A zombie company in the economy is a business that generates just enough revenue to continue operating and service its debt but lacks the financial strength to invest in growth or innovation. One prominent example is Sears Holdings Corporation, which struggled with declining sales and large debt loads for years before its eventual bankruptcy filing in 2018. This company's inability to modernize and compete with e-commerce giants left it financially impaired and dependent on continuous borrowing. Another example of a zombie company is Chesapeake Energy, a major player in the U.S. shale gas industry that faced significant financial distress due to high debt and volatile commodity prices. Despite struggling with losses and limited cash flow, Chesapeake managed to continue operations through debt refinancing and restructuring efforts until it filed for bankruptcy in 2020. The persistence of such companies in the market can create inefficiencies and drag on overall economic productivity.

Table of Comparison

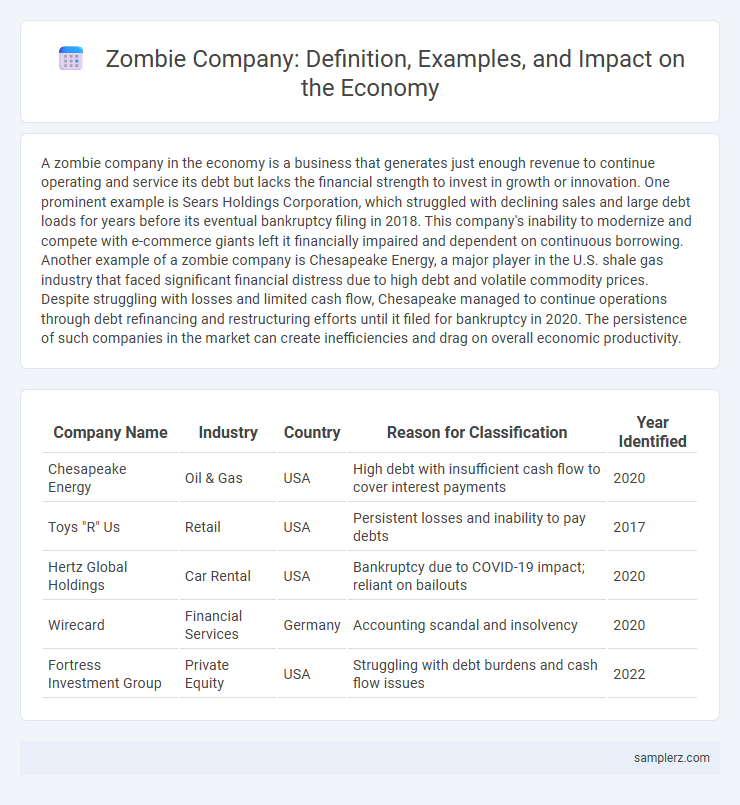

| Company Name | Industry | Country | Reason for Classification | Year Identified |

|---|---|---|---|---|

| Chesapeake Energy | Oil & Gas | USA | High debt with insufficient cash flow to cover interest payments | 2020 |

| Toys "R" Us | Retail | USA | Persistent losses and inability to pay debts | 2017 |

| Hertz Global Holdings | Car Rental | USA | Bankruptcy due to COVID-19 impact; reliant on bailouts | 2020 |

| Wirecard | Financial Services | Germany | Accounting scandal and insolvency | 2020 |

| Fortress Investment Group | Private Equity | USA | Struggling with debt burdens and cash flow issues | 2022 |

Defining Zombie Companies in Modern Economies

Zombie companies in modern economies are firms that generate just enough revenue to cover interest payments but lack sufficient profit to invest or grow, often relying on ongoing financial support. These companies, prevalent in industries facing structural decline or technological disruption, burden the economy by tying up capital and labor in unproductive activities. The persistence of zombie firms can slow economic growth and reduce overall market efficiency by impeding the entry and expansion of more innovative and competitive businesses.

