Burn rate in business refers to the rate at which a company spends its available capital to cover operating expenses before generating positive cash flow. For example, a startup with $1 million in funding that spends $100,000 per month on salaries, rent, and marketing has a burn rate of $100,000. This metric helps investors and management assess how long the company can sustain operations without additional funding. Understanding burn rate is critical for budgeting and financial planning, especially for early-stage businesses. A high burn rate may indicate aggressive expansion or inefficient spending, while a low burn rate suggests conservative cash management. Tracking monthly burn rate enables businesses to forecast runway, the duration the company can operate before depleting cash reserves.

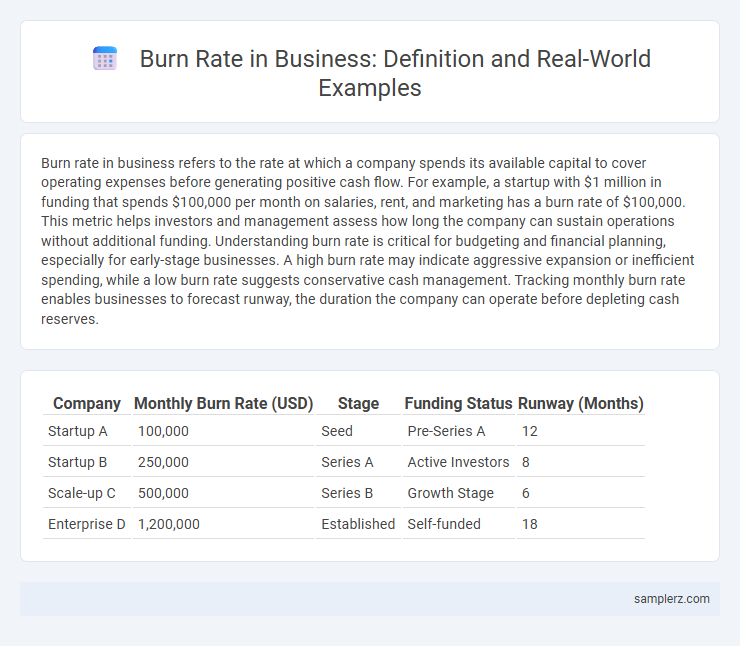

Table of Comparison

| Company | Monthly Burn Rate (USD) | Stage | Funding Status | Runway (Months) |

|---|---|---|---|---|

| Startup A | 100,000 | Seed | Pre-Series A | 12 |

| Startup B | 250,000 | Series A | Active Investors | 8 |

| Scale-up C | 500,000 | Series B | Growth Stage | 6 |

| Enterprise D | 1,200,000 | Established | Self-funded | 18 |

Understanding Burn Rate: Definition and Importance in Business

Burn rate measures the rate at which a company spends its capital before generating positive cash flow, typically expressed monthly. Tracking burn rate is crucial for startups and businesses to monitor financial health and determine the runway--the time remaining before funds deplete. Understanding and managing burn rate helps businesses make informed decisions about budgeting, fundraising, and scaling operations effectively.

Key Factors Influencing Burn Rate in Companies

Burn rate in business is primarily influenced by fixed costs such as salaries, rent, and utilities, which establish a baseline for monthly expenditures. Variable expenses like marketing campaigns, product development, and operational scaling cause fluctuations, impacting the overall cash outflow. Investor funding schedules and revenue generation rates also play critical roles in determining how quickly a company depletes its capital reserves.

Calculating Burn Rate: Step-by-Step Example

A company with monthly expenses of $50,000 and revenue of $20,000 has a burn rate of $30,000, indicating the net cash outflow per month. To calculate the burn rate, subtract monthly revenue from monthly expenses ($50,000 - $20,000 = $30,000). This metric helps businesses understand how quickly they are using their cash reserves and estimate the runway before needing additional funding.

Example of Burn Rate in a Startup Environment

A startup with monthly operating expenses of $100,000 and $1,000,000 in available capital has a burn rate of $100,000 per month, indicating it will exhaust funds in 10 months without generating revenue. Monitoring this burn rate helps founders manage cash flow and adjust spending to extend runway. Accurate assessment ensures strategic decisions for fundraising and scaling operations.

Burn Rate Analysis: Real-World Scenarios

A startup with monthly expenses of $150,000 and cash reserves of $1.2 million has a burn rate of 8 months, indicating how long it can operate before requiring additional funding. Burn rate analysis helps businesses forecast runway and make strategic decisions to extend operational longevity. In real-world scenarios, companies track burn rate changes to adjust budgets, optimize resource allocation, and prevent unforeseen insolvency.

Burn Rate vs. Runway: Business Implications Explained

A startup with a monthly burn rate of $50,000 and $500,000 in available capital has a runway of 10 months before requiring additional funding. This burn rate versus runway calculation is critical for financial planning, as it determines how long the business can sustain operations without revenue. Understanding this relationship helps entrepreneurs make strategic decisions about scaling expenses, raising capital, or adjusting growth targets.

Common Mistakes When Managing Burn Rate

A common mistake when managing burn rate is underestimating monthly expenses, which leads to cash flow problems and limits runway for growth. Many startups fail to account for variable costs and unexpected expenditures, causing their burn rate to accelerate faster than anticipated. Overoptimistic revenue projections also skew burn rate calculations, resulting in insufficient capital planning and increased financial risk.

Burn Rate Trends in Different Industries

Technology startups often experience high burn rates exceeding $500,000 per month due to rapid product development and marketing expenses. In contrast, retail businesses typically maintain lower burn rates around $50,000 monthly, reflecting inventory and staffing costs. Healthcare companies show moderate burn rates averaging $200,000, driven by regulatory compliance and equipment investments.

How to Reduce Burn Rate: Proven Strategies

Reducing burn rate in business involves cutting unnecessary expenses and optimizing cash flow management to extend runway. Implementing cost control measures such as negotiating supplier contracts, automating tasks to increase efficiency, and prioritizing high-impact projects significantly lowers monthly cash outflows. Regular financial forecasting and performance tracking enable early identification of overspending patterns, helping businesses adjust strategies and preserve capital.

Monitoring Burn Rate for Sustainable Business Growth

Monitoring burn rate is critical for sustainable business growth, as it directly impacts cash flow management and runway estimation. For instance, a startup with a monthly burn rate of $50,000 must closely track expenses to avoid depleting its $600,000 capital within 12 months, enabling timely fundraising or cost reduction strategies. Consistent analysis of burn rate helps businesses adjust operational budgets to maintain financial health and support long-term scalability.

example of burn rate in business Infographic

samplerz.com

samplerz.com