An example of an activist shareholder in business is Elliott Management Corporation, a firm known for acquiring significant stakes in public companies to influence management decisions. Elliott often pushes for operational changes, improved governance, or strategic shifts to increase shareholder value. Their activism has impacted various industries, including technology, retail, and energy, making them a prominent entity in shareholder activism. Carl Icahn is another notable activist shareholder who takes substantial equity positions to advocate for restructuring and enhancing company performance. His interventions frequently result in changes to corporate policies, board composition, or asset divestitures aimed at maximizing returns. Both Elliott Management and Carl Icahn demonstrate how activist shareholders leverage their ownership to drive change and unlock value in businesses.

Table of Comparison

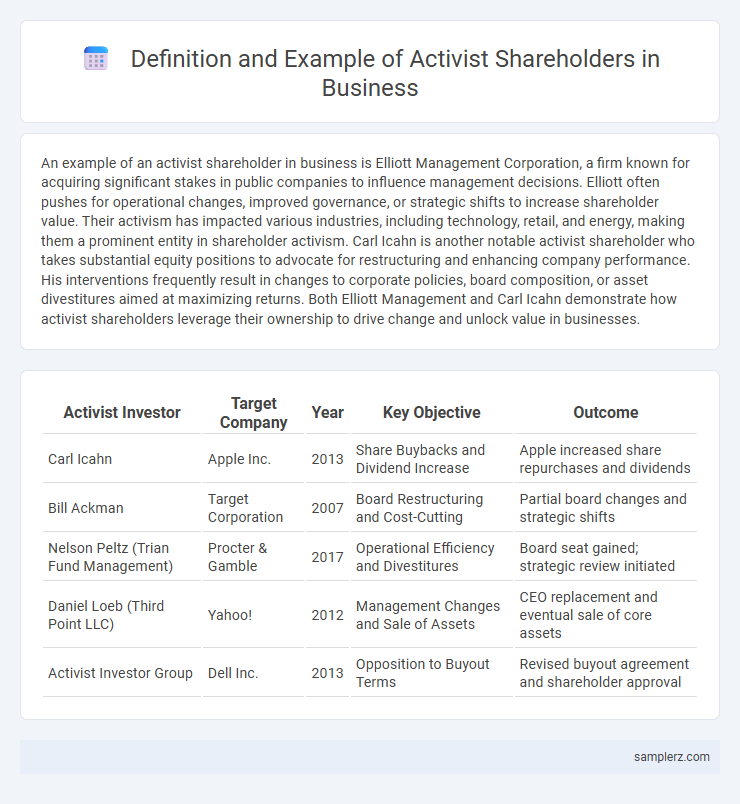

| Activist Investor | Target Company | Year | Key Objective | Outcome |

|---|---|---|---|---|

| Carl Icahn | Apple Inc. | 2013 | Share Buybacks and Dividend Increase | Apple increased share repurchases and dividends |

| Bill Ackman | Target Corporation | 2007 | Board Restructuring and Cost-Cutting | Partial board changes and strategic shifts |

| Nelson Peltz (Trian Fund Management) | Procter & Gamble | 2017 | Operational Efficiency and Divestitures | Board seat gained; strategic review initiated |

| Daniel Loeb (Third Point LLC) | Yahoo! | 2012 | Management Changes and Sale of Assets | CEO replacement and eventual sale of core assets |

| Activist Investor Group | Dell Inc. | 2013 | Opposition to Buyout Terms | Revised buyout agreement and shareholder approval |

Notable Shareholder Activist Campaigns

Elliott Management is renowned for high-profile shareholder activist campaigns, targeting underperforming companies such as AT&T and eBay to push for strategic changes and improved shareholder value. Carl Icahn's aggressive activism has reshaped major corporations like Apple and Xerox by advocating for restructuring and enhanced capital returns. The success of these campaigns often hinges on detailed financial analysis and persistent engagement with company management to drive reform and unlock hidden value.

