In the BCG matrix, a "dog" represents a business unit or product with low market share and low market growth. An example of a dog could be a struggling brand of physical newspapers in the digital age, facing declining readership and limited growth prospects. These entities often consume more resources than they generate, making them candidates for divestiture or restructuring. Businesses classify a product as a dog when it performs poorly in a stagnant or shrinking market. For instance, a legacy software application that fails to innovate and loses customers to newer solutions fits this category. Companies use this classification to make strategic decisions, focusing resources on more promising units such as "stars" or "question marks.

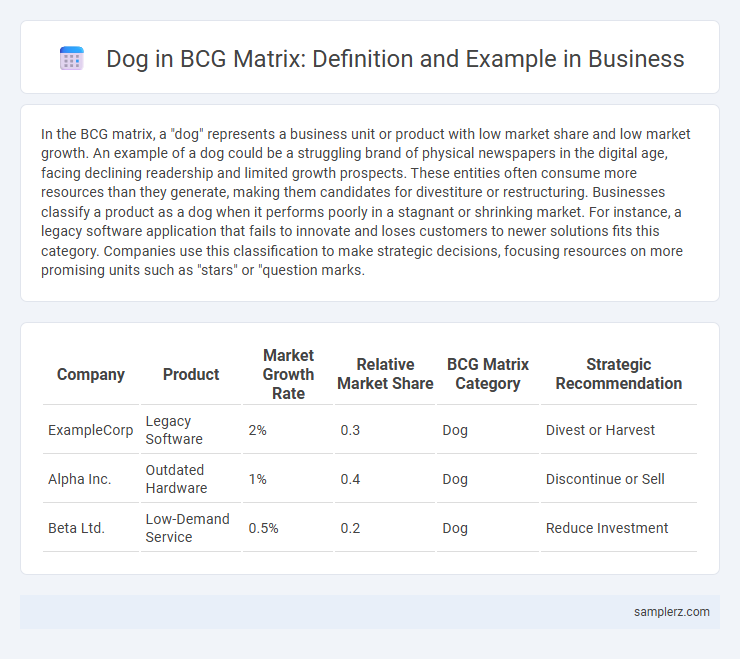

Table of Comparison

| Company | Product | Market Growth Rate | Relative Market Share | BCG Matrix Category | Strategic Recommendation |

|---|---|---|---|---|---|

| ExampleCorp | Legacy Software | 2% | 0.3 | Dog | Divest or Harvest |

| Alpha Inc. | Outdated Hardware | 1% | 0.4 | Dog | Discontinue or Sell |

| Beta Ltd. | Low-Demand Service | 0.5% | 0.2 | Dog | Reduce Investment |

Understanding Dogs in the BCG Matrix

Dogs in the BCG matrix represent business units with low market share in a mature, slow-growing industry, often generating weak cash flows or losses. These units typically struggle to compete and may consume more resources than they return, making them candidates for divestiture or repositioning. An example includes a declining product line in the highly competitive smartphone market that fails to gain traction against dominant players.

Defining the Dog Quadrant: Low Growth, Low Market Share

The Dog quadrant in the BCG matrix represents business units with low market share operating in low-growth industries, often yielding minimal profits or even losses. An example is a legacy product line in a declining market, where sales stagnate and competitive advantage is minimal. Companies typically consider divestiture or repositioning strategies for these units to optimize overall portfolio performance.

Characteristics of Dog Products in Business

Dog products in the BCG matrix are characterized by low market share and low market growth, often resulting in minimal profitability and limited future prospects. These products consume more resources than they generate, leading businesses to consider divestment or repositioning strategies. Companies must carefully evaluate dog products to avoid draining resources and focus on more promising areas of their portfolio.

Real-Life Examples of Dogs in the BCG Matrix

Blockbuster is a classic example of a Dog in the BCG matrix, as it struggled with declining market share and low growth in the video rental industry. Kodak also represents a Dog, having failed to adapt to digital photography, resulting in stagnant business segments. These companies highlight how products or units with poor market prospects can drain resources in a corporate portfolio.

Tech Industry Cases: Dog Category Illustrations

In the Tech Industry, companies like BlackBerry in the smartphone segment illustrate the Dog category in the BCG matrix, characterized by low market share and slow market growth. Once a market leader, BlackBerry's inability to adapt to evolving consumer preferences caused its position to weaken significantly. This example highlights how tech firms can struggle in highly competitive environments despite previous success.

FMCG Brands: Identifying Dog Products

In the FMCG sector, dog products within the BCG matrix often include declining brands with low market share in saturated categories, such as certain legacy snack items or outdated beverage lines. These dog brands generate minimal cash and experience stagnant or shrinking sales, failing to capitalize on market growth or consumer trends. Companies typically consider divesting or repositioning these products to reallocate resources toward higher-growth, star or cash cow brands.

Retail Sector Dogs: Notable Product Failures

In the retail sector, Blockbuster serves as a classic example of a "dog" in the BCG matrix due to declining market share and profitability amid digital streaming competition. Sears also illustrates a retail dog, struggling with outdated business models and increased e-commerce competition leading to store closures and revenue decline. These cases highlight how failing to adapt to market changes can position retail products or brands in the low-growth, low-share quadrant of the BCG matrix.

Why Businesses Retain or Divest Dogs

Businesses retain dogs in the BCG matrix when they generate steady cash flow despite low market growth, providing essential support to other units or maintaining niche market presence. Companies divest dogs to reallocate resources towards more promising stars or question marks, optimizing overall portfolio profitability and growth potential. Strategic decisions hinge on factors such as cash generation ability, alignment with core competencies, and long-term industry outlook.

Strategic Options for Managing Dogs in the BCG Matrix

Dogs in the BCG matrix represent business units with low market share in a slow-growing industry, often generating minimal profit or incurring losses. Strategic options for managing dogs include divestiture, harvesting, or repositioning to improve performance by focusing on niche markets or cost reduction. Companies may also choose to discontinue these units to reallocate resources toward higher-growth opportunities.

Lessons Learned from Dog Products in Business Strategy

Dog products in the BCG matrix typically represent low market share and low growth segments, highlighting the importance of divesting or repositioning underperforming business units. Lessons learned emphasize the necessity of rigorous market analysis to avoid sunk costs and to allocate resources toward high-growth, high-share units more effectively. Strategic pivots based on these insights can prevent prolonged investment in dog products and drive overall portfolio optimization.

example of dog in BCG matrix Infographic

samplerz.com

samplerz.com