A pro-forma statement in business is a financial report that projects future income, expenses, and cash flow based on certain assumptions. Companies use pro-forma statements to plan budgets, evaluate potential investments, and present forecasts to stakeholders. These documents often include estimated revenues, projected costs, and anticipated profits to guide strategic decisions. Pro-forma financial statements typically consist of an income statement, balance sheet, and cash flow statement. Entities rely on these projections to assess the impact of proposed transactions such as mergers, acquisitions, or new product launches. Data from pro-forma statements help investors and management analyze the financial viability and risks associated with business initiatives.

Table of Comparison

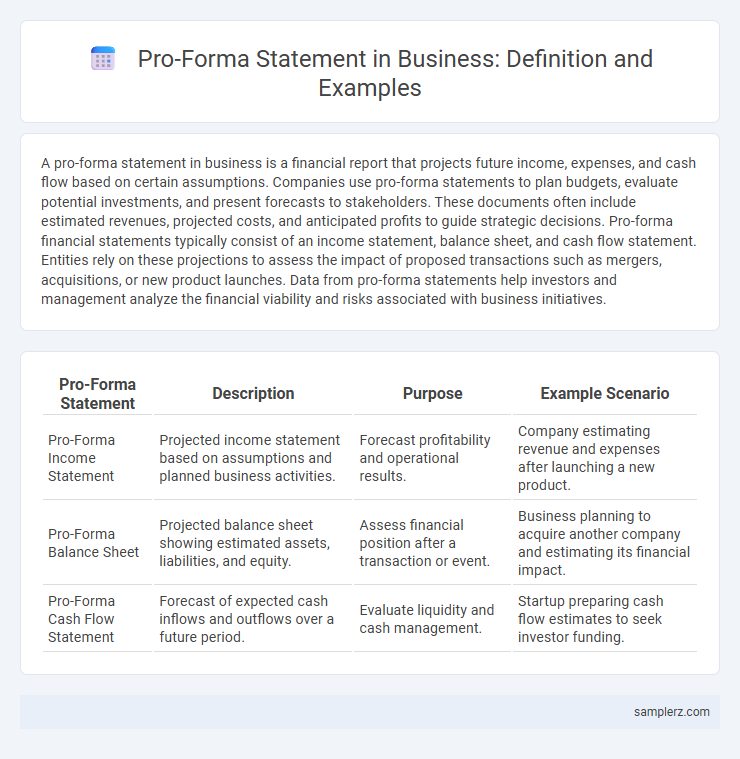

| Pro-Forma Statement | Description | Purpose | Example Scenario |

|---|---|---|---|

| Pro-Forma Income Statement | Projected income statement based on assumptions and planned business activities. | Forecast profitability and operational results. | Company estimating revenue and expenses after launching a new product. |

| Pro-Forma Balance Sheet | Projected balance sheet showing estimated assets, liabilities, and equity. | Assess financial position after a transaction or event. | Business planning to acquire another company and estimating its financial impact. |

| Pro-Forma Cash Flow Statement | Forecast of expected cash inflows and outflows over a future period. | Evaluate liquidity and cash management. | Startup preparing cash flow estimates to seek investor funding. |

Understanding Pro-Forma Statements in Business

Pro-forma statements in business serve as projected financial reports, illustrating potential future performance based on assumptions or hypothetical scenarios. An example includes a pro-forma income statement estimating revenue, expenses, and net income for a new product launch, helping stakeholders evaluate profitability before implementation. These statements are critical for budgeting, investment decisions, and strategic planning by providing a forward-looking financial perspective.

Key Components of Pro-Forma Financial Statements

Pro-forma financial statements typically include projected income statements, balance sheets, and cash flow statements, which help businesses forecast future financial performance. Key components consist of revenue projections based on sales forecasts, estimated operating expenses, anticipated capital expenditures, and planned financing activities. These elements provide decision-makers with a detailed view of potential financial outcomes to guide strategic planning and investment.

Benefits of Using Pro-Forma Statements for Strategic Planning

Pro-forma statements provide businesses with projected financial data, enabling precise forecasting of revenues, expenses, and cash flows essential for strategic decision-making. Utilizing these statements helps identify potential financial risks and opportunities, facilitating proactive adjustments in business plans. Incorporating pro-forma statements improves investor confidence by showcasing detailed, forward-looking financial insights that support sustainable growth strategies.

Pro-Forma Income Statement Example: A Step-by-Step Guide

A pro-forma income statement example typically forecasts future revenues, expenses, and profits based on assumptions such as sales growth rates and cost projections. It includes estimated line items like gross profit, operating expenses, and net income to guide budgeting and financial planning. This step-by-step approach helps businesses anticipate cash flow and make informed strategic decisions.

How to Prepare a Pro-Forma Balance Sheet

Prepare a pro-forma balance sheet by projecting future assets, liabilities, and equity based on anticipated business transactions and financial events. Incorporate detailed assumptions such as revenue growth, capital expenditures, debt repayment schedules, and equity injections to ensure accuracy. Use historical financial data combined with strategic forecasts to create a comprehensive snapshot of a company's financial position at a specific future date.

Common Pro-Forma Adjustments in Business Finance

Common pro-forma adjustments in business finance include normalization of earnings by removing one-time expenses or revenues, such as legal settlements or asset sales, to present a more accurate picture of ongoing profitability. Adjustments often involve excluding non-cash items like depreciation and amortization to focus on operational cash flow. These practices enhance financial statements' comparability and assist stakeholders in making informed investment and lending decisions.

Real-World Example: Pro-Forma Statement for a Startup

A startup's pro-forma statement typically projects future income, expenses, and cash flow based on realistic assumptions, such as anticipated sales growth and market penetration rates. For example, a tech startup might forecast $500,000 in revenue within the first year, accounting for product development costs and initial marketing expenses totaling $200,000. This financial projection aids investors in assessing potential profitability and guides strategic planning during early-stage business operations.

Using Pro-Forma Statements for Investment Analysis

Pro-forma statements project a company's future financial performance by incorporating assumptions about revenue growth, expenses, and capital expenditures, helping investors evaluate potential returns and risks. For example, an investor analyzing a start-up might use pro-forma income statements and balance sheets to estimate profitability and cash flow under different market scenarios. These forward-looking financial models support strategic decision-making by providing a clearer picture of investment viability and expected financial outcomes.

Comparing Pro-Forma vs. Historical Financial Statements

Pro-forma financial statements project future revenues and expenses based on assumptions, enabling businesses to forecast potential growth or impacts of strategic decisions, whereas historical financial statements report actual past performance verified by audits. Pro-forma reports often include adjusted figures excluding non-recurring items to provide a clearer view of operational profitability, contrasting with the comprehensive and standardized data in historical statements. Investors and stakeholders use pro-forma statements to assess future viability and comparative scenarios, while relying on historical financials for accuracy and regulatory compliance.

Best Practices for Presenting Pro-Forma Statements to Stakeholders

Pro-forma statements should clearly highlight projected revenues, anticipated expenses, and net income to provide stakeholders with a transparent view of future financial performance. Use well-labeled charts and concise notes to enhance comprehension and focus on critical metrics such as EBITDA and cash flow forecasts. Ensuring alignment with recognized accounting standards and including sensitivity analyses strengthens credibility and supports better decision-making.

example of pro-forma in statement Infographic

samplerz.com

samplerz.com