Key Characteristics of Zombie Firms

Zombie firms are companies that generate just enough revenue to cover operating expenses and interest payments without reducing their debt, often relying on continuous refinancing to stay afloat. They typically exhibit low productivity, poor profitability, and weak cash flow, hindering investment and growth potential within the economy. These characteristics contribute to resource misallocation, slowing overall economic dynamism and innovation.

Historical Overview: Rise of Zombie Companies

During Japan's "Lost Decade" in the 1990s, numerous zombie companies emerged due to prolonged economic stagnation and loose monetary policies, resulting in firms surviving on debt despite generating insufficient profits. U.S. and European markets witnessed a resurgence of zombie companies following the 2008 financial crisis, with companies relying heavily on low-interest rates to service debt without improving productivity. These historical waves highlight how economic downturns and accommodative central bank policies contribute to the rise and persistence of zombie companies.

Notable Global Examples of Zombie Companies

Notable global examples of zombie companies include Japan's Toshiba Corporation, which struggled with heavy debt despite government support, and Italy's Alitalia, burdened by chronic losses and state bailouts for years. In the United States, Chesapeake Energy exemplified a zombie company by continuing operations amid persistent financial distress and leveraged debt before filing for bankruptcy in 2020. These companies highlight the challenge of non-viable firms surviving due to excessive debt and external financial support, distorting economic efficiency.

Zombie Companies in the Banking Sector

Zombie companies in the banking sector are financial institutions that continue operating despite being unable to generate sufficient profits to cover their debt servicing costs. An example is Japan's long-standing banking crisis, where numerous banks struggled with non-performing loans during the 1990s economic stagnation, forcing prolonged support from the government. These zombie banks hinder economic growth by allocating capital inefficiently and maintaining weak credit standards, impacting overall financial stability.

The Impact of Zombie Firms on Economic Growth

Zombie firms, such as Japan's prolific example during the 1990s Lost Decade, persist by relying on continuous debt refinancing despite generating insufficient earnings to cover interest payments. These companies drain financial resources, distort capital allocation, and suppress productivity by crowding out viable businesses, leading to slower overall economic growth. Empirical studies indicate that economies with high concentrations of zombie firms experience reduced investment rates and innovation, undermining long-term development prospects.

Government Policies Supporting Zombie Businesses

Government policies that provide prolonged financial support and lenient credit conditions can inadvertently sustain zombie companies, preventing market reallocation and innovation. For example, during economic downturns, some countries implement subsidy programs and low-interest loan schemes aimed at preserving employment but end up propping up unprofitable firms like Japan's long-standing zombie corporations in the manufacturing sector. Maintaining such businesses through regulatory forbearance inhibits competition and economic growth by allocating resources away from more productive enterprises.

Warning Signs of a Zombie Company

Persistent negative cash flow, an inability to cover interest expenses from operating profits, and consistent reliance on debt refinancing are key warning signs of a zombie company. Declining productivity paired with sluggish revenue growth often indicates a firm's operational inefficiency and financial distress. Investors and creditors should monitor these indicators closely to avoid prolonged exposure to insolvent businesses.

Sectoral Analysis: Industries Prone to Zombie Firms

Industries such as retail, hospitality, and traditional manufacturing exhibit a higher prevalence of zombie companies due to intense competition and low profit margins. In the retail sector, firms struggling with outdated business models and rising e-commerce competition often become zombie companies, unable to cover debt servicing. The energy sector, particularly coal and fossil fuel industries, also shows vulnerability as declining demand and regulatory pressures trap firms in persistent financial distress.

Future Outlook: Reducing Zombie Company Prevalence

Improving financial regulations and promoting sustainable lending practices can significantly reduce the prevalence of zombie companies, which drain economic resources and hinder productivity. Increasing transparency in corporate disclosures and enhancing credit assessment models enable investors to identify and avoid distressed firms more effectively. Future economic growth depends on reallocating capital from non-viable zombie firms to innovative and high-potential businesses.

example of zombie company in economy Infographic

samplerz.com

samplerz.com