A golden parachute in business refers to a lucrative financial agreement granted to top executives if they are terminated or forced to leave the company following a merger or acquisition. One prominent example is the golden parachute awarded to Carly Fiorina, former CEO of Hewlett-Packard, who received a severance package worth approximately $21 million after her departure in 2005. These agreements often include cash bonuses, stock options, and other benefits meant to protect executives during uncertain corporate transitions. Another notable case involved Bob Nardelli, former CEO of Chrysler, who secured a golden parachute valued at over $45 million after stepping down in 2009 during the company's bankruptcy and restructuring process. Such contracts are designed to ensure executive loyalty and smooth leadership changes during mergers or hostile takeovers. Golden parachutes have drawn criticism for their size but remain a common feature in corporate governance for mitigating risks faced by high-level executives.

Table of Comparison

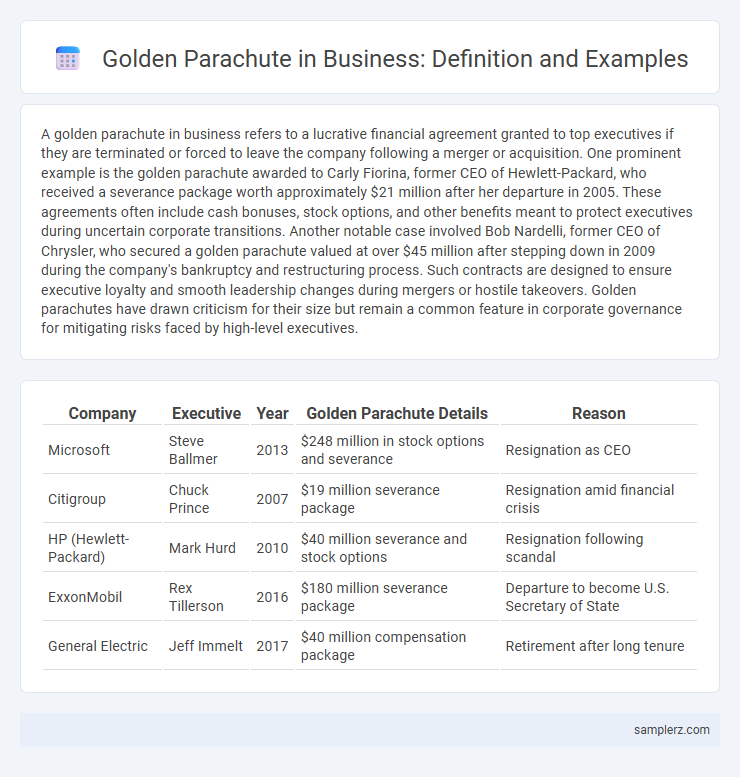

| Company | Executive | Year | Golden Parachute Details | Reason |

|---|---|---|---|---|

| Microsoft | Steve Ballmer | 2013 | $248 million in stock options and severance | Resignation as CEO |

| Citigroup | Chuck Prince | 2007 | $19 million severance package | Resignation amid financial crisis |

| HP (Hewlett-Packard) | Mark Hurd | 2010 | $40 million severance and stock options | Resignation following scandal |

| ExxonMobil | Rex Tillerson | 2016 | $180 million severance package | Departure to become U.S. Secretary of State |

| General Electric | Jeff Immelt | 2017 | $40 million compensation package | Retirement after long tenure |

Defining Golden Parachute in Modern Business

A golden parachute in modern business refers to a lucrative financial package awarded to top executives upon termination, usually triggered by mergers or acquisitions. These agreements typically include substantial severance pay, bonuses, stock options, and other benefits designed to provide security and incentivize leadership stability during corporate transitions. Golden parachutes aim to protect executives from abrupt financial loss while aligning their interests with shareholder value during potentially disruptive business events.

High-Profile Golden Parachute Case Studies

High-profile golden parachute case studies include Lloyd Blankfein's exit package from Goldman Sachs, which reportedly exceeded $100 million, highlighting the lucrative severance arrangements for top executives during mergers or leadership transitions. Another notable example is the $120 million golden parachute awarded to Marissa Mayer following her departure from Yahoo after its acquisition by Verizon, underscoring the significant financial protections for CEOs amid corporate restructuring. These cases illustrate the strategic use of golden parachutes to secure executive loyalty and smooth leadership changes in major corporations.

