Stagflation occurs when an economy experiences stagnant growth, high unemployment, and rising inflation simultaneously. A notable example is the United States in the 1970s, where oil price shocks led to increased production costs and consumer prices while economic output slowed down. During this period, businesses faced higher input costs, reduced consumer demand, and a challenging environment for investment and expansion. The combination of slow GDP growth and inflation eroded purchasing power and profit margins, complicating monetary policy decisions. Companies struggled to balance cost management with pricing strategies in a worsening economic climate. Stagflation also caused wage pressures to rise as workers demanded higher pay to keep up with inflation, further increasing operational expenses for businesses.

Table of Comparison

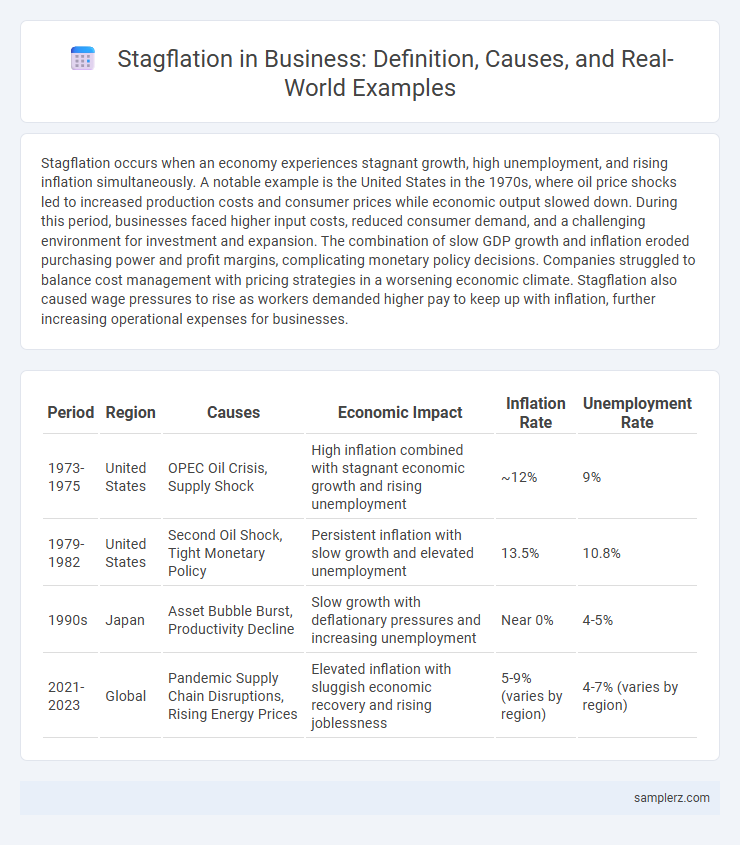

| Period | Region | Causes | Economic Impact | Inflation Rate | Unemployment Rate |

|---|---|---|---|---|---|

| 1973-1975 | United States | OPEC Oil Crisis, Supply Shock | High inflation combined with stagnant economic growth and rising unemployment | ~12% | 9% |

| 1979-1982 | United States | Second Oil Shock, Tight Monetary Policy | Persistent inflation with slow growth and elevated unemployment | 13.5% | 10.8% |

| 1990s | Japan | Asset Bubble Burst, Productivity Decline | Slow growth with deflationary pressures and increasing unemployment | Near 0% | 4-5% |

| 2021-2023 | Global | Pandemic Supply Chain Disruptions, Rising Energy Prices | Elevated inflation with sluggish economic recovery and rising joblessness | 5-9% (varies by region) | 4-7% (varies by region) |

Understanding Stagflation: A Business Perspective

Stagflation occurs when an economy experiences stagnant growth alongside high inflation and rising unemployment, as seen in the 1970s oil crisis when soaring fuel prices disrupted supply chains and increased production costs. Businesses faced shrinking consumer demand while grappling with higher operational expenses, leading to tighter profit margins and uncertainty in investment decisions. Understanding stagflation helps companies develop resilient strategies by balancing cost management with innovation to maintain competitiveness in volatile markets.

