Runway in funding refers to the amount of time a startup or business can operate before it exhausts its available capital. It is calculated by dividing the current cash balance by the monthly burn rate, which includes all operating expenses. A longer runway provides a business more time to grow, seek additional funding, or achieve profitability. Investors and founders closely monitor runway to ensure the company does not run out of cash unexpectedly. For example, a startup with $500,000 in cash and monthly expenses of $50,000 has a runway of 10 months. Managing runway effectively helps businesses make strategic decisions about scaling, spending, and fundraising efforts.

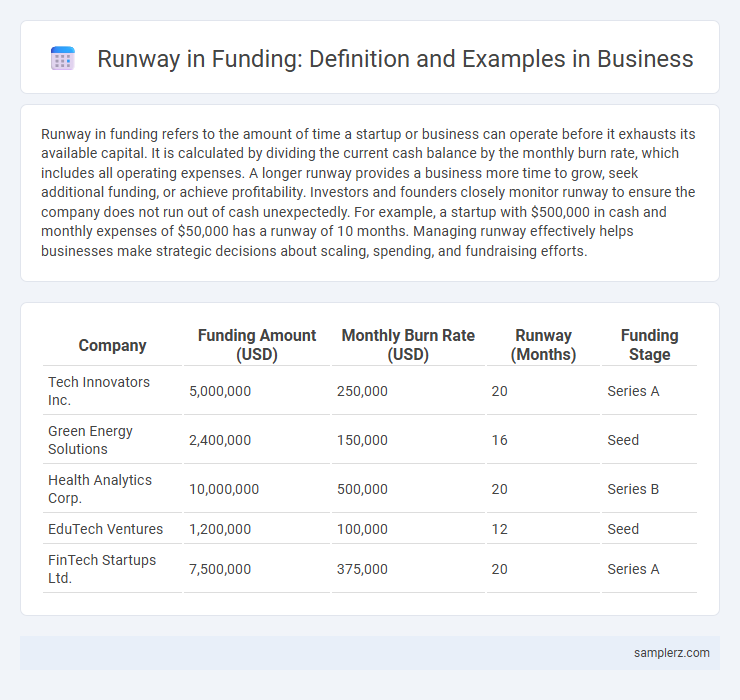

Table of Comparison

| Company | Funding Amount (USD) | Monthly Burn Rate (USD) | Runway (Months) | Funding Stage |

|---|---|---|---|---|

| Tech Innovators Inc. | 5,000,000 | 250,000 | 20 | Series A |

| Green Energy Solutions | 2,400,000 | 150,000 | 16 | Seed |

| Health Analytics Corp. | 10,000,000 | 500,000 | 20 | Series B |

| EduTech Ventures | 1,200,000 | 100,000 | 12 | Seed |

| FinTech Startups Ltd. | 7,500,000 | 375,000 | 20 | Series A |

Understanding Runway in Business Funding

Runway in business funding refers to the amount of time a startup can operate before exhausting its capital, calculated by dividing available cash by monthly burn rate. For instance, if a company has $500,000 in cash and spends $50,000 per month, its runway is 10 months. Understanding runway helps entrepreneurs plan fundraising efforts and operational strategies to ensure continuous growth and sustainability.

Key Metrics to Calculate Your Runway

Runway in funding is calculated by dividing your current cash balance by your monthly burn rate, which includes all operating expenses such as salaries, rent, and marketing costs. Key metrics to accurately calculate runway are monthly recurring revenue (MRR), burn rate, and cash on hand, enabling startups to project how many months they can operate before needing additional funding. Monitoring these metrics helps businesses manage liquidity and plan fundraising timelines effectively.

Real-Life Examples of Runway Calculations

A startup with $500,000 in available capital and monthly expenses of $50,000 has a runway of 10 months, calculated by dividing total funds by burn rate. For example, Airbnb in its early stages managed its runway carefully by extending the burn rate through strategic spending cuts during the COVID-19 downturn, preserving cash flow to survive. Uber's initial funding rounds also demonstrated runway extension by increasing capital infusion, allowing operational scaling before revenues matched expenses.

Factors Affecting Startups’ Financial Runway

Startups' financial runway depends heavily on monthly burn rate, initial capital, and revenue growth velocity. Market conditions, operational efficiency, and fundraising success also play critical roles in extending runway duration. Proper financial planning and cost management directly impact a startup's ability to sustain operations and achieve key milestones before needing additional funding.

The Role of Runway in Investor Decision-Making

Runway, defined as the amount of time a startup can operate before requiring additional funding, critically influences investor decisions by signaling the company's financial health and growth potential. A longer runway often indicates prudent cash management and reduces the urgency for immediate follow-up funding rounds, increasing investor confidence. Investors prioritize startups with at least 12 to 18 months of runway, viewing this timeframe as sufficient to achieve key milestones and reduce investment risk.

Strategies to Extend Your Business Runway

Extending your business runway involves optimizing cash flow through cost reduction strategies, such as renegotiating supplier contracts and delaying non-essential expenditures. Securing bridge financing or convertible notes can provide immediate capital without diluting equity prematurely. Enhancing revenue generation by targeting high-margin customers and accelerating sales cycles also boosts financial sustainability and prolongs operational longevity.

Case Study: Runway Management for Early-Stage Startups

Early-stage startups often face critical challenges in managing financial runway, exemplified by the case of XYZ Tech, which strategically extended its runway from six to twelve months through phased product launches and controlled operating expenses. Implementing rigorous financial forecasting and prioritizing key hires enabled XYZ Tech to optimize cash flow and attract subsequent funding rounds. Effective runway management directly impacts a startup's ability to achieve market traction and secure investor confidence.

Common Mistakes When Estimating Funding Runway

Entrepreneurs often overestimate their funding runway by assuming constant revenue growth without accounting for market fluctuations and unexpected expenses. Ignoring fixed and variable costs leads to inaccurate budget projections, reducing the ability to sustain operations during funding gaps. Failure to update runway estimates regularly in response to actual burn rate and financial changes can result in premature cash depletion and strategic missteps.

How to Communicate Runway to Stakeholders

Communicating runway to stakeholders requires clear presentation of current cash reserves and monthly burn rate to highlight the available funding duration. Use visual aids like graphs or charts to illustrate runway projections and emphasize how upcoming milestones align with funding needs. Ensure transparency about potential risks and contingency plans to maintain stakeholder confidence and support.

Tools and Resources for Accurate Runway Forecasting

Tools like Cash Flow Analyzer and ProjectionHub enable startups to create precise runway forecasts by integrating revenue, expenses, and growth metrics. Resources such as industry benchmarks and historical financial data enhance the accuracy of projections, reducing the risk of funding shortfalls. Leveraging advanced scenarios and sensitivity analyses helps business leaders optimize resource allocation and extend runway effectively.

example of runway in funding Infographic

samplerz.com

samplerz.com