

samplerz.com