In business financing, a seed round refers to the initial capital raised by a startup to support product development and market research. Seed funding typically involves angel investors, venture capitalists, or crowdfunding platforms providing early-stage investment in exchange for equity. This phase is crucial for validating the business idea and building a prototype before seeking larger Series A funding. Seed financing data shows that the average seed round amount ranges from $500,000 to $2 million, depending on the industry and startup maturity. Key entities involved in seed rounds include accelerators, incubators, and early-stage venture funds that specialize in startups. Tracking seed investment trends helps entrepreneurs understand market dynamics and attract targeted investors for subsequent financing rounds.

Table of Comparison

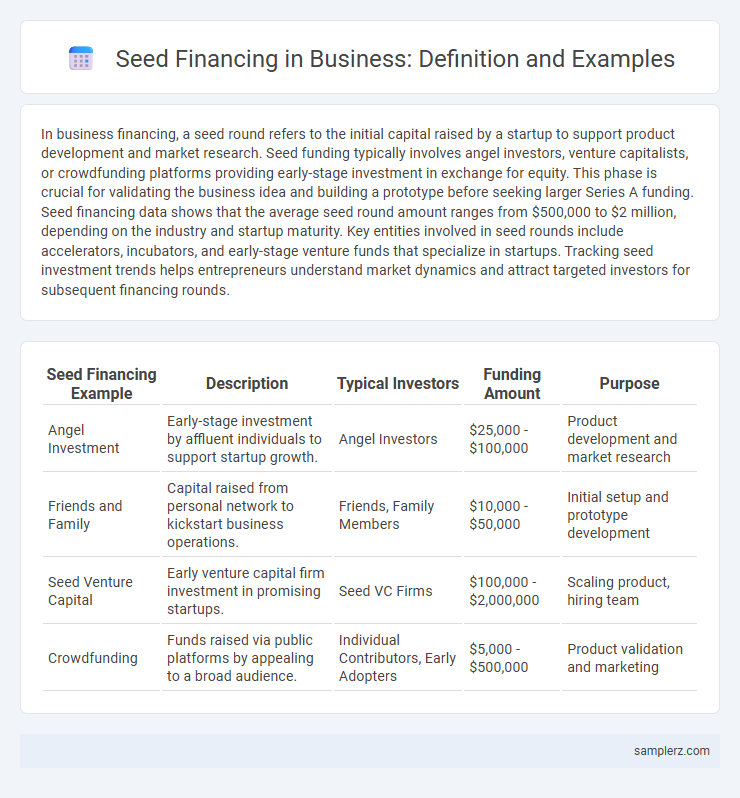

| Seed Financing Example | Description | Typical Investors | Funding Amount | Purpose |

|---|---|---|---|---|

| Angel Investment | Early-stage investment by affluent individuals to support startup growth. | Angel Investors | $25,000 - $100,000 | Product development and market research |

| Friends and Family | Capital raised from personal network to kickstart business operations. | Friends, Family Members | $10,000 - $50,000 | Initial setup and prototype development |

| Seed Venture Capital | Early venture capital firm investment in promising startups. | Seed VC Firms | $100,000 - $2,000,000 | Scaling product, hiring team |

| Crowdfunding | Funds raised via public platforms by appealing to a broad audience. | Individual Contributors, Early Adopters | $5,000 - $500,000 | Product validation and marketing |

Understanding Seed Financing in Business

Seed financing represents the initial capital investment used to start a business, typically sourced from angel investors, venture capitalists, or crowdfunding platforms. This early-stage funding supports product development, market research, and operational expenses before substantial revenue generation. Understanding seed financing is essential for entrepreneurs aiming to secure the necessary resources to transform innovative ideas into viable enterprises.

Key Characteristics of Seed Funding

Seed funding is the initial capital raised to support early-stage startups in developing their product or service and validating their business model. It typically involves smaller investment amounts ranging from $10,000 to $2 million, provided by angel investors, seed venture capital firms, or crowdfunding platforms. Key characteristics include a high level of risk, limited financial history, emphasis on the founding team's potential, and a focus on achieving product-market fit.

Notable Examples of Seed Financing Rounds

Notable examples of seed financing rounds include Airbnb's $600,000 seed funding in 2009 led by Y Combinator, which enabled early product development and market validation. Instagram secured $500,000 in seed capital from Baseline Ventures and Andreessen Horowitz, fueling rapid user growth before acquisition by Facebook. Dropbox raised $1.2 million in seed funding from Sequoia Capital and Accel Partners, accelerating platform expansion and customer acquisition.

Successful Startups and Their Seed Stage Investors

Successful startups like Airbnb and Uber secured seed funding from prominent investors such as Y Combinator and First Round Capital, fueling early product development and market entry. Seed stage investors play a crucial role in validating business models and providing essential capital, often leading to exponential growth in the Series A round. This initial investment phase typically ranges from $100,000 to $2 million, enabling startups to achieve critical milestones and attract larger venture capital firms.

Common Sources of Seed Capital

Common sources of seed capital in business financing include angel investors who provide early-stage funding in exchange for equity, venture capital firms specializing in seed rounds, and crowdfunding platforms that pool small investments from many contributors. Friends and family often serve as initial seed investors by offering personal funds to support startups. Government grants and startup incubators also play a significant role in providing seed capital to promising entrepreneurs.

Equity vs. Convertible Notes in Seed Funding

Seed funding often involves equity investments where investors receive ownership shares in exchange for capital, providing founders with clear valuation and investor alignment. Convertible notes serve as debt instruments that convert into equity during a future financing round, delaying valuation negotiation while offering simplicity for early-stage startups. Choosing between equity and convertible notes depends on factors like investor preference, startup valuation certainty, and fundraising timeline.

Criteria Investors Use in Seed Financing

Investors in seed financing typically evaluate the founding team's experience, market potential, and product feasibility to determine investment viability. Key criteria include a clear value proposition, scalable business model, and initial traction or proof of concept. Financial metrics such as burn rate, capital efficiency, and realistic valuation projections also play a crucial role in decision-making.

Strategic Use of Seed Funds in Business Growth

Seed funding acts as the foundation for startups to develop prototypes, validate market demand, and build initial teams, accelerating early-stage growth. Strategic allocation of seed capital toward product development and market research fosters sustainable competitive advantages. Entrepreneurs often leverage seed investments to attract subsequent venture capital rounds, ensuring scalable expansion and increased valuation.

Challenges Faced During Seed Fundraising

Seed fundraising presents challenges such as limited investor interest due to early-stage risk and lack of proven business models, which complicates capital acquisition for startups. Founders often face difficulties in accurately valuing their company without substantial revenue or traction, leading to strained negotiations with potential investors. Navigating regulatory requirements and managing resource constraints further complicate the seed funding process, requiring strategic planning and resilience from entrepreneurs.

Lessons Learned from Real Seed Financing Cases

Successful seed financing cases reveal crucial lessons, such as the importance of clear equity agreements to prevent future disputes and the value of securing investors who provide strategic guidance beyond capital. Founders often underestimate the need for thorough due diligence on potential investors' reputations and alignment with company vision, impacting long-term growth. Early-stage startups benefit significantly from transparent communication and setting realistic milestones to build investor trust and attract follow-on funding.

example of seed in financing Infographic

samplerz.com

samplerz.com