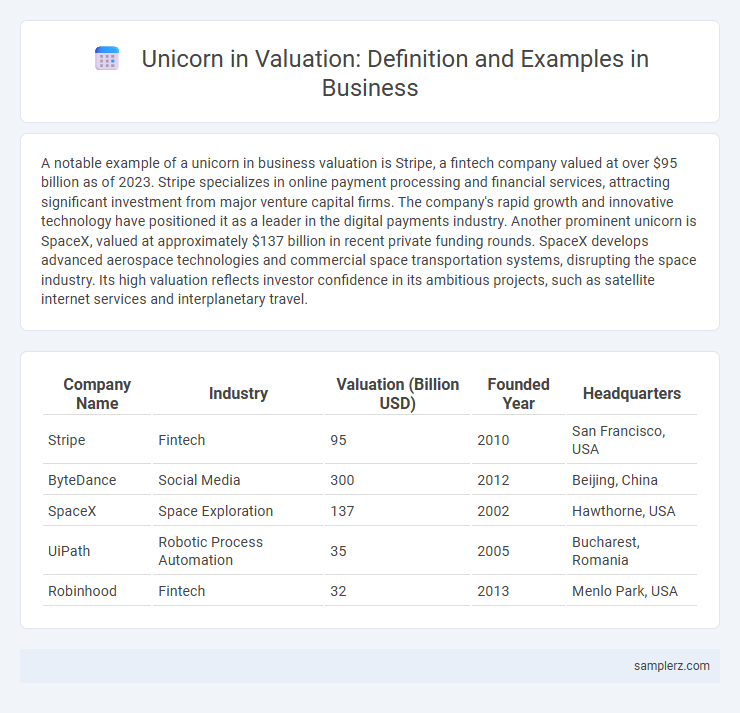

A notable example of a unicorn in business valuation is Stripe, a fintech company valued at over $95 billion as of 2023. Stripe specializes in online payment processing and financial services, attracting significant investment from major venture capital firms. The company's rapid growth and innovative technology have positioned it as a leader in the digital payments industry. Another prominent unicorn is SpaceX, valued at approximately $137 billion in recent private funding rounds. SpaceX develops advanced aerospace technologies and commercial space transportation systems, disrupting the space industry. Its high valuation reflects investor confidence in its ambitious projects, such as satellite internet services and interplanetary travel.

Table of Comparison

| Company Name | Industry | Valuation (Billion USD) | Founded Year | Headquarters |

|---|---|---|---|---|

| Stripe | Fintech | 95 | 2010 | San Francisco, USA |

| ByteDance | Social Media | 300 | 2012 | Beijing, China |

| SpaceX | Space Exploration | 137 | 2002 | Hawthorne, USA |

| UiPath | Robotic Process Automation | 35 | 2005 | Bucharest, Romania |

| Robinhood | Fintech | 32 | 2013 | Menlo Park, USA |

Defining Unicorns: What Qualifies a Startup as a Unicorn in Valuation

Unicorns in business valuation are privately held startups valued at over $1 billion. Key examples include companies like Airbnb and Stripe, which reached this milestone through rapid growth and disruptive innovation. The valuation criteria emphasize market potential, revenue scalability, and investor confidence in transformative technology or business models.

Global Unicorns: Leading Companies That Achieved Billion-Dollar Status

Global unicorns such as ByteDance, SpaceX, and Stripe exemplify companies that have reached billion-dollar valuations through innovation and rapid market expansion. ByteDance revolutionized content consumption with TikTok, amassing over a billion users worldwide. SpaceX disrupted the aerospace industry by developing reusable rockets, while Stripe transformed online payment processing for millions of businesses globally.

Notable Tech Unicorns: Transformative Startups and Their Valuations

Notable tech unicorns like Stripe, with a valuation exceeding $50 billion, and SpaceX, valued around $140 billion, exemplify transformative startups reshaping industries through innovative payment processing and private space exploration, respectively. UiPath, a leader in robotic process automation, reached a valuation of over $35 billion, driving efficiency in business operations globally. These tech unicorns demonstrate how breakthrough technologies attract massive investment, signaling market confidence in future growth potential.

Fintech Unicorn Examples: Industry Leaders Disrupting Finance

Stripe, valued at over $50 billion, exemplifies a leading fintech unicorn revolutionizing digital payments and financial infrastructure globally. Robinhood, with a valuation exceeding $20 billion, disrupts traditional brokerage by enabling commission-free stock trading and democratizing investment access. Plaid, valued around $13 billion, transforms financial services by providing seamless data connectivity between consumers' bank accounts and fintech applications.

Consumer-Focused Unicorns: High-Value Companies in Retail & Services

Consumer-focused unicorns like Instacart and DoorDash have achieved valuations exceeding $10 billion by revolutionizing retail and delivery services through technology-driven platforms. These companies leverage data analytics and user experience optimization to capture substantial market share in the competitive e-commerce and food delivery industries. Their rapid growth highlights the increasing consumer demand for convenience and personalized service in the retail and services sectors.

Healthtech Unicorns: Startups Revolutionizing Healthcare Valuation

Healthtech unicorns such as Oscar Health, valued at over $7 billion, and Ro, with a $5 billion valuation, exemplify startups transforming healthcare through technology-driven solutions. These companies leverage digital platforms and telemedicine to improve patient outcomes while attracting significant investment in a rapidly evolving market. Their valuations underscore the growing investor confidence in innovation-focused healthcare services that address accessibility and efficiency challenges.

Unicorn Valuation Drivers: Key Factors Behind High Startup Valuations

Unicorn valuation drivers include disruptive technology, strong market demand, and scalable business models that attract significant venture capital funding. Companies like Stripe exemplify how robust revenue growth and innovative payment solutions fuel billion-dollar valuations. High user engagement, network effects, and competitive advantages elevate startups to unicorn status in the business ecosystem.

Emerging Markets: Prominent Unicorns from Asia, Europe, and Beyond

Prominent unicorns in emerging markets include Byju's in India, valued at over $22 billion, and Nubank in Brazil, with a valuation exceeding $45 billion, highlighting the rapid growth of fintech in these regions. In Europe, companies like Klarna, a Swedish fintech giant valued at around $46 billion, demonstrate the continent's rising influence in the tech startup ecosystem. These unicorns exemplify significant market potential and investment opportunities across Asia, Latin America, and Europe, reflecting diversified economic innovation beyond traditional tech hubs.

Unicorns in IPO Spotlight: Case Studies of Public Listing Success

Snowflake exemplifies a unicorn achieving remarkable IPO success, debuting on the NYSE with a valuation exceeding $33 billion. Its SaaS-based cloud data platform attracted significant investor interest, reflecting robust market demand for innovative data management solutions. Snowflake's public listing underscores the transformative potential of cloud technology firms in generating substantial shareholder value.

Lessons from Unicorns: What High-Valuation Startups Teach Entrepreneurs

High-valuation startups like Airbnb and Stripe exemplify the power of innovative business models and customer-centric solutions in scaling rapidly. These unicorns demonstrate the importance of leveraging technology to disrupt traditional industries and create new market opportunities. Entrepreneurs can learn to prioritize product-market fit, agile growth strategies, and strong brand narratives to achieve sustained high valuations.

example of unicorn in valuation Infographic

samplerz.com

samplerz.com