A poison pill is a defensive strategy used by companies to prevent or discourage hostile takeovers. One common example is the shareholder rights plan, where existing shareholders are given the right to purchase additional shares at a discount if a single investor acquires a certain percentage of the company's shares. This dilutes the ownership interest of the potential acquirer, making the takeover more expensive and less attractive. Another example involves issuing new shares to friendly investors or employees, increasing the total shares outstanding and reducing the acquirer's influence. Companies may also implement debt-heavy strategies, increasing liabilities to make the financial structure less appealing. These tactics protect the company's management and existing shareholders by maintaining control and avoiding unwanted acquisition attempts.

Table of Comparison

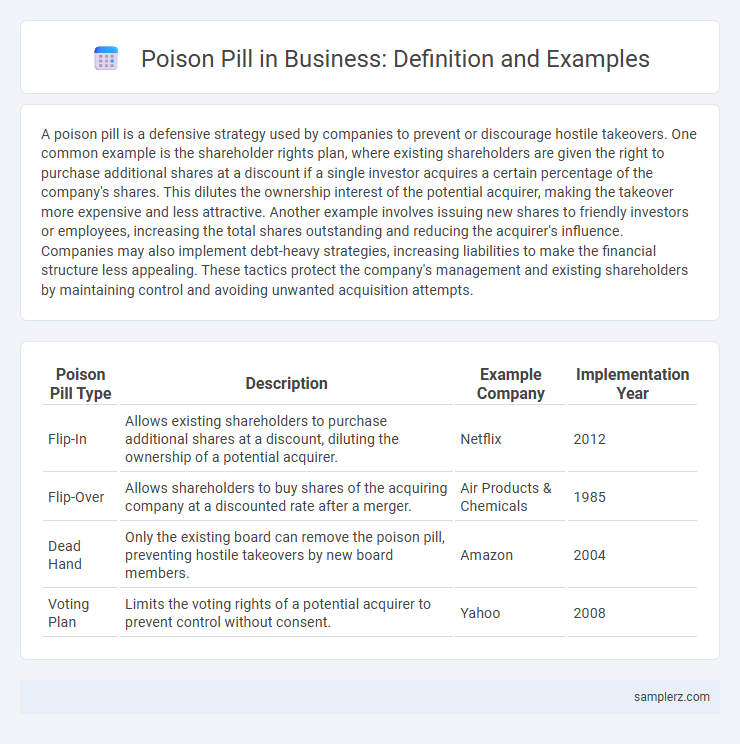

| Poison Pill Type | Description | Example Company | Implementation Year |

|---|---|---|---|

| Flip-In | Allows existing shareholders to purchase additional shares at a discount, diluting the ownership of a potential acquirer. | Netflix | 2012 |

| Flip-Over | Allows shareholders to buy shares of the acquiring company at a discounted rate after a merger. | Air Products & Chemicals | 1985 |

| Dead Hand | Only the existing board can remove the poison pill, preventing hostile takeovers by new board members. | Amazon | 2004 |

| Voting Plan | Limits the voting rights of a potential acquirer to prevent control without consent. | Yahoo | 2008 |

Classic Examples of Poison Pills in Corporate Takeovers

The most notable example of a poison pill is the 1985 case of Netflix's pioneering use to fend off a hostile takeover by Carl Icahn, where shareholders were allowed to buy additional shares at a discount, diluting the potential acquirer's stake. Another classic instance occurred with People's United Financial in 2019, which adopted a shareholder rights plan to prevent M&T Bank's aggressive acquisition attempts. These tactics serve as effective deterrents in corporate takeovers by making hostile bids prohibitively expensive or complex.

Notable Companies That Employed Poison Pill Strategies

Notable companies that employed poison pill strategies include Netflix, which implemented a shareholder rights plan in 2012 to fend off activist investor Carl Icahn, and Papa John's, which adopted a poison pill in 2018 to prevent a hostile takeover attempt by activist investors. Hilton Worldwide Holdings also used a poison pill strategy in 2015 to block a potential bid from Blackstone Group, protecting the company's control structure. These cases demonstrate how poison pills serve as tactical defenses to deter unwanted acquisitions and maintain board stability.

