A poison put is a defensive strategy used in bond issuance to discourage hostile takeovers by altering bond terms after a triggering event. This mechanism often involves a significant increase in the bond's interest rate, making it expensive for an acquiring company to purchase the debt. Corporations implement poison puts to protect their control structure and prevent unwanted investors from gaining influence through debt acquisition. In practice, a poison put clause might allow bondholders to demand early repayment if a merger or acquisition occurs without board approval. The resulting financial strain acts as a deterrent to potential acquirers seeking to leverage the company's bonds for control. This tactic aligns with broader corporate governance strategies aimed at preserving management's autonomy and shareholder value.

Table of Comparison

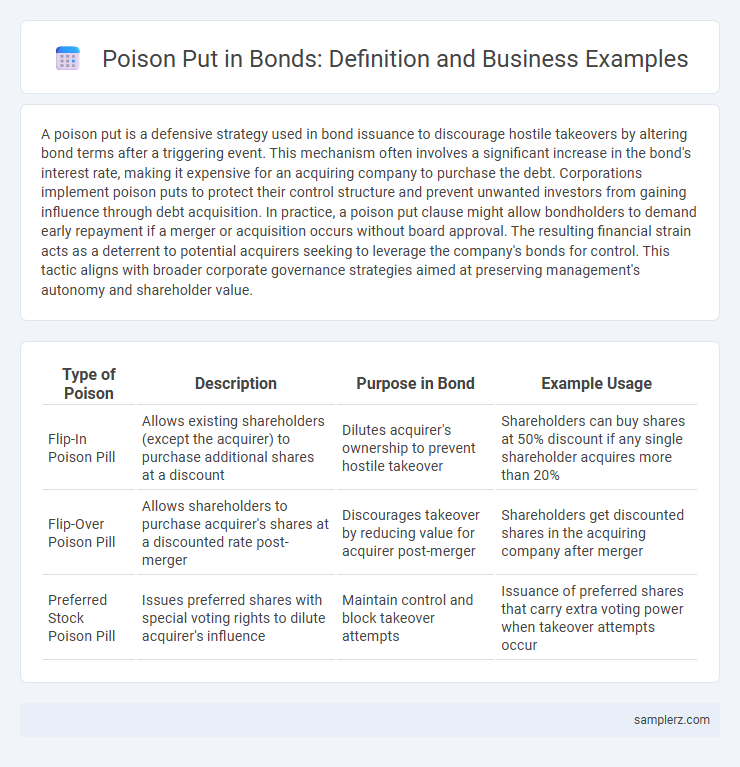

| Type of Poison | Description | Purpose in Bond | Example Usage |

|---|---|---|---|

| Flip-In Poison Pill | Allows existing shareholders (except the acquirer) to purchase additional shares at a discount | Dilutes acquirer's ownership to prevent hostile takeover | Shareholders can buy shares at 50% discount if any single shareholder acquires more than 20% |

| Flip-Over Poison Pill | Allows shareholders to purchase acquirer's shares at a discounted rate post-merger | Discourages takeover by reducing value for acquirer post-merger | Shareholders get discounted shares in the acquiring company after merger |

| Preferred Stock Poison Pill | Issues preferred shares with special voting rights to dilute acquirer's influence | Maintain control and block takeover attempts | Issuance of preferred shares that carry extra voting power when takeover attempts occur |

Understanding Poison Put Provisions in Bonds

Poison put provisions in bonds allow investors to sell bonds back to the issuer at a predetermined price if a hostile takeover or significant credit deterioration occurs, protecting bondholders from increased risk. This mechanism is often activated during acquisition threats, providing a safeguard against issuer default or unfavorable changes in control. Understanding these provisions is crucial for investors aiming to mitigate risk and preserve bond value during corporate restructuring events.

Key Examples of Poison Put Clauses in Corporate Bonds

Key examples of poison put clauses in corporate bonds include the 2008 General Motors bond issuance, which allowed investors to sell bonds back at par upon a downgrade below investment grade. Another notable instance is the 2012 Sprint Nextel bond, which enabled bondholders to put bonds back to the issuer if a change of control occurred. These clauses provide protection to bondholders by enabling early redemption in adverse financial situations or corporate events.

