A decacorn is a privately held startup company valued at over $10 billion. One prominent example in the business world is Stripe, a fintech company specializing in online payment processing. Founded in 2010, Stripe has revolutionized the payments industry and achieved a valuation exceeding $95 billion as of early 2024. Another notable decacorn is SpaceX, an aerospace manufacturer and space transport services company. Established by Elon Musk in 2002, SpaceX focuses on reducing the cost of space travel and enabling Mars colonization. The company's valuation surpassed $137 billion, making it one of the most valuable private startups worldwide.

Table of Comparison

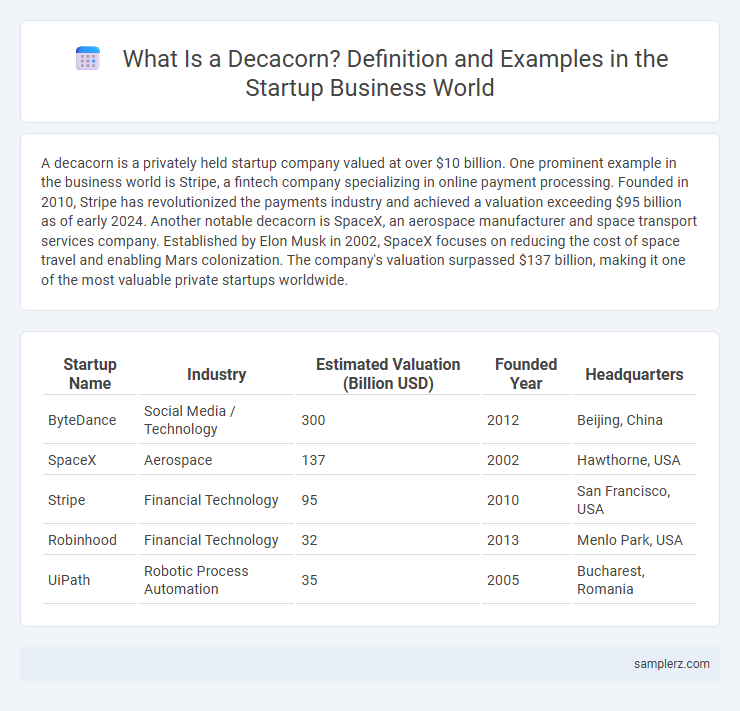

| Startup Name | Industry | Estimated Valuation (Billion USD) | Founded Year | Headquarters |

|---|---|---|---|---|

| ByteDance | Social Media / Technology | 300 | 2012 | Beijing, China |

| SpaceX | Aerospace | 137 | 2002 | Hawthorne, USA |

| Stripe | Financial Technology | 95 | 2010 | San Francisco, USA |

| Robinhood | Financial Technology | 32 | 2013 | Menlo Park, USA |

| UiPath | Robotic Process Automation | 35 | 2005 | Bucharest, Romania |

What is a Decacorn in the Startup Ecosystem?

A decacorn is a privately held startup valued at over $10 billion, representing a rare and highly successful entity in the global startup ecosystem. Examples of decacorns include companies like Airbnb, Stripe, and SpaceX, which have transformed their industries through innovative technology and business models. These startups demonstrate significant market impact, rapid growth, and substantial investor confidence, highlighting the scale and potential of decacorns.

Key Characteristics of Decacorn Startups

Decacorn startups, such as ByteDance and Stripe, exhibit rapid scalability with valuations exceeding $10 billion and disrupt existing markets through innovative technology and business models. They demonstrate strong network effects, enabling exponential user growth and market dominance, while maintaining high capital efficiency and robust revenue streams. These startups prioritize continuous innovation, data-driven decision-making, and global expansion to sustain competitive advantages in dynamic industries.

Top Global Decacorn Examples in Business

Top global decacorn examples in business include ByteDance, the Beijing-based tech giant behind TikTok, valued at over $300 billion, and SpaceX, the American aerospace manufacturer transforming space exploration with a valuation exceeding $150 billion. Other notable decacorns are Stripe, a leading fintech company specializing in online payment processing with a valuation around $95 billion, and Grab, Southeast Asia's super app delivering ride-hailing, food delivery, and financial services, valued at approximately $40 billion. These startups exemplify how decacorns dominate their industries through innovation, scalability, and significant market disruption.

Decacorn Startups Disrupting Traditional Industries

Decacorn startups like SpaceX in aerospace, Stripe in fintech, and ByteDance in media are revolutionizing traditional industries by leveraging disruptive technologies and innovative business models. These companies attract multi-billion dollar valuations by scaling rapidly and addressing unmet market needs through AI, automation, and digital platforms. Their impact reshapes sectors, driving efficiency, customer experience, and global market expansion in industries once dominated by legacy firms.

Funding Strategies Adopted by Decacorns

Decacorns such as Stripe, SpaceX, and Bytedance have leveraged diversified funding strategies, including late-stage venture capital, strategic corporate investments, and large-scale private equity rounds, to accelerate growth and innovation. They focus heavily on securing substantial Series E and beyond funding rounds, often exceeding $100 million, to fuel global expansion and technological advancements. These startups also emphasize building strong investor relations and exploring alternative financing options like convertible notes and secondary market transactions to maintain liquidity and valuation momentum.

The Journey from Unicorn to Decacorn: Notable Startups

Airbnb exemplifies the journey from unicorn to decacorn by revolutionizing the hospitality industry with its global home-sharing platform, achieving a valuation surpassing $10 billion. Stripe, a fintech startup specializing in online payment processing, rapidly scaled its services to become a decacorn through strategic partnerships and international expansion. These startups highlight the critical role of innovation, market disruption, and scalability in evolving from a billion-dollar valuation to the decacorn status.

Impact of Decacorns on the Startup Landscape

Decacorns like ByteDance, SpaceX, and Stripe have revolutionized the global startup landscape by setting new benchmarks for valuation and innovation. These companies drive significant investment flows, foster advanced technological development, and create extensive employment opportunities, accelerating industry growth. Their market dominance influences startup strategies and investor expectations, reshaping the competitive ecosystem worldwide.

Noteworthy Decacorns in Technology and Fintech

Noteworthy decacorns in technology include companies like ByteDance, valued over $300 billion, revolutionizing social media with TikTok's global reach. In fintech, Stripe stands out as a decacorn with a valuation exceeding $95 billion, providing seamless online payment infrastructure across various markets. These startups exemplify innovation and massive market influence in their respective sectors.

Lessons Learned from Successful Decacorns

Decacorns like Stripe and Airbnb exemplify the power of scalable business models paired with strong customer-centric innovation, highlighting the importance of adaptability in rapidly evolving markets. Their success underscores the value of robust data-driven decision-making and strategic global expansion to capture diverse market segments. These startups teach the significance of maintaining a long-term vision while building a sustainable company culture that fosters continuous growth.

Future Trends: The Next Potential Decacorns

Emerging sectors such as artificial intelligence, renewable energy, and fintech are fueling the rise of potential decacorns like OpenAI, Rivian, and Stripe, each demonstrating rapid valuation growth surpassing $10 billion. Startups leveraging innovative technologies, scalable business models, and global expansion strategies are positioned to join this exclusive group within the next decade. Market analysts predict that advancements in AI-driven automation, sustainable solutions, and blockchain-enabled financial services will significantly contribute to the emergence of the next wave of decacorns.

example of decacorn in startup Infographic

samplerz.com

samplerz.com