A carve-out in business refers to the process where a company sells a minority stake in a subsidiary or business unit to outside investors while retaining control. For example, in 2020, General Electric carved out its healthcare division by selling a 20% stake to private equity firms. This transaction allowed GE to raise capital while maintaining strategic oversight of its healthcare operations. Another example is when PayPal carved out part of its business by spinning off its enterprise risk and compliance unit into a separate company. The carve-out enabled PayPal to focus on its core payment services and streamlined its business model. Data from the transaction showed increased investor interest and improved operational efficiency in both the parent company and the newly independent entity.

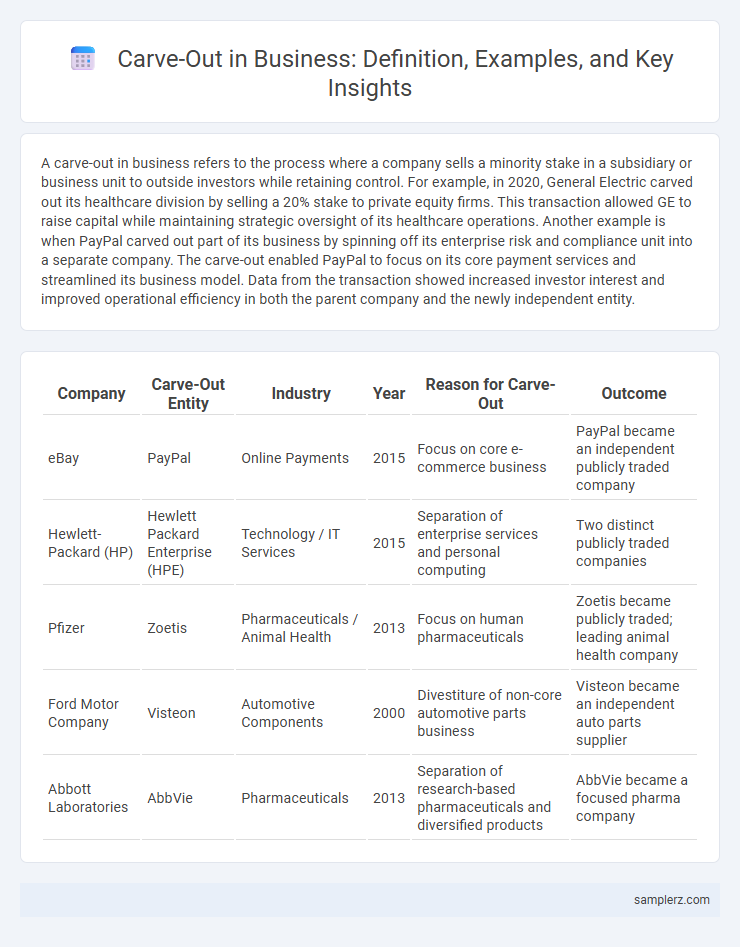

Table of Comparison

| Company | Carve-Out Entity | Industry | Year | Reason for Carve-Out | Outcome |

|---|---|---|---|---|---|

| eBay | PayPal | Online Payments | 2015 | Focus on core e-commerce business | PayPal became an independent publicly traded company |

| Hewlett-Packard (HP) | Hewlett Packard Enterprise (HPE) | Technology / IT Services | 2015 | Separation of enterprise services and personal computing | Two distinct publicly traded companies |

| Pfizer | Zoetis | Pharmaceuticals / Animal Health | 2013 | Focus on human pharmaceuticals | Zoetis became publicly traded; leading animal health company |

| Ford Motor Company | Visteon | Automotive Components | 2000 | Divestiture of non-core automotive parts business | Visteon became an independent auto parts supplier |

| Abbott Laboratories | AbbVie | Pharmaceuticals | 2013 | Separation of research-based pharmaceuticals and diversified products | AbbVie became a focused pharma company |

Introduction to Carve-Outs in Business

Carve-outs in business involve a company divesting a specific division or asset to streamline operations and unlock shareholder value. A prominent example is eBay's 2015 separation of PayPal, creating two focused entities to enhance strategic growth and market responsiveness. This strategic move illustrates how carve-outs facilitate specialization and enable parent companies to concentrate resources on core competencies.