How Poison Put Provisions Protect Bondholders

Poison put provisions empower bondholders to demand early repayment if a company undergoes significant financial changes, such as a credit rating downgrade or a hostile takeover, safeguarding their investment. These clauses help maintain bondholder confidence by mitigating risks associated with declining issuer creditworthiness or adverse corporate actions. By allowing prompt redemption, poison put provisions reduce potential losses and enhance the liquidity of bonds in volatile market conditions.

Notable Cases: Poison Put Activation in Mergers and Acquisitions

Notable cases of poison put activation in mergers and acquisitions include the 2007 Jefferson County bond deal, where bondholders exercised poison puts following the county's financial crisis, protecting investors from default risk. In the 2015 Sprint-SoftBank merger, bondholders utilized poison puts to mitigate uncertainty during ownership changes, ensuring debt repayment terms remained favorable. These instances demonstrate how poison puts serve as strategic safeguards for bondholders amid corporate restructuring and M&A events.

Real-World Companies Utilizing Poison Put Strategies

Real-world companies like Netflix and Tesla have employed poison put strategies to protect against hostile takeovers by allowing bondholders to demand early repayment if a change in control occurs. This mechanism disincentivizes potential acquirers by increasing their financial risk and cost of acquisition. Corporate lawyers and financial strategists often recommend poison puts as an effective defense tool in leveraged buyouts or merger negotiations.

Poison Put Versus Other Defensive Measures in Bond Agreements

A poison put clause empowers bondholders to sell their bonds back to the issuer at a premium upon a change of control, serving as a powerful deterrent against hostile takeovers. Unlike traditional covenants that limit issuer actions, poison puts provide immediate liquidity and financial protection to bondholders, enhancing their negotiating position. Compared to other defensive measures such as call protections or restriction on asset sales, poison puts uniquely align bondholder interests with protection against adverse corporate control changes.

Impact of Poison Put on Corporate Financing Decisions

Poison put provisions, such as those triggered during hostile takeovers or significant credit rating downgrades, can significantly influence corporate financing by increasing bondholders' leverage to demand early repayment, thereby raising the issuer's cost of debt. Firms with poison put clauses often face reduced flexibility in refinancing strategies and may avoid risky ventures to prevent triggering these put options. Consequently, the presence of poison puts leads to more conservative capital structures, impacting overall financial decision-making and investor perceptions.

Legal and Regulatory Considerations for Poison Put Provisions

Poison put provisions in bonds allow bondholders to demand early repayment if a company undergoes a significant change, such as a hostile takeover or regulatory breach, safeguarding investor interests under legal frameworks. These provisions must comply with securities laws and regulations, including disclosure requirements under the Securities Act and continuous reporting obligations mandated by the SEC. Properly structured poison put clauses reduce litigation risks by clearly defining triggering events and remedies, ensuring enforceability in courts and regulatory bodies.

Investor Perspectives on Bonds with Poison Put Features

Investors value bonds with poison put features because these provisions allow them to sell bonds back to issuers at a premium if a hostile takeover or significant change in control occurs, protecting their investments from abrupt risk shifts. Such features enhance bond attractiveness by reducing credit risk and providing a safeguard against potential corporate instability. Consequently, poison put bonds often command favorable yields and attract risk-averse investors seeking downside protection.

The Future of Poison Put Provisions in Modern Bond Markets

Poison put provisions, designed to protect bondholders by allowing early redemption if a company undergoes significant changes, are evolving in response to modern bond markets' complexity. Recent trends indicate increased utilization in high-yield and emerging market bonds, offering investors enhanced control against credit deterioration. Advances in regulatory frameworks and investor demand suggest poison puts will remain integral to bond contracts, balancing issuer flexibility with bondholder security.

example of poison put in bond Infographic

samplerz.com

samplerz.com