A leveraged buyout (LBO) in private equity involves acquiring a company using a significant amount of borrowed capital, with the assets of the acquired company often serving as collateral. One notable example is the 1989 acquisition of RJR Nabisco by Kohlberg Kravis Roberts & Co. (KKR) for $25 billion. This transaction remains one of the largest and most famous LBOs in private equity history, highlighting the use of debt financing to maximize investor returns. Another example is the 2007 buyout of TXU Energy by a consortium led by KKR, TPG Capital, and Goldman Sachs Capital Partners. The deal was valued at approximately $45 billion, making it one of the largest energy sector LBOs. These examples demonstrate how private equity firms use leveraged buyouts to acquire major companies, restructure operations, and deliver value to investors.

Table of Comparison

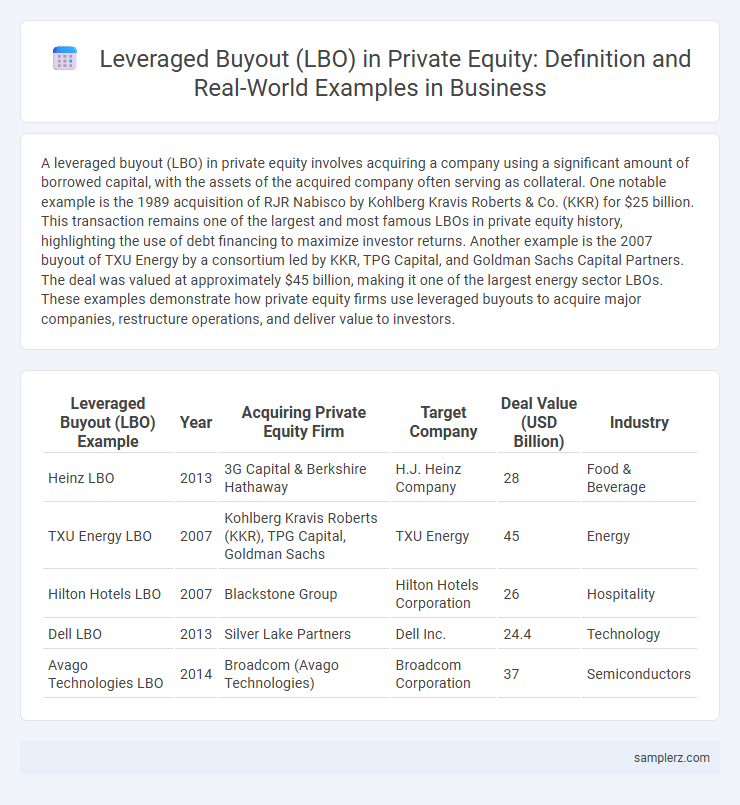

| Leveraged Buyout (LBO) Example | Year | Acquiring Private Equity Firm | Target Company | Deal Value (USD Billion) | Industry |

|---|---|---|---|---|---|

| Heinz LBO | 2013 | 3G Capital & Berkshire Hathaway | H.J. Heinz Company | 28 | Food & Beverage |

| TXU Energy LBO | 2007 | Kohlberg Kravis Roberts (KKR), TPG Capital, Goldman Sachs | TXU Energy | 45 | Energy |

| Hilton Hotels LBO | 2007 | Blackstone Group | Hilton Hotels Corporation | 26 | Hospitality |

| Dell LBO | 2013 | Silver Lake Partners | Dell Inc. | 24.4 | Technology |

| Avago Technologies LBO | 2014 | Broadcom (Avago Technologies) | Broadcom Corporation | 37 | Semiconductors |

Introduction to Leveraged Buyouts in Private Equity

A leveraged buyout (LBO) in private equity involves acquiring a company primarily using borrowed funds, with the acquired company's assets serving as collateral. A classic example is the 1989 acquisition of RJR Nabisco by Kohlberg Kravis Roberts & Co. (KKR) for $25 billion, one of the largest LBOs in history. This transaction highlighted how private equity firms utilize leverage to amplify returns while managing risk through operational improvements and strategic management.

