An angel investor is an individual who provides capital to startups or early-stage businesses in exchange for equity or convertible debt. These investors often bring valuable industry experience and mentorship, helping new companies grow and succeed. For example, an angel investor might contribute $100,000 to a tech startup in exchange for a 10% ownership stake. Angel funding plays a crucial role in bridging the gap between initial concept development and larger venture capital investments. Business owners use angel capital to finance product development, marketing, and operational costs during critical growth phases. Prominent angel investors like Jeff Bezos and Peter Thiel have funded successful startups, demonstrating the significant impact of angel contributions in the business ecosystem.

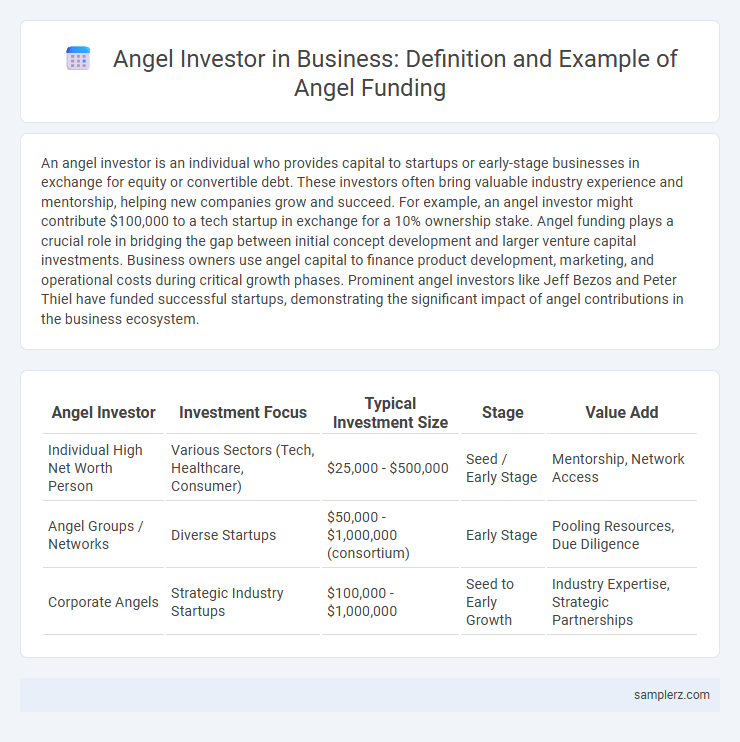

Table of Comparison

| Angel Investor | Investment Focus | Typical Investment Size | Stage | Value Add |

|---|---|---|---|---|

| Individual High Net Worth Person | Various Sectors (Tech, Healthcare, Consumer) | $25,000 - $500,000 | Seed / Early Stage | Mentorship, Network Access |

| Angel Groups / Networks | Diverse Startups | $50,000 - $1,000,000 (consortium) | Early Stage | Pooling Resources, Due Diligence |

| Corporate Angels | Strategic Industry Startups | $100,000 - $1,000,000 | Seed to Early Growth | Industry Expertise, Strategic Partnerships |

Introduction to Angel Investors in Business Funding

Angel investors are high-net-worth individuals who provide early-stage capital to startups in exchange for equity ownership. They often bring valuable industry experience and mentorship to help businesses grow during critical stages. Their funding bridges the gap between personal savings and venture capital, enabling innovative ideas to develop into viable enterprises.

Key Characteristics of Angel Investors

Angel investors typically provide early-stage funding to startups, often contributing between $25,000 and $100,000 per investment. They bring not only capital but also valuable industry expertise, mentorship, and networking opportunities, accelerating business growth. High risk tolerance and a hands-on approach to nurturing innovative ventures are key characteristics distinguishing angel investors from other funding sources.

Real-Life Examples of Successful Angel Funding

Jeff Bezos received angel funding from his family and friends during Amazon's early stages, enabling initial product development and market entry. Airbnb founder Brian Chesky obtained angel investment from Y Combinator, which provided critical seed capital and mentorship to scale the platform. LinkedIn's Reid Hoffman secured angel funding from individuals like Peter Thiel, accelerating growth and positioning the company for its successful IPO.

Notable Angel Investors in Startup Ecosystem

Notable angel investors in the startup ecosystem include individuals like Ron Conway, known for early investments in Google and Facebook, and Naval Ravikant, co-founder of AngelList who has funded over 100 startups including Uber and Twitter. Chris Sacca, through his fund Lowercase Capital, played a critical role in funding companies such as Airbnb and Twitter during their seed stages. These investors contribute not only capital but also expert guidance, leveraging extensive networks that accelerate startup growth and innovation.

Case Studies: Startups Boosted by Angel Funding

Angel funding played a pivotal role in the early growth of Airbnb, where early investors contributed $600,000 that enabled product development and market expansion. Another example is Uber, which secured angel investments that fueled its initial platform launch and rapid scaling in multiple cities. These case studies demonstrate how strategic angel capital accelerates startup growth by providing critical early-stage resources and industry mentorship.

Investment Strategies Used by Angel Investors

Angel investors often use diversified investment strategies, allocating capital across multiple startups to mitigate risk while targeting high-growth sectors like technology and healthcare. They typically engage in seed or early-stage funding, leveraging their industry expertise and networks to provide not only capital but strategic mentorship. This hands-on approach maximizes the potential for scalable returns and accelerates the development trajectory of portfolio companies.

Angel Funding vs. Venture Capital: Key Differences

Angel funding typically involves individual investors providing early-stage capital to startups, often contributing between $25,000 and $100,000, whereas venture capital entails institutional investors managing larger funds, usually investing millions of dollars in later stages. Angel investors often offer mentorship and personal networks to entrepreneurs, contrasting with venture capital firms that emphasize structured growth strategies and board involvement. The flexible terms and personal engagement in angel funding differ significantly from the formalized processes and rigorous due diligence characteristic of venture capital.

How Startups Attract Angel Investors

Startups attract angel investors by presenting a strong value proposition supported by a scalable business model and clear market potential. Demonstrating traction through early customer acquisition or prototype development increases credibility. Founders often leverage personal networks and participate in pitch events to connect with angel investors seeking innovative ventures with high growth prospects.

Impact of Angel Funding on Business Growth

Angel funding significantly accelerates business growth by providing early-stage companies with crucial capital and strategic mentorship. Startups receiving angel investments often experience improved product development and faster market entry due to access to financial resources and industry expertise. This influx of support enables businesses to scale operations efficiently, attract further investment, and enhance long-term sustainability.

Lessons Learned from Angel Investment Success Stories

Angel investors like Jeff Clavier, who funded early-stage companies such as Fitbit and Postmates, demonstrate the importance of nurturing startups with not just capital but strategic guidance. Successful angel investments reveal that thorough due diligence and active involvement in the company's growth phases significantly increase the likelihood of high returns. Lessons from these stories emphasize aligning investor expertise with the startup's industry to enhance mentorship and scalability outcomes.

example of angel in funding Infographic

samplerz.com

samplerz.com