High-Profile Hostile Takeover Cases Involving Poison Pills

In the landmark case of Netflix's defense against Carl Icahn in 2012, a poison pill was implemented to prevent the activist investor from acquiring more than 10% of shares, effectively deterring a hostile takeover. Another prominent example is the 1985 takeover battle for Revlon, where the company adopted a poison pill strategy to discourage corporate raiders, ultimately leading to an acquisition that maximized shareholder value. These cases highlight how poison pills serve as strategic defenses to protect companies from unwelcome takeovers by diluting ownership and complicating acquisition attempts.

Case Study: Netflix’s Use of Poison Pill Defense

Netflix implemented a poison pill defense in 2012 to prevent a hostile takeover by activist investor Carl Icahn. The strategy involved issuing new shares to existing shareholders at a discount, diluting Icahn's stake and making a takeover prohibitively expensive. This case exemplifies how poison pills serve as an effective anti-takeover mechanism in protecting corporate control.

How Yahoo Utilized Poison Pills Against Microsoft

Yahoo implemented a poison pill strategy in 2008 to defend against Microsoft's unsolicited $44.6 billion takeover bid by allowing existing shareholders to purchase additional shares at a discount, diluting Microsoft's potential ownership. This tactic aimed to make the acquisition prohibitively expensive and maintain Yahoo's independence. The poison pill effectively stalled Microsoft's hostile takeover attempt, exemplifying defensive measures in corporate mergers.

Twitter’s Poison Pill Response to Elon Musk’s Bid

Twitter deployed a poison pill defense in 2022 to prevent Elon Musk from acquiring more than 15% of its shares, triggering a shareholder rights plan that diluted Musk's ownership if he exceeded the threshold. This strategy aimed to make a hostile takeover prohibitively expensive and deter Musk's attempt to gain controlling interest. The move highlighted how companies use poison pills as a tactical response to aggressive bids, protecting shareholder value and corporate independence.

The RJR Nabisco Poison Pill: A Landmark Corporate Battle

The RJR Nabisco poison pill strategy became a landmark in corporate defense during the 1988 takeover battle, where the board implemented shareholder rights plans to thwart hostile bids. This tactic allowed existing shareholders to purchase additional stock at a discount, diluting the potential acquirer's stake and making the takeover prohibitively expensive. The poison pill played a critical role in enabling the management to negotiate better terms, setting a precedent for corporate governance and takeover defenses in the business world.

Airgas vs. Air Products: A Textbook Poison Pill Scenario

Airgas deployed a poison pill strategy to defend against Air Products' hostile takeover bid in 2010, issuing rights to dilute shares if any entity acquired more than 10% of company stock without board approval. This defense mechanism effectively stalled Air Products' aggressive acquisition attempts by making the takeover prohibitively expensive and complex. The Airgas vs. Air Products case remains a textbook example of how poison pills can protect target companies from unsolicited buyouts while preserving shareholder value.

PeopleSoft’s Defense Mechanisms Against Oracle’s Hostile Bid

PeopleSoft employed a poison pill strategy by adopting a shareholder rights plan that allowed existing shareholders to purchase additional shares at a discount if Oracle's stake exceeded a certain threshold, effectively diluting Oracle's ownership and making the takeover prohibitively expensive. This defense mechanism was coupled with frequent legal battles and board restructuring to prevent Oracle from seizing control. The combination of these tactics exemplifies how poison pill strategies protect companies from hostile acquisitions.

Real-World Outcomes of Poison Pill Activations in Business

In 2018, Netflix employed a poison pill strategy to prevent activist investor Carl Icahn from acquiring a significant stake, successfully maintaining control and avoiding takeover threats. Another notable example is Ebay's 2014 poison pill activation to deter activist investors seeking board control, which preserved the company's strategic direction and shareholder value. These real-world outcomes demonstrate how poison pills effectively safeguard companies from hostile takeovers, ensuring management retains decision-making authority.

example of poison pill in business Infographic

samplerz.com

samplerz.com