A golden parachute in a business context refers to a substantial financial compensation package guaranteed to top executives if they are terminated or forced to leave the company due to a merger or acquisition. For example, when Steve Jobs returned to Apple in 1997, his contract included a golden parachute that awarded him millions in stock options and severance pay if he was ousted. Such agreements serve to protect executives' financial interests during corporate restructuring or leadership changes. Another example is the golden parachute granted to Marissa Mayer when Yahoo was acquired by Verizon in 2017. Her deal included severance payments totaling over $23 million, encompassing cash, stock options, and bonuses. These arrangements often aim to retain high-level talent during uncertain transitions and deter hostile takeovers by imposing significant costs on acquiring firms.

Table of Comparison

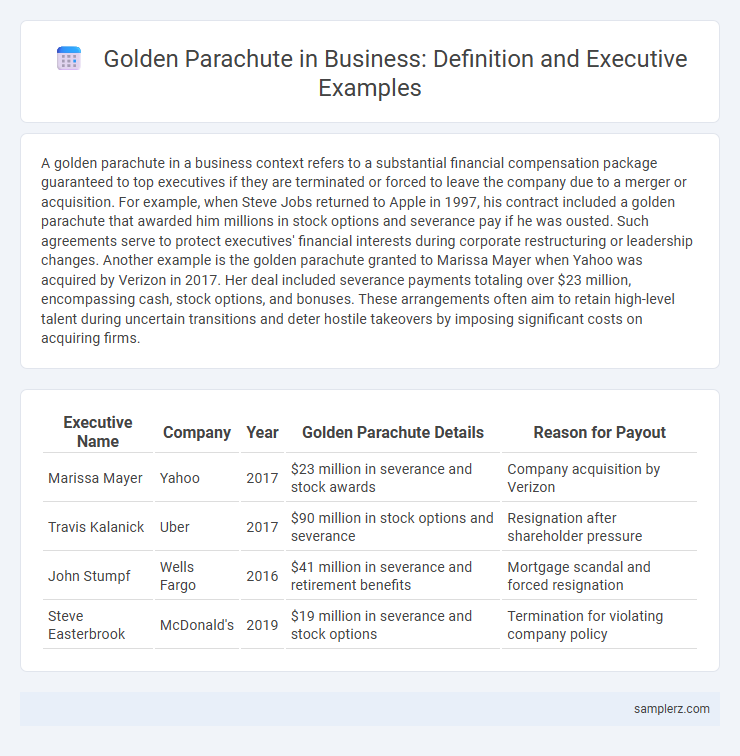

| Executive Name | Company | Year | Golden Parachute Details | Reason for Payout |

|---|---|---|---|---|

| Marissa Mayer | Yahoo | 2017 | $23 million in severance and stock awards | Company acquisition by Verizon |

| Travis Kalanick | Uber | 2017 | $90 million in stock options and severance | Resignation after shareholder pressure |

| John Stumpf | Wells Fargo | 2016 | $41 million in severance and retirement benefits | Mortgage scandal and forced resignation |

| Steve Easterbrook | McDonald's | 2019 | $19 million in severance and stock options | Termination for violating company policy |

Iconic Golden Parachute Cases in Corporate History

Iconic golden parachute cases in corporate history include Steve Jobs' exit from Apple in 1985, where he received a substantial severance package that safeguarded his financial interests despite his departure. Another notable example is Meg Whitman's exit from eBay, where her golden parachute provided a multimillion-dollar payout amid leadership transitions. These cases exemplify how executive severance agreements can protect top leaders while influencing corporate governance and shareholder perceptions.

Notable Golden Parachute Agreements: Real-Life Examples

Elon Musk's 2018 Tesla contract included a notable golden parachute with stock options valued at over $2.6 billion, triggered by company performance milestones. Yahoo's former CEO Marissa Mayer secured a severance package worth $23 million following the company's acquisition by Verizon. These high-profile agreements exemplify how golden parachutes provide substantial financial security for executives during corporate transitions and mergers.

