Synergy in a business merger occurs when the combined value and performance of two companies exceed the sum of their individual contributions. For example, when Disney acquired Pixar, the merger created synergy by integrating Pixar's innovative animation technology with Disney's extensive distribution network, leading to increased box office revenues and enhanced brand equity. This collaboration allowed both companies to leverage each other's strengths, resulting in cost savings and higher profitability. Another example of synergy is the merger between Exxon and Mobil, which capitalized on economies of scale in production and distribution. The combined entity streamlined operations, reduced redundancies, and improved supply chain efficiency, driving down operational costs. Data indicated that this merger generated significant financial gains by enhancing market share and improving cash flow, demonstrating how strategic alignment can maximize shareholder value.

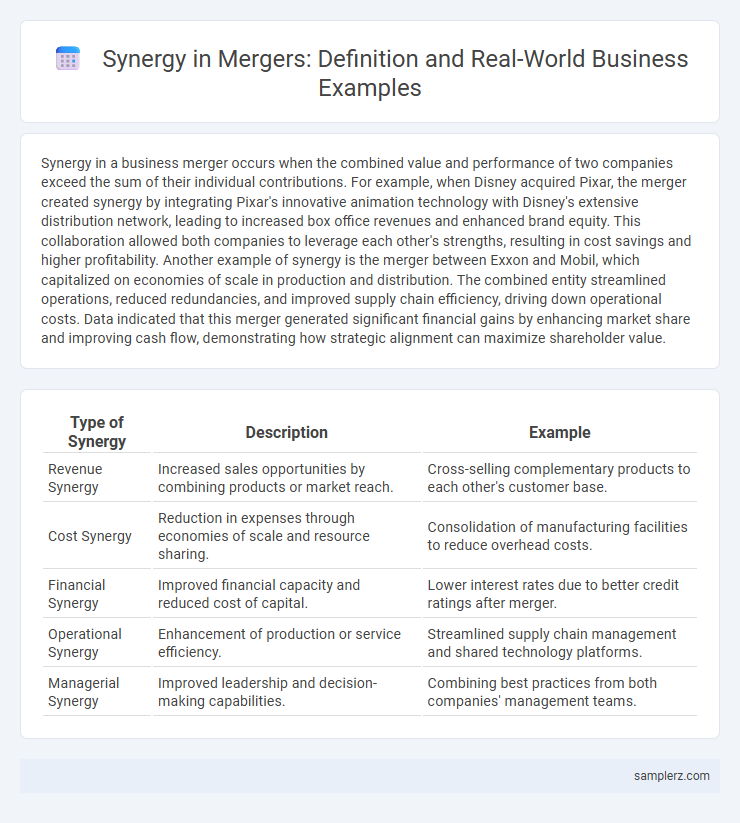

Table of Comparison

| Type of Synergy | Description | Example |

|---|---|---|

| Revenue Synergy | Increased sales opportunities by combining products or market reach. | Cross-selling complementary products to each other's customer base. |

| Cost Synergy | Reduction in expenses through economies of scale and resource sharing. | Consolidation of manufacturing facilities to reduce overhead costs. |

| Financial Synergy | Improved financial capacity and reduced cost of capital. | Lower interest rates due to better credit ratings after merger. |

| Operational Synergy | Enhancement of production or service efficiency. | Streamlined supply chain management and shared technology platforms. |

| Managerial Synergy | Improved leadership and decision-making capabilities. | Combining best practices from both companies' management teams. |

Understanding Synergy in Mergers

Synergy in mergers occurs when the combined value and performance of two companies exceed the sum of their separate individual parts, generating increased revenue, cost savings, or enhanced market reach. A classic example is the Disney-Pixar merger, where Disney's global distribution network and Pixar's innovative animation technology created superior creative content and expanded box office success. Understanding such synergy involves analyzing potential efficiencies like economies of scale, cross-selling opportunities, and complementary capabilities that drive sustainable growth post-merger.

