Greenmail in business occurs when an investor acquires a significant amount of a company's stock and threatens a hostile takeover unless the company buys back the shares at a premium. This tactic forces the target company to pay above market value to avoid the acquisition, leading to significant financial strain. A notable example of greenmail involved corporate raider T. Boone Pickens in the 1980s, who used this strategy against Gulf Oil. The practice of greenmail often results in short-term gains for the greenmailer, while the target company's shareholders may face diluted value and instability. Companies impacted by greenmail sometimes implement poison pill strategies to deter such hostile moves. Monitoring stock accumulation and ownership changes becomes critical for corporate boards to protect against greenmail threats.

Table of Comparison

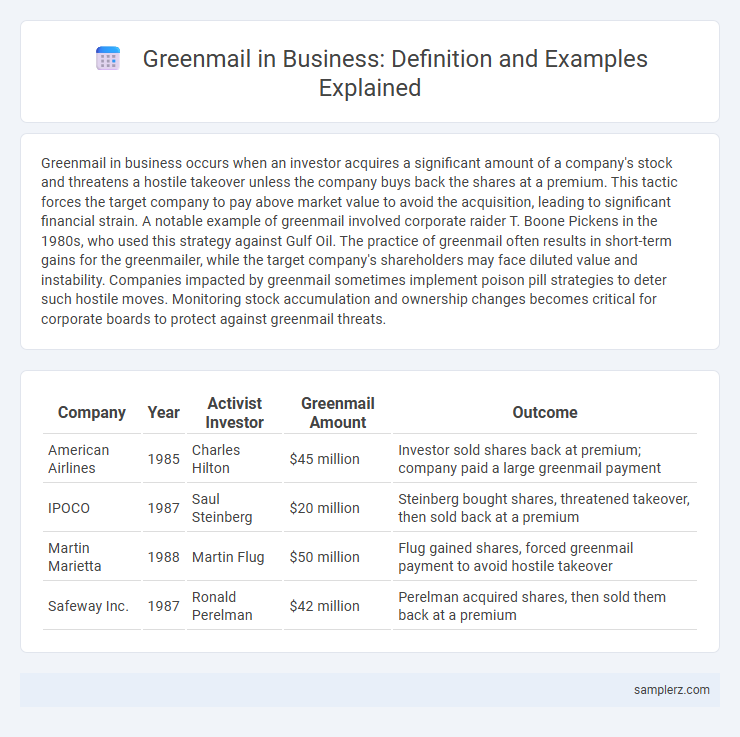

| Company | Year | Activist Investor | Greenmail Amount | Outcome |

|---|---|---|---|---|

| American Airlines | 1985 | Charles Hilton | $45 million | Investor sold shares back at premium; company paid a large greenmail payment |

| IPOCO | 1987 | Saul Steinberg | $20 million | Steinberg bought shares, threatened takeover, then sold back at a premium |

| Martin Marietta | 1988 | Martin Flug | $50 million | Flug gained shares, forced greenmail payment to avoid hostile takeover |

| Safeway Inc. | 1987 | Ronald Perelman | $42 million | Perelman acquired shares, then sold them back at a premium |

Understanding Greenmail: Definition and Business Context

Greenmail occurs when a company repurchases its own shares at a premium from a hostile bidder to prevent a takeover, often leading to significant financial costs and shareholder dissatisfaction. A notable example is the 1980s case where corporate raider T. Boone Pickens amassed shares of Gulf Oil, prompting Gulf Oil to pay a premium to buy back the shares and avoid a takeover. Understanding greenmail helps businesses recognize the risks of defensive strategies that can impact long-term shareholder value and corporate governance.

Historical Examples of Greenmail in Corporate America

T. Boone Pickens' 1980s attempts to takeover Gulf Oil resulted in the company paying millions in greenmail to end the hostile bid, showcasing a classic example of greenmail in Corporate America. In 1984, Martin Marietta Industries repurchased stock from investor Meshulam Riklis at a premium, effectively paying greenmail to avoid a takeover. These instances highlight how companies used greenmail as a defensive tactic to prevent hostile acquisitions during periods of high corporate raiding activity.