Famous CEOs with Lucrative Golden Parachute Packages

Famous CEOs like Steve Jobs of Apple and Bob Iger of Disney received lucrative golden parachute packages, ensuring millions in severance and stock options upon departure. These agreements often include cash bonuses, stock grants, and continued benefits, safeguarding executives financially during mergers or leadership transitions. Such high-value golden parachutes exemplify corporate strategies to retain top talent while mitigating risks associated with executive turnover.

Golden Parachute Clauses: High-Profile Industry Examples

Golden parachute clauses have been prominently featured in executive contracts at major corporations such as Apple, where Tim Cook received a severance package valued at over $120 million in 2021. Another high-profile example is Elon Musk's Tesla agreement, including a $2.3 billion compensation deal with significant golden parachute protections. These clauses provide substantial financial security, often involving multi-million dollar payouts and stock options, designed to protect executives during mergers or abrupt departures.

Case Studies: Golden Parachute Payouts in Major Mergers

In the 2001 AOL-Time Warner merger, executives received golden parachute payouts totaling over $100 million, exemplifying the protection provided during corporate restructuring. Similarly, the 2018 Disney-Fox deal triggered $160 million in severance packages for top executives, highlighting the financial safeguards in large-scale acquisitions. These case studies illustrate how golden parachutes serve as critical components in executive compensation agreements during major mergers to mitigate personal financial risk.

Golden Parachutes in Tech: Executive Examples

Goldman Sachs provided a notable golden parachute of $68 million to its former CEO during a merger, reflecting the tech industry's trend of lucrative executive exit packages. In the tech sector, Sundar Pichai of Google secured a golden parachute exceeding $100 million, including salary, bonuses, and stock options, ensuring financial security upon leadership transition. These substantial severance packages underscore the strategic importance placed on retaining and rewarding top-tier talent amidst corporate restructuring.

Exemplary Golden Parachute Deals in the Fortune 500

Exemplary golden parachute deals in Fortune 500 companies include former Tesla CEO Elon Musk, who reportedly secured a $56 billion compensation package tied to performance milestones, and General Electric's Jeff Immelt, who received a $200 million severance bundle upon retirement. These agreements often encompass cash payouts, stock options, and other benefits designed to protect executives during mergers or leadership transitions. Such lucrative parachutes reflect corporate governance strategies aimed at retaining top talent while ensuring smooth executive departures.

Golden Parachute Stories: Lessons from Big Business

In 2020, Elon Musk secured a golden parachute valued at over $2.3 billion amid Tesla's exponential growth, illustrating how such agreements can protect executives during corporate transitions. Amazon's former CEO Jeff Bezos also benefited from substantial golden parachute packages, underscoring the importance of negotiated exit compensations in major business changes. These high-profile cases highlight the strategic role golden parachutes play in aligning executive incentives with company resilience and shareholder value.

Controversial Executive Golden Parachute Packages

Controversial executive golden parachute packages often involve multi-million dollar severance deals granted to CEOs despite company underperformance or layoffs, sparking public and shareholder backlash. For example, former Uber CEO Travis Kalanick received a $45 million exit package amid scandals and declining investor confidence. These abusive golden parachutes raise concerns over corporate governance and equitable executive compensation.

Golden Parachute Examples: Impact on Corporate Takeovers

Golden parachute agreements often provide top executives with substantial financial compensation, including severance pay, stock options, and bonuses, upon a change in company control, which can influence the dynamics of corporate takeovers. Prominent examples include the $120 million golden parachute awarded to Steve Jobs during Apple's 1997 restructuring, highlighting how these contracts can protect executives but also deter hostile bids by increasing acquisition costs. Such provisions impact negotiation strategies by offering stability for executives while creating potential financial burdens for acquiring firms, thereby shaping merger and acquisition outcomes.

example of golden parachute in executive Infographic

samplerz.com

samplerz.com