A greenfield investment in business refers to the process where a company builds its operations from the ground up in a new location. This investment involves acquiring land, constructing facilities, and establishing new production or service capabilities without relying on existing infrastructure. For example, a multinational corporation constructing a new manufacturing plant in a foreign country to serve local markets exemplifies a greenfield investment. Such investments are significant because they provide full control over operational processes and allow tailoring the business environment to specific needs. Data from the World Bank indicates that greenfield investments often lead to higher productivity improvements compared to mergers or acquisitions. This type of investment is especially common in emerging markets where companies seek to capitalize on growth opportunities with new facilities customized to modern standards.

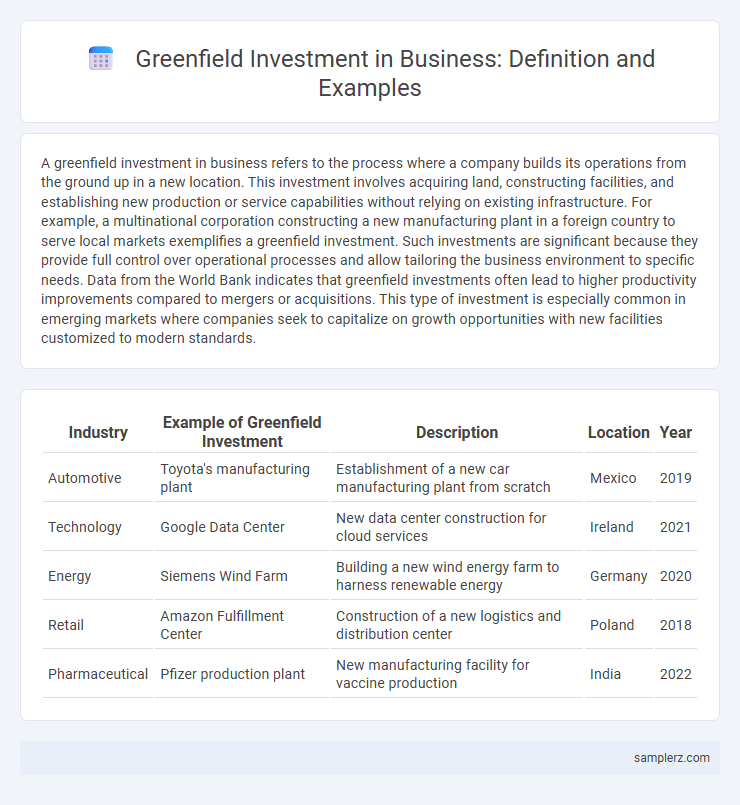

Table of Comparison

| Industry | Example of Greenfield Investment | Description | Location | Year |

|---|---|---|---|---|

| Automotive | Toyota's manufacturing plant | Establishment of a new car manufacturing plant from scratch | Mexico | 2019 |

| Technology | Google Data Center | New data center construction for cloud services | Ireland | 2021 |

| Energy | Siemens Wind Farm | Building a new wind energy farm to harness renewable energy | Germany | 2020 |

| Retail | Amazon Fulfillment Center | Construction of a new logistics and distribution center | Poland | 2018 |

| Pharmaceutical | Pfizer production plant | New manufacturing facility for vaccine production | India | 2022 |

Introduction to Greenfield Investments

Greenfield investments involve establishing new operations from the ground up, such as building factories, offices, or manufacturing plants in foreign markets. This investment strategy allows businesses to maintain full control over their facilities and customize operations according to local regulations and market demands. Companies like Tesla and Amazon have utilized greenfield investments to expand their global footprint by creating purpose-built infrastructure tailored to specific regions.

Key Features of Greenfield Investment Projects

Greenfield investment projects involve establishing new operations or facilities from the ground up, allowing full control over site selection, design, and technology implementation. Key features include high initial capital expenditure, longer project development timelines, and the opportunity to tailor infrastructure to specific business needs and local regulations. These investments often stimulate local economies by creating jobs and fostering innovation through customized, state-of-the-art production systems.

Top Greenfield Investment Examples in Various Industries

Top greenfield investment examples include Tesla's Gigafactory in Nevada, which created a state-of-the-art electric vehicle manufacturing plant from scratch, significantly boosting local employment and clean technology. Amazon's construction of new fulfillment centers worldwide demonstrates large-scale greenfield investments in logistics, optimizing supply chain responsiveness and regional market reach. In the pharmaceutical industry, Pfizer's establishment of advanced vaccine research facilities exemplifies greenfield investments driving innovation and production capacity in critical healthcare sectors.

Greenfield Investment in the Manufacturing Sector

Greenfield investment in the manufacturing sector involves establishing a new production facility from the ground up, enabling companies to customize operations for efficiency and innovation. Major examples include Tesla's Gigafactory in Nevada and Samsung's semiconductor plants in South Korea, both designed to support advanced manufacturing capabilities. This approach allows firms to access local resources, technology, and skilled labor while contributing significantly to regional economic development.

Greenfield FDI in the Technology Industry

Greenfield Foreign Direct Investment (FDI) in the technology industry involves establishing new operations or facilities from scratch, such as building a semiconductor fabrication plant or a software development center. Major examples include Google's launch of new data centers in Europe and Samsung's construction of advanced display manufacturing units in Vietnam. Such investments drive technological innovation, create high-skilled jobs, and enhance local infrastructure in host countries.

Greenfield Projects in Renewable Energy

Greenfield projects in renewable energy involve developing new infrastructure from scratch, such as constructing solar farms, wind power plants, or hydroelectric facilities on undeveloped land. These projects enable investors to implement cutting-edge technologies and sustainable practices without constraints from existing structures or systems. Investment in greenfield renewable energy projects often attracts significant funding due to rising global demand for clean energy and government incentives promoting carbon reduction.

Greenfield Investments by Multinational Corporations

Greenfield investments by multinational corporations involve establishing new operations from scratch in foreign markets, such as building factories, offices, or distribution centers. A notable example is Toyota's Greenfield investment in the United States, where the company constructed manufacturing plants to cater to local demand while maintaining full operational control. These investments enable MNCs to tailor business practices to specific market needs, creating jobs and contributing to regional economic development.

Economic Impacts of Greenfield Investments

Greenfield investments, such as the establishment of a new automotive manufacturing plant in Southeast Asia by a multinational corporation, generate significant economic impacts including job creation, technology transfer, and infrastructure development. These projects enhance local economies by increasing productivity and stimulating ancillary industries through supply chain integration. The long-term benefits also include elevated export capabilities and improved regional competitiveness in the global market.

Greenfield vs. Brownfield Investment: A Comparative Overview

Greenfield investment involves establishing a new operation from the ground up, such as building factories or offices in a new location, offering full control over the project and custom infrastructure tailored to specific business needs. In contrast, brownfield investment entails acquiring or leasing existing facilities for modernization, which often reduces setup time and initial capital expenditure but limits design flexibility. Choosing between greenfield and brownfield investments depends on factors like market entry strategy, cost considerations, and long-term operational goals.

Future Trends in Greenfield Investment Strategies

Greenfield investment strategies are evolving with a focus on sustainability, where companies establish new operations on undeveloped land to leverage renewable energy sources and eco-friendly infrastructure. Emerging trends show increased integration of digital technologies, such as AI and IoT, to optimize resource management and reduce environmental impact in greenfield projects. These approaches position businesses to meet regulatory demands and consumer expectations for green innovation while unlocking long-term value in untapped markets.

example of greenfield in investment Infographic

samplerz.com

samplerz.com