Historical Overview of Stagflation in Business

The 1970s oil crisis triggered stagflation characterized by high inflation rates exceeding 10% combined with stagnant GDP growth and rising unemployment in major economies like the United States and the United Kingdom. Businesses faced soaring production costs due to skyrocketing energy prices while consumer demand remained weak, resulting in profit margin compression and operational challenges. Central banks struggled to balance monetary policies as traditional tools either worsened inflation or deepened economic stagnation, highlighting the complex dynamics of stagflation in business environments.

Key Indicators of Stagflation in the Marketplace

Stagflation in the marketplace is marked by a persistent rise in inflation rates exceeding 5%, coupled with stagnant or negative GDP growth and unemployment rates above 6%. Key indicators include soaring consumer prices, declining industrial production, and a slowdown in consumer spending despite tightening monetary policies. These conditions create a challenging environment for businesses, characterized by reduced profit margins and increased operational costs.

Stagflation’s Impact on Consumer Demand and Business Growth

Stagflation, characterized by stagnant economic growth coupled with high inflation and unemployment, severely diminishes consumer demand as rising prices erode purchasing power and increased job insecurity limits spending. Businesses face shrinking revenues and tighter profit margins, slowing investment and expansion efforts while struggling to balance cost controls with maintaining workforce morale. The prolonged period of reduced consumer spending and elevated costs creates a challenging environment for sustainable business growth and market competitiveness.

Notable Real-World Examples of Stagflation Conditions

The 1970s oil crisis stands as a prominent example of stagflation, where rising oil prices triggered high inflation alongside stagnant economic growth and unemployment. During this period, the U.S. experienced double-digit inflation rates exceeding 10% while GDP growth slowed dramatically, leading to widespread economic distress. Another notable case occurred in Japan during the early 1990s asset bubble burst, which resulted in prolonged economic stagnation paired with rising price levels.

Case Study: Stagflation in the 1970s and Business Response

The stagflation of the 1970s, characterized by simultaneous high inflation rates exceeding 10% and unemployment nearing 9%, severely impacted global businesses by eroding purchasing power and increasing production costs. Companies like General Motors and Ford responded by implementing cost-cutting measures, investing in automation to boost productivity, and shifting towards more fuel-efficient products in response to the 1973 oil crisis. This period highlighted the challenge of managing operational efficiency and pricing strategies amid stagnant economic growth and rising inflation.

Stagflation Effects on Supply Chains and Operational Costs

Stagflation causes supply chains to experience prolonged disruptions due to rising input costs and reduced supplier capacity, leading to delays and inventory shortages. Increased operational costs, driven by higher energy prices and wage inflation, force businesses to reevaluate budgeting and operational efficiencies. These factors combined result in squeezed profit margins and constrained investment in growth initiatives.

Business Strategies for Managing Stagflation Risks

During periods of stagflation, businesses face the dual challenge of rising costs and stagnant demand, necessitating strategies such as cost optimization, diversification of revenue streams, and flexible supply chain management. Implementing dynamic pricing models and investing in innovation can also help mitigate risks associated with prolonged inflation and economic stagnation. Companies that prioritize liquidity management and focus on value creation tend to better navigate the complexities of stagflation.

Lessons Learned from Past Stagflationary Periods

Past stagflationary periods, such as the 1970s oil crisis, revealed that simultaneous high inflation and unemployment require nuanced monetary policies beyond traditional measures. Businesses learned to prioritize cost control, supply chain diversification, and adaptive pricing strategies to maintain resilience during economic stagnation. These lessons underscore the importance of flexibility and innovation in navigating complex macroeconomic challenges.

Preparing for Future Stagflation: Business Best Practices

Businesses can prepare for future stagflation by diversifying supply chains to reduce vulnerability to inflation-driven cost increases and economic stagnation. Implementing dynamic pricing strategies and enhancing operational efficiency help maintain profitability during periods of stagnant growth combined with rising costs. Maintaining strong cash reserves and investing in flexible budgeting allow companies to navigate prolonged economic uncertainty and volatile market conditions.

example of stagflation in condition Infographic

samplerz.com

samplerz.com