A friendly takeover in business occurs when one company acquires another with the approval and cooperation of the target company's management and board. This type of acquisition minimizes conflict and ensures a smoother integration process between the two entities. One notable example is Facebook's acquisition of Instagram in 2012, where both companies agreed on terms beneficial to their growth strategies. Another example is Google's purchase of YouTube in 2006, which was a mutually agreed deal that expanded Google's presence in the video-sharing market. Both companies worked collaboratively to maintain YouTube's brand identity while leveraging Google's resources for development. These friendly takeovers often result in synergistic benefits, enhanced market reach, and strengthened competitive positioning.

Table of Comparison

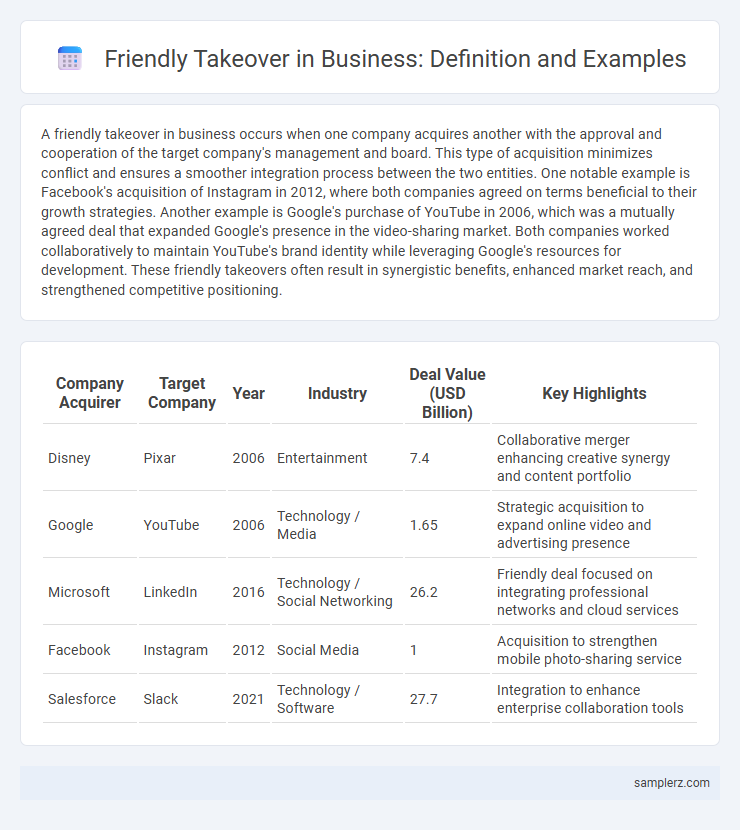

| Company Acquirer | Target Company | Year | Industry | Deal Value (USD Billion) | Key Highlights |

|---|---|---|---|---|---|

| Disney | Pixar | 2006 | Entertainment | 7.4 | Collaborative merger enhancing creative synergy and content portfolio |

| YouTube | 2006 | Technology / Media | 1.65 | Strategic acquisition to expand online video and advertising presence | |

| Microsoft | 2016 | Technology / Social Networking | 26.2 | Friendly deal focused on integrating professional networks and cloud services | |

| 2012 | Social Media | 1 | Acquisition to strengthen mobile photo-sharing service | ||

| Salesforce | Slack | 2021 | Technology / Software | 27.7 | Integration to enhance enterprise collaboration tools |

Introduction to Friendly Takeovers in Business

A friendly takeover occurs when one company acquires another with the full cooperation and agreement of the target company's management and board of directors. An example is Disney's acquisition of Pixar in 2006, where both companies collaborated closely to ensure a smooth transition and mutual benefit. This strategic partnership enhanced Disney's animation portfolio while preserving Pixar's creative independence, illustrating the advantages of a cooperative acquisition approach.

Defining Friendly Takeover: Key Characteristics

A friendly takeover occurs when a company acquires another with the full consent and cooperation of the target company's management and board. Key characteristics include transparent negotiations, mutual agreement on terms, and a collaborative integration process that aims to benefit both organizations. This approach contrasts sharply with hostile takeovers, fostering smoother transitions and preserving stakeholder relationships.

Why Companies Choose Friendly Takeovers

Companies choose friendly takeovers to ensure a smoother integration process, minimize employee resistance, and preserve organizational culture. By negotiating terms collaboratively, businesses can maintain brand reputation and customer loyalty while achieving strategic growth objectives. This cooperative approach often leads to synergistic benefits, increased market share, and enhanced shareholder value.

Famous Examples of Friendly Takeovers

A famous example of a friendly takeover is Disney's acquisition of Pixar in 2006, which strengthened Disney's animation capabilities while preserving Pixar's creative culture. Another notable case is Facebook's acquisition of Instagram in 2012, where both companies worked collaboratively to enhance social media offerings. Google's takeover of YouTube in 2006 also exemplifies a friendly acquisition that allowed rapid growth and integration of video-sharing technology into Google's platform.

Case Study: Disney’s Acquisition of Pixar

Disney's acquisition of Pixar in 2006 exemplifies a friendly takeover that enhanced both companies' creative and technological strengths. Valued at $7.4 billion, the deal combined Disney's vast distribution network with Pixar's innovative animation expertise, driving increased box office success and franchise development. This strategic partnership revitalized Disney's animation division and established a collaborative leadership structure focused on shared goals.

Benefits of a Friendly Takeover for Both Parties

A friendly takeover, such as Disney's acquisition of Pixar, fosters collaboration and smooth integration, minimizing operational disruptions and preserving company culture. Both parties benefit from shared expertise and resources, leading to enhanced innovation and market expansion. The acquiring company gains valuable assets and intellectual property, while the acquired firm secures financial stability and growth opportunities.

Steps Involved in a Friendly Business Takeover

A friendly business takeover typically begins with preliminary discussions where both companies explore mutual benefits and strategic alignment. This is followed by due diligence, where the acquiring company thoroughly reviews financial statements, operations, and legal obligations to ensure transparency. The final steps involve negotiation of terms, drafting of acquisition agreements, and obtaining necessary approvals from shareholders and regulatory bodies to complete the transaction.

Comparing Friendly and Hostile Takeovers

A friendly takeover occurs when the target company's management and board of directors agree to the acquisition, fostering cooperation and smoother integration, as seen in Disney's acquisition of Pixar. In contrast, a hostile takeover involves acquiring a company against the wishes of its management, exemplified by Vodafone's bid for Mannesmann. Friendly takeovers typically result in higher shareholder value and less disruption compared to the often contentious nature of hostile bids.

Lessons Learned from Successful Friendly Takeovers

Successful friendly takeovers, such as Disney's acquisition of Pixar in 2006, demonstrate the importance of aligning corporate cultures and maintaining transparent communication to ensure smooth integration. Emphasizing mutual respect and shared goals can enhance collaboration and preserve key talent, as seen in the seamless merger process. These lessons highlight that prioritizing relationship-building over aggressive tactics leads to lasting value creation in business consolidations.

The Future of Friendly Takeovers in Business

The future of friendly takeovers in business hinges on transparent negotiations and strategic alliances that benefit both parties, as seen in Microsoft's acquisition of LinkedIn, which fostered innovation without conflict. Companies increasingly prioritize cultural compatibility and shared visions to ensure seamless integration and sustained growth post-takeover. Advances in technology and data analytics further facilitate due diligence and trust-building, making friendly takeovers a preferred strategy in corporate expansions.

example of friendly takeover in business Infographic

samplerz.com

samplerz.com