Influential Shareholder Activist Investors

Influential shareholder activist investors like Elliott Management, Carl Icahn, and Third Point have reshaped corporate governance by pressuring companies to enhance shareholder value through strategic changes and operational improvements. Their activism often targets underperforming firms, advocating for board restructuring, divestitures, or shifts in capital allocation. These investors leverage significant stakes and public campaigns to influence corporate decisions and drive value creation.

Case Studies: Successful Shareholder Activism

Elliott Management's campaign at AT&T demonstrates successful shareholder activism by pushing for strategic asset sales and operational efficiencies that significantly enhanced shareholder value. Starboard Value's involvement with Darden Restaurants led to major board restructuring and improved corporate governance, resulting in a notable stock price increase. Third Point's activism at Sony focused on unlocking shareholder value through management changes and strategic realignment, yielding substantial returns for investors.

Famous Activist Funds and Their Strategies

Elliott Management is a prominent activist fund known for aggressive value-driven strategies, often targeting underperforming corporations to push for strategic changes and unlock shareholder value. Carl Icahn's Icahn Enterprises specializes in identifying firms with untapped potential, applying pressure through board seat acquisitions and public campaigns to influence corporate governance. Third Point LLC, led by Daniel Loeb, employs a combination of detailed financial analysis and shareholder engagement to advocate for operational improvements and strategic shifts.

Shareholder Activism in Corporate Governance

Elliott Management is a prominent example of an activist shareholder driving change in corporate governance by pressuring companies to improve financial performance and strategic direction. The firm often targets underperforming boards to push for board restructuring, cost reductions, and enhanced shareholder value. Such activism highlights the increasing influence shareholders wield in shaping corporate policies and governance frameworks.

Impactful Shareholder Activist Interventions

Impactful shareholder activist interventions often target corporate governance reforms, pushing for increased transparency and accountability to enhance shareholder value. Notable examples include Carl Icahn's campaign at Apple, which led to a substantial increase in stock buybacks and dividends, improving investor returns. Another significant case is Elliott Management's activism at AT&T, where strategic restructuring and asset divestitures were implemented to optimize operational efficiency and boost market performance.

Real-World Examples of Proxy Battles

Elliott Management is a prominent activist shareholder known for its proxy battles, successfully pressuring companies like AT&T and Twitter to implement strategic changes that enhance shareholder value. Another example is Carl Icahn, whose proxy fights with Apple and Netflix have driven significant corporate governance reforms and capital allocation shifts. These real-world proxy battles demonstrate how activist investors leverage shareholder voting rights to influence company policies and leadership decisions.

Shareholder Activists Driving Corporate Change

Shareholder activists such as Carl Icahn have significantly influenced corporate governance by pushing for strategic changes that enhance shareholder value. Their campaigns often target underperforming management, advocating for asset divestitures, cost reductions, and board restructuring to improve profitability. By leveraging their equity stakes, activists drive transparency and accountability, leading to measurable improvements in stock performance and corporate policies.

High-Profile Shareholder Activism Cases

Elliott Management is a prominent example of high-profile shareholder activism, known for its aggressive campaigns to unlock shareholder value in underperforming companies such as AT&T and eBay. Carl Icahn's interventions at Apple and Herbalife demonstrated the power of activist investors to influence corporate governance and strategic direction. These cases highlight the growing influence of activist shareholders in reshaping corporate policies and improving financial performance through targeted ownership stakes and public pressure.

Lessons from Prominent Shareholder Activists

Prominent shareholder activists like Carl Icahn and Paul Singer demonstrate the power of targeted engagement to unlock shareholder value through strategic boardroom interventions and public campaigns. Their ability to leverage significant equity stakes drives corporate governance reforms and operational improvements, emphasizing the importance of thorough analysis and persuasive communication. Lessons from these activists highlight the need for clear objectives and deep understanding of company fundamentals to achieve successful outcomes in shareholder activism.

example of activist in shareholder Infographic

samplerz.com

samplerz.com