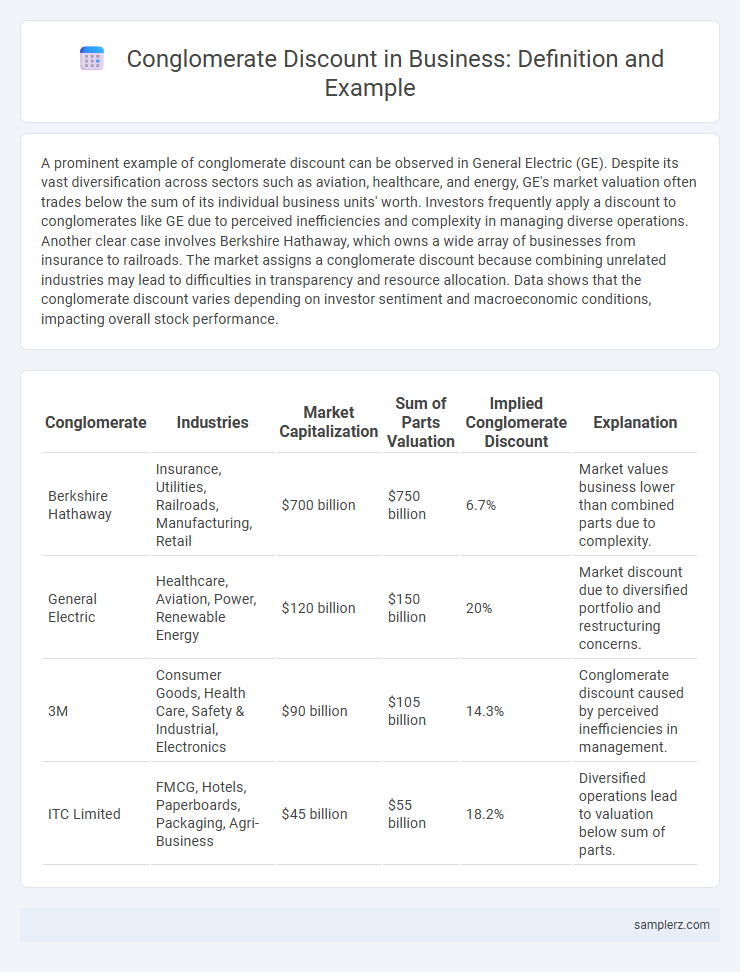

A prominent example of conglomerate discount can be observed in General Electric (GE). Despite its vast diversification across sectors such as aviation, healthcare, and energy, GE's market valuation often trades below the sum of its individual business units' worth. Investors frequently apply a discount to conglomerates like GE due to perceived inefficiencies and complexity in managing diverse operations. Another clear case involves Berkshire Hathaway, which owns a wide array of businesses from insurance to railroads. The market assigns a conglomerate discount because combining unrelated industries may lead to difficulties in transparency and resource allocation. Data shows that the conglomerate discount varies depending on investor sentiment and macroeconomic conditions, impacting overall stock performance.

Table of Comparison

| Conglomerate | Industries | Market Capitalization | Sum of Parts Valuation | Implied Conglomerate Discount | Explanation |

|---|---|---|---|---|---|

| Berkshire Hathaway | Insurance, Utilities, Railroads, Manufacturing, Retail | $700 billion | $750 billion | 6.7% | Market values business lower than combined parts due to complexity. |

| General Electric | Healthcare, Aviation, Power, Renewable Energy | $120 billion | $150 billion | 20% | Market discount due to diversified portfolio and restructuring concerns. |

| 3M | Consumer Goods, Health Care, Safety & Industrial, Electronics | $90 billion | $105 billion | 14.3% | Conglomerate discount caused by perceived inefficiencies in management. |

| ITC Limited | FMCG, Hotels, Paperboards, Packaging, Agri-Business | $45 billion | $55 billion | 18.2% | Diversified operations lead to valuation below sum of parts. |

Understanding the Conglomerate Discount Phenomenon

Conglomerate discount occurs when the market values a diversified company lower than the sum of its individual business units, often due to perceived inefficiencies in management or lack of transparency. For example, General Electric experienced a significant conglomerate discount as investors questioned the synergies among its diverse operations like aviation, healthcare, and financial services. This phenomenon highlights investor skepticism toward complex corporate structures that can obscure financial performance and strategic focus.

