A carve-out in business restructuring involves separating a specific division or subsidiary from the parent company to operate independently or be sold to another entity. This process allows the parent company to streamline its operations and focus on core activities while unlocking value from non-core assets. Data from recent industry reports indicate that carve-outs have resulted in average value increases of 15% to 25% for both the parent company and the spun-off entity. Carve-outs typically require detailed financial analysis to establish standalone financial statements and operational capabilities for the divested unit. Companies often engage external consultants and legal advisors to ensure compliance and maximize the strategic benefits of the restructuring. Case studies from major corporations reveal that successful carve-outs improve operational efficiency and drive shareholder value by enabling targeted growth strategies in each separate entity.

Table of Comparison

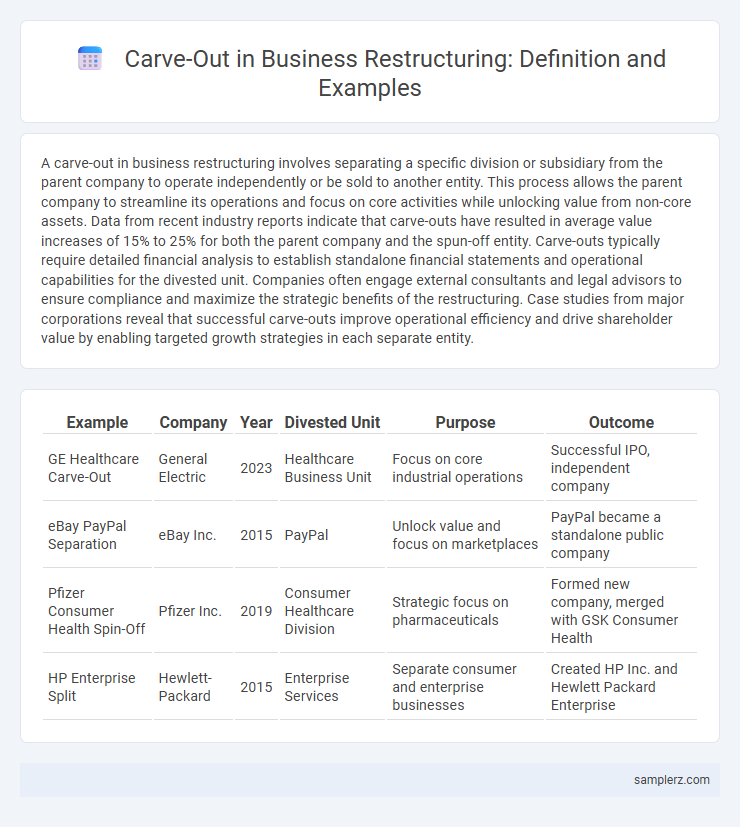

| Example | Company | Year | Divested Unit | Purpose | Outcome |

|---|---|---|---|---|---|

| GE Healthcare Carve-Out | General Electric | 2023 | Healthcare Business Unit | Focus on core industrial operations | Successful IPO, independent company |

| eBay PayPal Separation | eBay Inc. | 2015 | PayPal | Unlock value and focus on marketplaces | PayPal became a standalone public company |

| Pfizer Consumer Health Spin-Off | Pfizer Inc. | 2019 | Consumer Healthcare Division | Strategic focus on pharmaceuticals | Formed new company, merged with GSK Consumer Health |

| HP Enterprise Split | Hewlett-Packard | 2015 | Enterprise Services | Separate consumer and enterprise businesses | Created HP Inc. and Hewlett Packard Enterprise |

Overview of Carve-Outs in Business Restructuring

Carve-outs in business restructuring involve separating a business unit or asset from the parent company to create a standalone entity, often to unlock value or focus on core operations. This process includes divesting non-core assets, optimizing operational efficiency, and attracting strategic investors for the new entity. Prominent examples include Pfizer's spin-off of its animal health business, Zoetis, which enhanced shareholder value by allowing specialized focus and investment in core pharmaceuticals.