Key Reasons Companies Pursue Carve-Outs

Companies pursue carve-outs primarily to unlock shareholder value by separating non-core assets into independent entities. Carve-outs enable businesses to focus on core operations while attracting strategic investors and raising capital efficiently. This restructuring often improves operational efficiency and enhances market valuation of both the parent company and the spun-off business.

Notable Corporate Carve-Out Case Studies

Pfizer's 2020 separation of its Upjohn unit merged with Mylan to form Viatris exemplifies a strategic carve-out enhancing focus on innovative pharmaceuticals. eBay's spin-off of PayPal in 2015 targeted value creation by allowing both companies to pursue independent growth in distinct markets. News Corp's 2013 division into new News Corp and 21st Century Fox sharpened business models, optimizing media and entertainment sector performance.

Carve-Out vs. Spin-Off: Understanding the Difference

A carve-out involves a company selling a minority stake in a subsidiary or business unit to outside investors while retaining control, often through an initial public offering (IPO) of the carved-out entity. In contrast, a spin-off leads to the creation of an independent company by distributing shares of the subsidiary to existing shareholders, completely separating it from the parent company. Understanding the difference helps businesses strategically optimize capital structure, enhance shareholder value, and focus on core operations.

Steps Involved in Executing a Carve-Out

Executing a carve-out in business involves several critical steps including identifying the business units or assets to be separated, establishing an independent management team, and preparing standalone financial statements. The process requires thorough due diligence to ensure operational, legal, and regulatory compliance while developing a detailed transition service agreement to support the newly separated entity. Integration planning, effective communication with stakeholders, and systematic asset transfer complete the carve-out execution, ensuring a smooth transition and value preservation.

Financial Implications of Business Carve-Outs

A notable example of a business carve-out is eBay's spin-off of PayPal in 2015, which allowed both companies to focus on their core operations and unlock shareholder value. Financial implications of carve-outs include immediate liquidity through asset sales and potential cost synergies by separating underperforming divisions. This strategy often enhances market valuation by providing clearer financial metrics and improving operational efficiency.

Legal and Regulatory Considerations in Carve-Outs

Carve-outs in business often involve the divestiture of a subsidiary or business unit, requiring careful navigation of complex legal and regulatory frameworks, such as antitrust laws, securities regulations, and contractual obligations. Ensuring compliance with data privacy regulations like GDPR or HIPAA during asset separation is critical to avoid penalties and safeguard stakeholder interests. Legal teams must conduct thorough due diligence to identify liabilities, secure necessary approvals, and draft clear carve-out agreements that delineate the allocation of risks and responsibilities post-transaction.

Challenges and Risks in Carve-Out Transactions

Carve-out transactions often face challenges such as operational disruption, misaligned business processes, and cultural integration issues that can affect both the parent company and the carved-out entity. Risks include valuation complexities, regulatory compliance hurdles, and the potential loss of key employees who may seek stability elsewhere. Effective risk mitigation requires detailed due diligence, clear communication strategies, and robust transition service agreements to ensure business continuity.

Success Factors for Effective Carve-Outs

Successful carve-outs depend on clear strategic objectives that align the divestiture with overall corporate goals. Key success factors include thorough due diligence, robust project management, and effective communication between parent and carved-out entities to ensure operational continuity. Leveraging technology for data integration and maintaining strong stakeholder engagement significantly enhance the carve-out process and value realization.

Future Trends in Business Carve-Out Strategies

Future trends in business carve-out strategies emphasize digital transformation and data-driven decision-making to maximize value extraction. Companies increasingly leverage advanced analytics and artificial intelligence to identify optimal carve-out targets and streamline operational separation. Strategic carve-outs now prioritize agility and scalability to adapt quickly to evolving market conditions and investor demands.

example of carve-out in business Infographic

samplerz.com

samplerz.com