Key Examples of Conglomerate Discounts in Major Corporations

Berkshire Hathaway experienced a conglomerate discount as its diverse portfolio of businesses was initially undervalued compared to the sum of its parts, reflecting investor skepticism about managing unrelated industries. General Electric historically faced a discount due to its sprawling operations across finance, healthcare, and energy, where the market struggled to accurately price its heterogeneous assets. Similarly, Samsung's wide array of businesses, from electronics to heavy industries, resulted in a valuation gap between the conglomerate and its individual subsidiaries, highlighting the market's difficulty in assessing complex corporate structures.

How Investors Identify Conglomerate Discounts

Investors identify conglomerate discounts by analyzing discrepancies between a conglomerate's market valuation and the combined value of its individual business units. They examine financial metrics such as price-to-earnings ratios, sum-of-the-parts valuations, and cash flow generation relative to standalone competitors. This method helps reveal undervaluation caused by management inefficiencies, lack of strategic focus, or market skepticism toward diversified operations.

Notable Case Studies of Conglomerate Discount in Business History

Berkshire Hathaway historically experienced a conglomerate discount despite its diversified portfolio of insurance, energy, and manufacturing businesses, as investors initially undervalued its combined assets. ITT Corporation faced significant conglomerate discount during the 1980s due to its sprawling operations in telecommunications, hospitality, and industrial products, leading to activist investor interventions. General Electric's diverse range of aviation, healthcare, and finance sectors showed periods of conglomerate discount, prompting strategic refocus and divestitures to unlock shareholder value.

Conglomerate Discount: Impact on Shareholder Value

Conglomerate discount occurs when investors value a diversified group of businesses lower than the sum of their parts, often due to perceived inefficiencies or complexities in managing unrelated industries. This discount reduces shareholder value as market capitalization falls below the aggregate market values of individual subsidiaries. Companies like General Electric and ABB have experienced conglomerate discounts, prompting strategies such as spin-offs or divestitures to unlock hidden value and improve stock performance.

Real-World Illustration: GE’s Experience with Conglomerate Discount

General Electric (GE) historically experienced a conglomerate discount as its diverse business portfolio, spanning aviation, healthcare, and financial services, led investors to undervalue the overall firm compared to the sum of individual units. Analysts noted that GE's complex structure and cross-sector exposure increased perceived risk and reduced transparency, contributing to a market valuation below its intrinsic asset value. This discount pressured GE to divest non-core assets and streamline operations to boost investor confidence and unlock shareholder value.

Conglomerate Discount in Emerging Markets: Recent Examples

Conglomerate discounts in emerging markets are evident in companies like Tata Group and Reliance Industries, where the market values diversified holdings lower than the sum of their individual parts due to perceived inefficiencies and risk. Recent analysis shows conglomerates in Brazil, such as Gran Colombia Gold, experience significant market valuation gaps driven by governance concerns and lack of strategic focus. These discounts often reflect investor skepticism about management capabilities and the complexity of cross-industry operations in volatile economic environments.

Lessons Learned from Corporate Breakups and Discount Reduction

Corporate breakups often reveal that conglomerate discounts arise from market skepticism about the efficiency and transparency of combined entities. Lessons learned show that separating business units can unlock shareholder value by improving management focus and enhancing financial clarity. Reducing these discounts involves clear communication of strategic benefits, streamlined operations, and focused capital allocation within each independent company.

Factors Contributing to Conglomerate Discount in Large Firms

Large firms face conglomerate discount due to complex organizational structures that reduce transparency and increase administrative costs, leading investors to undervalue their diversified portfolios. Inefficient capital allocation across unrelated business units often results in lower overall performance compared to focused competitors. Market perceptions of increased risk and lack of strategic coherence also contribute significantly to the valuation gap seen in conglomerates.

Conglomerate Discount: Implications for Business Strategy

Conglomerate discount occurs when investors value a diversified company lower than the sum of its individual business units, often due to perceived inefficiencies or lack of focus. This valuation gap influences business strategy by pushing conglomerates to streamline operations, divest non-core assets, or improve transparency to unlock shareholder value. Strategic responses to conglomerate discount include refocusing on core competencies and enhancing operational synergies to boost investor confidence and market valuation.

example of conglomerate discount in business Infographic

samplerz.com

samplerz.com