Key Drivers Behind Carve-Out Decisions

Carve-out decisions in business restructuring are primarily driven by the need to unlock shareholder value, improve focus on core operations, and enhance financial performance. Key drivers include divesting non-core assets to streamline the portfolio, raising capital for strategic investments, and mitigating regulatory risks. Market conditions and the potential for operational synergies also significantly influence carve-out execution strategies.

Notable Real-World Carve-Out Examples

General Electric's 2015 separation of its appliance division into the independent company Haier demonstrated a successful carve-out restructuring, enabling GE to refocus on its core industrial operations. PayPal's spin-off from eBay in 2015 allowed both entities to pursue distinct strategic objectives, enhancing shareholder value through tailored operational approaches. Similarly, Hewlett-Packard's 2015 split into HP Inc. and Hewlett Packard Enterprise exemplified a strategic carve-out aimed at specialization within printing and personal computing versus enterprise technology services.

Carve-Out vs. Spin-Off: Differences Explained

A carve-out involves a company selling a minority stake in a subsidiary to outside investors while retaining control, providing immediate capital infusion without full divestiture. A spin-off occurs when a parent company distributes shares of a subsidiary to existing shareholders, creating an independent company with separate management and financials. Carve-outs offer partial ownership retention and strategic partnerships, whereas spin-offs lead to complete operational and ownership separation.

Strategic Benefits of Carve-Out Transactions

Carve-out transactions in business restructuring enable companies to unlock hidden value by divesting non-core assets, allowing management to concentrate on strategic growth areas. These transactions improve operational agility and financial performance by separating underperforming divisions or subsidiaries, making the core business more attractive to investors. Enhanced focus on core competencies and streamlined organizational structures drive sustainable competitive advantage following a carve-out.

Common Challenges During Carve-Out Execution

Common challenges during carve-out execution include data integration complexities, regulatory compliance risks, and cultural alignment issues between divested units and the parent company. Inadequate separation of IT systems often leads to operational disruptions, while unclear communication can cause employee uncertainty and decreased productivity. Managing financial reporting and ensuring seamless transition of contracts and assets are critical to maintaining business continuity throughout the carve-out process.

Steps Involved in a Successful Carve-Out

Successful carve-outs in business restructuring involve strategic planning, asset separation, and operational realignment. Key steps include identifying and isolating the carve-out assets, establishing independent financial systems and governance, and ensuring seamless transition for employees and customers. Detailed due diligence, clear communication, and robust integration frameworks are essential to maximize value and minimize disruption during the carve-out process.

Legal and Regulatory Considerations in Carve-Outs

Carve-outs in business restructuring demand meticulous attention to legal and regulatory considerations, including compliance with antitrust laws and securities regulations. Clear delineation of asset ownership, intellectual property rights, and contract novations is critical to avoid disputes and ensure smooth transition. Regulatory approvals from bodies such as the SEC or FTC often dictate timelines and conditions for successful divestitures.

Impact of Carve-Outs on Stakeholders

Carve-outs in business restructuring significantly affect stakeholders by reshaping ownership and operational control, often leading to realigned shareholder value and altered employee roles. Investors may experience changes in stock valuation due to the separation of non-core assets, while employees might face job restructuring or new opportunities within specialized entities. Customers and suppliers could encounter shifts in service delivery and contract negotiations as the carved-out company develops its independent strategic focus.

Future Trends in Carve-Out Restructuring

Future trends in carve-out restructuring highlight increased adoption of digital tools and data analytics to enhance due diligence and asset valuation accuracy. Companies are leveraging artificial intelligence to streamline the separation process, reducing costs and accelerating transaction timelines. Emphasis on environmental, social, and governance (ESG) factors is reshaping asset selection, with carve-outs prioritizing sustainable and high-growth business units to attract forward-looking investors.

example of carve-out in restructuring Infographic

samplerz.com

samplerz.com