A golden parachute in a business merger refers to lucrative financial benefits guaranteed to top executives if they are terminated due to the acquisition. These benefits typically include large cash bonuses, stock options, and severance packages. For example, when AT&T acquired Time Warner in 2018, CEO John Stankey received a golden parachute worth millions of dollars as part of his exit compensation. Such agreements aim to protect executives' financial interests and reduce resistance to mergers or acquisitions. Data shows that golden parachutes often total several million dollars, reflecting the high stakes involved in corporate leadership changes. In mergers involving Fortune 500 companies, these packages can exceed $20 million, underscoring their significant role in corporate restructuring deals.

Table of Comparison

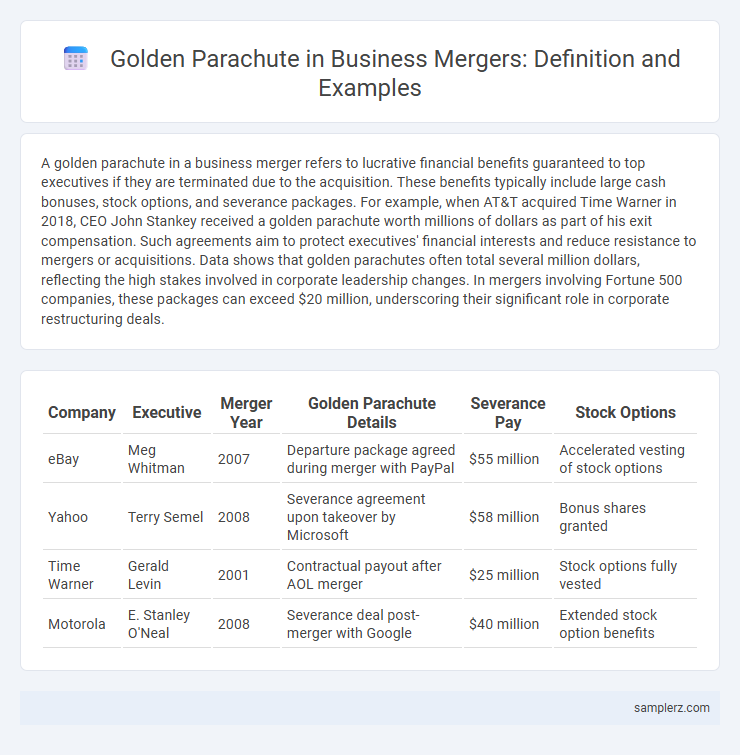

| Company | Executive | Merger Year | Golden Parachute Details | Severance Pay | Stock Options |

|---|---|---|---|---|---|

| eBay | Meg Whitman | 2007 | Departure package agreed during merger with PayPal | $55 million | Accelerated vesting of stock options |

| Yahoo | Terry Semel | 2008 | Severance agreement upon takeover by Microsoft | $58 million | Bonus shares granted |

| Time Warner | Gerald Levin | 2001 | Contractual payout after AOL merger | $25 million | Stock options fully vested |

| Motorola | E. Stanley O'Neal | 2008 | Severance deal post-merger with Google | $40 million | Extended stock option benefits |

Notable Golden Parachute Cases in Recent Mergers

Notable golden parachute cases in recent mergers include the 2019 acquisition of Anadarko Petroleum by Occidental Petroleum, where Anadarko's CEO secured a $78 million severance package. In the 2020 merger between Morgan Stanley and E*TRADE, executives received significant golden parachute payouts exceeding $30 million combined. These high-profile deals highlight the financial protections executives negotiate to cushion the impact of corporate restructuring during mergers.

High-Profile CEO Exits with Golden Parachutes

High-profile CEO exits during mergers often feature golden parachutes, providing substantial financial packages to ease their transition. For example, Apple's former CEO Steve Jobs negotiated a lucrative golden parachute during Apple's acquisition of NeXT in 1997, ensuring millions in severance and stock options. These arrangements protect executives' interests while facilitating smoother corporate transitions in merger scenarios.

Golden Parachute Example: The Disney-21st Century Fox Merger

The Disney-21st Century Fox merger in 2019 showcased a prominent golden parachute, where key Fox executives received multi-million-dollar severance packages triggered by the acquisition. Disney agreed to compensate top Fox leaders with substantial bonuses and stock options, ensuring smooth leadership transition and retention during the merger. This golden parachute exemplified how such agreements protect executives' financial interests amid corporate consolidation.

Successful Leadership Transitions with Golden Parachutes

In the 2015 acquisition of WhatsApp by Facebook, CEO Jan Koum secured a golden parachute worth $850 million, ensuring a seamless leadership transition that maintained company stability. This substantial payout incentivized Koum to support the merger, facilitating sustained innovation and employee retention throughout the integration process. Golden parachutes like this exemplify how well-structured executive agreements contribute to successful leadership continuity during high-stakes mergers.

How Golden Parachutes Shaped the Dow-DuPont Merger

Golden parachutes played a crucial role in the Dow-DuPont merger by providing substantial severance packages to top executives in case of termination following the merger, ensuring executive stability and alignment during the complex integration process. These agreements included multi-million dollar payouts and stock options that mitigated leadership disruptions and safeguarded strategic continuity. The presence of golden parachutes helped facilitate shareholder approval by demonstrating management's commitment to a smooth transition while protecting key talent.

Top Executive Payouts in Tech Industry Mergers

Top executive payouts in tech industry mergers often feature golden parachutes that include multimillion-dollar severance packages, stock options, and bonuses to ensure leadership retention during transitions. For instance, during Microsoft's acquisition of LinkedIn, some executives received payouts exceeding $20 million, reflecting substantial golden parachute benefits. These lucrative agreements help mitigate risks for top executives while facilitating smoother merger integrations.

Lessons from the AOL-Time Warner Golden Parachute Deal

The AOL-Time Warner merger highlighted significant risks of golden parachute agreements, revealing how excessive executive payouts can undermine shareholder value during corporate consolidation. This deal serves as a cautionary tale about aligning executive incentives with long-term company performance to avoid costly severance packages that fail to motivate sustained growth. Lessons emphasize the importance of transparent contract terms and balanced compensation structures in merger negotiations to protect both leaders and shareholders.

Impact of Golden Parachutes in Pfizer-Wyeth Merger

The Pfizer-Wyeth merger highlighted the significant role of golden parachutes by providing multimillion-dollar exit packages to top executives, ensuring their financial security during corporate restructuring. These agreements mitigated leadership resistance, facilitating smoother negotiations and faster integration processes. By aligning executive incentives with shareholder interests, golden parachutes enhanced stability and confidence throughout the $68 billion merger deal.

Golden Parachutes and Shareholder Response in M&A

Golden parachutes often provide hefty severance packages to executives during mergers, aligning management interests with shareholder value by reducing resistance to deals. Shareholders may react positively when golden parachutes facilitate smoother M&A transactions and preserve company stability. However, excessive golden parachutes can provoke shareholder backlash due to perceived misalignment with shareholder wealth maximization.

Financial Breakdown of Golden Parachute Packages in Mergers

Golden parachute packages in mergers often include substantial financial components such as lump-sum cash payments, accelerated stock vesting, and extended benefits like health insurance or retirement contributions. A typical financial breakdown might allocate $20 million as a cash severance, $10 million in accelerated equity awards, and $5 million in perquisites and continued benefits, totaling a $35 million golden parachute. These agreements are structured to protect executives' financial interests and incentivize smooth transitions during corporate takeovers.

example of golden parachute in merger Infographic

samplerz.com

samplerz.com