Impactful Golden Parachute Examples in Fortune 500 Companies

Apple's former CEO Steve Jobs received a golden parachute valued at approximately $250 million during his departure, highlighting the company's commitment to executive retention. Similarly, JPMorgan Chase granted a $90 million severance package to CEO Jamie Dimon, demonstrating the financial safety net large corporations provide top executives. These impactful golden parachute examples in Fortune 500 companies underscore the strategic use of lucrative exit packages to maintain leadership stability during transitions.

Notable CEO Exits with Golden Parachute Packages

Notable CEO exits with golden parachute packages include Steve Jobs' departure from Apple in 1985, where he received a substantial severance clause despite being forced out. Another prominent example is Carly Fiorina's exit from Hewlett-Packard in 2005, marked by a multi-million dollar package tied to leadership transition. These golden parachutes serve to protect top executives financially during abrupt or contentious company leadership changes.

Golden Parachute Payouts: Real-World Business Scenarios

Golden parachute payouts frequently occur in mergers and acquisitions, such as the $210 million package awarded to Steve Elkington after the merger of ClubCorp and Arcis Golf. These agreements protect high-level executives from financial loss by providing substantial severance payments upon termination following a change in control. Real-world examples demonstrate how golden parachutes serve as strategic tools to facilitate executive transitions while safeguarding leadership stability and shareholder value.

Examining Golden Parachute Clauses in Major Mergers

Golden parachute clauses in major mergers often provide top executives with substantial severance packages, including cash bonuses, stock options, and benefits upon termination due to a merger or acquisition. Notable examples include the 2016 AT&T and Time Warner merger, where executives received multi-million dollar payouts, and the Disney-Fox deal, which featured significant golden parachute agreements to secure leadership stability. These clauses aim to retain key talent during transitions while mitigating risks associated with executive departures.

Lessons from Iconic Golden Parachute Agreements

Iconic golden parachute agreements, such as those negotiated by Steve Jobs during Apple's 1997 return and Meg Whitman's exit from Hewlett-Packard in 2011, illustrate critical lessons in aligning executive incentives with shareholder value during corporate transitions. These agreements often include multi-million dollar severance packages, stock options, and bonuses designed to protect executives from fallout due to mergers or leadership changes. The strategic design of these parachutes emphasizes the importance of balancing risk mitigation for executives with the long-term interests of investors and corporate stability.

Financial Implications of Golden Parachute Examples

Golden parachutes often include multi-million dollar severance packages triggered by mergers or acquisitions, impacting company financials through increased liabilities and potential shareholder dilution. For instance, in the 2017 Verizon and Yahoo merger, executive payouts exceeded $50 million, significantly influencing transaction costs and investor perceptions. These financial implications can affect stock prices and corporate valuation, leading companies to carefully weigh golden parachute clauses during deal negotiations.

Shareholder Reactions to Golden Parachute Deals

Shareholder reactions to golden parachute deals often vary, with some investors viewing them as essential protections for executives during mergers and acquisitions, while others criticize them for excessive payouts that may not align with company performance. Empirical studies show that shareholder activism tends to increase when golden parachute packages exceed industry norms or lack transparent justification. Companies like Yahoo and eBay have faced significant shareholder scrutiny over golden parachute terms, prompting calls for stricter governance and improved disclosure practices.

Trends in Golden Parachute Packages Across Industries

Golden parachute packages have become increasingly common in technology and finance sectors, with executives receiving severance pay often exceeding $20 million to safeguard against corporate takeovers. Recent trends indicate a rise in performance-based triggers and equity compensation components in industries such as pharmaceuticals and manufacturing. Data from 2023 shows a 15% increase in golden parachute agreements in mergers and acquisitions, reflecting growing corporate emphasis on executive risk management.

example of golden parachute in business Infographic

samplerz.com

samplerz.com