Notorious Greenmail Cases: High-Profile Business Scenarios

Tactics used in notorious greenmail cases like Carl Icahn's battle with TWA in the 1980s spotlight how aggressive investors pressured companies to repurchase shares at a premium to avoid hostile takeovers. Another prominent example involves Sir James Goldsmith's campaign against Crown Zellerbach, where the firm resorted to greenmail to protect against leveraged buyouts. These high-profile scenarios underscore the financial and strategic impacts of greenmail in corporate governance and shareholder negotiations.

The Mechanics of Greenmail: How It Works in Practice

Greenmail occurs when a hostile investor acquires a significant stake in a company and threatens a takeover to coerce the target firm into repurchasing the shares at a premium price, thereby preventing the takeover. This process exploits the target company's vulnerability and liquidity to buy back stock at inflated prices, often leading to substantial financial losses for remaining shareholders. Companies often implement anti-greenmail provisions or poison pills in their corporate governance to deter such tactics and protect shareholder value.

Consequences of Greenmail for Target Companies

Greenmail occurs when an investor acquires a significant stake in a company and threatens a hostile takeover, prompting the target firm to repurchase the shares at a premium to prevent control loss. This practice can lead to substantial financial strain on the target company due to the costly buyback, diverting funds from productive investments or growth initiatives. Furthermore, greenmail often damages shareholder trust and can trigger negative market perceptions, impacting the company's stock price and long-term valuation.

Legal and Regulatory Responses to Greenmail Tactics

Greenmail occurs when an investor acquires a significant stake in a company to threaten a hostile takeover, then demands a premium to sell back their shares. Legal and regulatory responses include imposing anti-greenmail provisions in corporate charters and enforcing securities laws that mandate disclosure of large share acquisitions. Courts have also upheld poison pill strategies, empowering companies to dilute hostile stakes and protect shareholder value against greenmail threats.

Famous Greenmailers: Key Figures in Business History

Famous greenmailers such as Carl Icahn and Sir James Goldsmith exemplify aggressive corporate raiding by acquiring significant shares in target companies and threatening hostile takeovers to force buybacks at premium prices. Carl Icahn's 1980s battle with TWA and Texaco showcased his strategic greenmail tactics, resulting in substantial financial gains and industry-wide attention. Sir James Goldsmith's high-profile greenmail maneuvers during the 1980s further solidified his reputation as a key figure in business history, illustrating the impact of greenmail on corporate control and shareholder value.

Greenmail vs. Hostile Takeover: Key Differences

Greenmail occurs when a company buys back its shares at a premium from a hostile party to prevent a takeover, contrasting with a hostile takeover where the acquiring company aggressively pursues control despite resistance. Greenmail benefits the greenmailer by providing a profitable exit, while hostile takeovers aim to gain control and restructure the target. The key difference lies in greenmail serving as a defensive tactic to avoid acquisition, whereas hostile takeovers are offensive strategies to secure ownership.

Modern-Day Examples of Greenmail in Global Markets

Modern-day examples of greenmail in global markets include activist investors targeting multinational corporations such as Samsung and Sony, where large shareholders acquire significant stakes to pressure buybacks at premium prices. In 2023, hedge fund Elliott Management notably engaged in greenmail tactics with Japanese conglomerates, leveraging share purchases to prompt favorable corporate restructuring. These instances highlight how greenmail remains a strategic maneuver for investors seeking quick profits through buyouts in competitive international business landscapes.

Preventing Greenmail: Strategies for Business Leaders

Business leaders can prevent greenmail by implementing poison pill strategies that dilute the value of shares acquired aggressively, making hostile takeovers less attractive. Establishing strong shareholder communication ensures transparency and deters potential greenmailers by reducing uncertainty in ownership intentions. Regularly monitoring stock ownership patterns helps identify unusual accumulation early, allowing timely defensive actions against greenmail threats.

example of greenmail in business Infographic

samplerz.com

samplerz.com