A prominent example of a unicorn in the fintech sector is Stripe. Founded in 2010, Stripe revolutionized online payments by providing seamless payment processing solutions for businesses globally. The company's valuation surpassed $95 billion in 2023, highlighting its significant impact on digital transactions and ecommerce growth. Another notable fintech unicorn is Robinhood, which transformed the investment landscape by offering commission-free stock trading via a mobile app. Since its inception in 2013, Robinhood attracted millions of users, particularly millennials, democratizing access to financial markets. The platform's valuation crossed $30 billion following its 2021 public offering, marking it as a key player in the fintech industry.

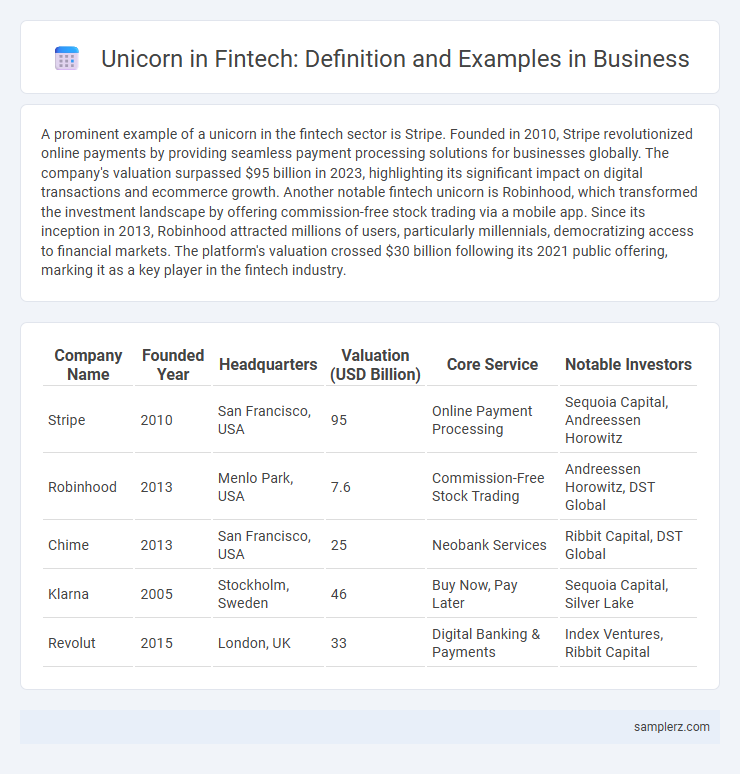

Table of Comparison

| Company Name | Founded Year | Headquarters | Valuation (USD Billion) | Core Service | Notable Investors |

|---|---|---|---|---|---|

| Stripe | 2010 | San Francisco, USA | 95 | Online Payment Processing | Sequoia Capital, Andreessen Horowitz |

| Robinhood | 2013 | Menlo Park, USA | 7.6 | Commission-Free Stock Trading | Andreessen Horowitz, DST Global |

| Chime | 2013 | San Francisco, USA | 25 | Neobank Services | Ribbit Capital, DST Global |

| Klarna | 2005 | Stockholm, Sweden | 46 | Buy Now, Pay Later | Sequoia Capital, Silver Lake |

| Revolut | 2015 | London, UK | 33 | Digital Banking & Payments | Index Ventures, Ribbit Capital |

Overview of Fintech Unicorns

Fintech unicorns like Stripe, valued at over $50 billion, revolutionize the payment processing industry by providing seamless digital transactions. Companies such as Robinhood, with a valuation exceeding $30 billion, disrupt traditional investment platforms through commission-free trading and user-friendly mobile apps. These fintech giants exemplify rapid growth fueled by innovation in financial technology, reshaping global financial services.

Key Characteristics of Fintech Unicorns

Fintech unicorns such as Stripe and Robinhood exhibit rapid scalability, innovative financial technology solutions, and strong valuation driven by disruptive business models in payments and investment sectors. These companies leverage advanced AI algorithms, seamless user experiences, and regulatory agility to capture significant market share. High customer acquisition rates, robust funding rounds exceeding $1 billion, and global expansion strategies typify key characteristics of successful fintech unicorns.

Notable Global Fintech Unicorns

Notable global fintech unicorns include Stripe, valued at over $50 billion, revolutionizing online payment processing worldwide. Robinhood, with its $11.7 billion valuation, transformed retail investing through commission-free trading platforms. Another key player, Revolut, boasting a $33 billion valuation, offers comprehensive digital banking services across multiple countries.

Success Stories: Fintech Unicorn Case Studies

Stripe, valued at over $50 billion, exemplifies fintech unicorn success by revolutionizing online payment processing with a developer-friendly platform that supports global transactions. Revolut, achieving a $33 billion valuation, disrupted traditional banking by offering multi-currency accounts, cryptocurrency trading, and seamless international transfers through its mobile app. These case studies highlight how innovative technology and customer-centric services drive exponential growth and market dominance in the fintech sector.

Factors Driving Fintech Unicorn Valuations

Fintech unicorns like Stripe showcase how innovation in payment solutions, scalability, and strong customer acquisition can drive high valuations. Strategic partnerships with major financial institutions and robust regulatory compliance enhance investor confidence and market positioning. Advanced data analytics and artificial intelligence enable personalized financial products, significantly boosting user engagement and revenue growth.

Emerging Fintech Unicorns to Watch

Emerging fintech unicorns like Chipper Cash and Nubank are transforming financial services across Africa and Latin America, leveraging innovative payment solutions and digital banking platforms. These companies have secured valuations exceeding $1 billion by addressing underbanked populations and driving financial inclusion through technology. Their rapid growth highlights the potential of emerging markets to foster groundbreaking fintech innovation and attract significant venture capital investments.

Innovative Technologies in Fintech Unicorns

Fintech unicorns like Stripe and Affirm leverage innovative technologies such as AI-driven fraud detection and blockchain-based smart contracts to revolutionize digital payments and lending. These companies harness machine learning algorithms to enhance risk assessment and provide seamless user experiences. Their adoption of decentralized finance (DeFi) platforms accelerates transparency and security in financial transactions globally.

Investment Trends in Fintech Unicorn Startups

Fintech unicorn startups like Stripe demonstrate significant investment trends by attracting extensive venture capital focused on payment processing innovations. These companies leverage advanced technologies such as AI-driven risk assessment and blockchain to disrupt traditional financial services, capturing substantial market share. Investor interest intensifies around scalable platforms addressing digital banking, lending, and personal finance management, reflecting evolving consumer demands and regulatory landscapes.

Challenges Faced by Fintech Unicorns

Fintech unicorns like Stripe face significant challenges including stringent regulatory compliance, cybersecurity threats, and the need for rapid technological innovation to stay competitive in a dynamic market. These companies often struggle with balancing aggressive growth strategies and maintaining customer trust amid evolving data privacy laws. Navigating complex global payment systems and securing funding also remain critical hurdles for sustained scalability.

The Future of Unicorns in Fintech

Fintech unicorns such as Stripe, valued at over $50 billion, exemplify rapid innovation by transforming payment infrastructure globally. The future of unicorns in fintech hinges on advancements in artificial intelligence, blockchain scalability, and embedded finance solutions driving enhanced user experiences and financial inclusion. Investors increasingly prioritize firms demonstrating robust regulatory compliance, sustainable growth, and disruptive potential within digital banking, lending, and insurance sectors.

example of unicorn in fintech Infographic

samplerz.com

samplerz.com