Key Characteristics of Leveraged Buyouts

Leveraged buyouts (LBOs) in private equity typically involve acquiring a company using a significant amount of borrowed capital, often exceeding 60% of the purchase price, to enhance returns on equity. Key characteristics include the use of the target company's assets as collateral for debt, high financial leverage to amplify potential gains, and a strong focus on operational improvements and cash flow generation to service debt. These transactions often target mature, stable companies with predictable earnings and substantial tangible assets suitable for securing loans.

Noteworthy Historical Leveraged Buyout Deals

The 1989 RJR Nabisco leveraged buyout, valued at $25 billion, remains one of the most significant deals in private equity history, showcasing the power of debt-financed acquisitions. Another notable example is the 2007 TXU buyout by Kohlberg Kravis Roberts (KKR) for approximately $45 billion, exemplifying massive deal structuring and capital deployment. These transactions highlight how leveraged buyouts drive value creation by using substantial leverage to acquire and optimize corporate entities.

Anatomy of a Successful LBO Transaction

A successful leveraged buyout (LBO) transaction typically involves acquiring a company using a significant amount of debt, often 60-70% of the purchase price, to enhance equity returns. Key elements include thorough due diligence, strong cash flow generation to service debt, and operational improvements post-acquisition that drive value creation. Private equity firms leverage these factors to maximize returns while carefully managing financial risk throughout the investment horizon.

Step-by-Step Example of a Private Equity LBO

A leveraged buyout in private equity typically starts with identifying a target company with stable cash flows and growth potential, followed by acquiring the company primarily through debt financing, often 60-70% of the purchase price. The private equity firm then works on operational improvements and strategic initiatives to increase the company's value over a 3 to 7-year holding period. Finally, the exit strategy involves selling the company via an IPO, secondary buyout, or strategic sale, generating returns that outperform the cost of debt and equity invested.

Financing Structures in Leveraged Buyout Examples

Financing structures in leveraged buyouts (LBOs) typically involve a combination of senior debt, mezzanine debt, and equity to maximize purchase power while managing risk. An illustrative example is the 2007 buyout of TXU Energy by Kohlberg Kravis Roberts (KKR), where approximately $45 billion was financed through $8 billion in equity and $37 billion in various layers of debt, including senior secured loans and high-yield bonds. This multi-tiered financing strategy enhances returns by optimizing the capital mix and leveraging tax benefits associated with debt.

Case Study: Famous Leveraged Buyout in Private Equity

The leveraged buyout of RJR Nabisco in 1989 remains one of the most notable cases in private equity history, with Kohlberg Kravis Roberts & Co. (KKR) acquiring the conglomerate for $25 billion. This deal exemplified the use of significant debt financing to achieve control and generate high returns through operational improvements and asset sales. The RJR Nabisco buyout highlighted key strategies in leveraged buyouts, including extensive leverage, management incentives, and rigorous financial restructuring.

Common Industries for Leveraged Buyouts

Leveraged buyouts (LBOs) in private equity typically target industries with stable cash flows and tangible assets, such as manufacturing, consumer goods, healthcare, and technology services. These sectors often provide predictable revenue streams essential for servicing the high debt levels used in LBO transactions. Retail and energy industries also frequently attract leveraged buyouts due to their capacity for operational improvements and asset-based financing opportunities.

Risks and Rewards Illustrated by LBO Examples

Leveraged buyouts (LBOs) in private equity often involve acquiring companies with significant debt to maximize returns, exemplified by the high-profile acquisition of RJR Nabisco by Kohlberg Kravis Roberts (KKR) in 1989. The risks include amplified financial vulnerability due to heavy leverage, which can lead to insolvency if cash flows deteriorate, while the rewards stem from the potential for substantial equity gains when operational improvements increase company value. This duality underscores the critical balance private equity firms must manage between aggressive financing structures and sustainable business performance to achieve successful exits.

Lessons Learned from Real-World Leveraged Buyouts

The 2007 buyout of TXU Energy by private equity firms Kohlberg Kravis Roberts and TPG highlighted the risks of high leverage amid volatile energy prices, resulting in bankruptcy protection in 2014. This case demonstrated the importance of thorough market analysis and conservative debt structures to withstand economic fluctuations. Effective due diligence and flexible capital planning are crucial lessons for private equity investors managing leveraged buyouts in dynamic industries.

example of leveraged buyout in private equity Infographic

samplerz.com

samplerz.com