Key Types of Synergy Achieved in Mergers

Revenue synergy in mergers often arises when combined companies expand market reach and cross-sell products, boosting overall sales. Cost synergy typically results from eliminating duplicate functions and streamlining operations, leading to significant savings in overhead and production expenses. Financial synergy can improve capital efficiency through enhanced borrowing capacity and optimized tax structures, strengthening the merged entity's balance sheet.

Real-World Examples of Successful Merger Synergy

The merger between Disney and Pixar exemplifies successful synergy, combining Disney's extensive distribution network with Pixar's innovative animation technology to create blockbuster hits and increase market share. Another notable example is the acquisition of WhatsApp by Facebook, which leveraged WhatsApp's large user base to enhance Facebook's messaging ecosystem and drive user engagement. These mergers demonstrate how complementary strengths in technology, market reach, and resources can generate substantial value and competitive advantage.

Cost Synergy: Streamlining Operations Post-Merger

Cost synergy in mergers is exemplified by consolidating supply chain operations, which reduces procurement expenses through bulk purchasing and vendor negotiation. Streamlining administrative functions like finance and HR eliminates redundancies, leading to significant payroll and overhead cost reductions. Integrating IT systems enhances operational efficiency, cutting maintenance costs and accelerating decision-making processes.

Revenue Synergy: Growing Sales Through Integration

Revenue synergy in mergers occurs when combined companies leverage cross-selling opportunities, expanding customer reach and enhancing product offerings, leading to increased sales. For example, after the Disney acquisition of Pixar, Disney integrated Pixar's innovative animation technology with its vast distribution network, significantly boosting box office revenues. This strategic integration exemplifies how harmonizing strengths drives sales growth beyond the sum of individual companies' capabilities.

Strategic Synergy: Enhancing Market Position

Strategic synergy in mergers enhances market position by combining complementary strengths, such as expanding product lines and increasing geographic reach. For example, the merger between Disney and Pixar leveraged Disney's global distribution network and Pixar's innovative animation technology to dominate the entertainment industry. This synergy resulted in accelerated market growth, strengthened brand presence, and improved competitive advantage.

Financial Synergy: Strengthening Capital Structure

Financial synergy in mergers enhances capital structure by combining resources to reduce the overall cost of capital and improve creditworthiness. The merged entity can access larger pools of funding, negotiate better interest rates, and optimize debt-to-equity ratios for increased financial stability. This strengthened capital base supports expansion opportunities and long-term value creation for shareholders.

Technological Synergy: Leveraging Combined Innovations

Technological synergy in mergers drives innovation by integrating proprietary technologies from both companies, leading to accelerated product development and enhanced R&D capabilities. For example, the merger between IBM and Red Hat combined IBM's cloud infrastructure with Red Hat's open-source software expertise, resulting in innovative hybrid cloud solutions. This synergy enables the merged entity to deliver cutting-edge technologies faster and gain a competitive edge in the market.

Cultural Synergy: Merging Organizational Cultures

Cultural synergy in mergers occurs when two organizations successfully blend their values, management styles, and workplace behaviors to create a unified corporate culture that enhances employee engagement and productivity. For example, the merger between Disney and Pixar leveraged Pixar's innovative and creative culture alongside Disney's strong brand and distribution expertise, resulting in a collaborative environment that propelled creative output and sustained competitive advantage. This alignment of organizational cultures reduces integration challenges and fosters a shared vision, driving long-term business success.

Lessons Learned from Synergistic Business Mergers

Synergistic business mergers demonstrate that aligning complementary strengths, such as combining advanced technology from one company with expansive distribution networks from another, maximizes market reach and operational efficiency. Lessons learned emphasize the importance of integrating corporate cultures to avoid employee turnover and maintain productivity during the transition. Financial analyses reveal that clear communication and setting realistic synergy targets prevent overestimation of benefits and support long-term sustainable growth.

example of synergy in merger Infographic

samplerz.com

samplerz.com