Sweat equity plays a crucial role in business valuation by representing the non-monetary investment of time, effort, and expertise contributed by founders and employees. For instance, in a startup, a founder who works full-time without drawing a salary builds sweat equity that increases the company's overall value. This intangible asset is often quantified during funding rounds, impacting the share distribution and ownership percentage of early contributors. In mergers and acquisitions, sweat equity can be factored into the valuation by assessing the contributions of key management and technical teams. A technology firm might evaluate the sweat equity of its developers when determining its worth, especially if their innovation has created proprietary software or intellectual property. Data-driven methods like discounted cash flow models may be adjusted to incorporate the value generated by sweat equity, ensuring a fair representation in the company's total valuation.

Table of Comparison

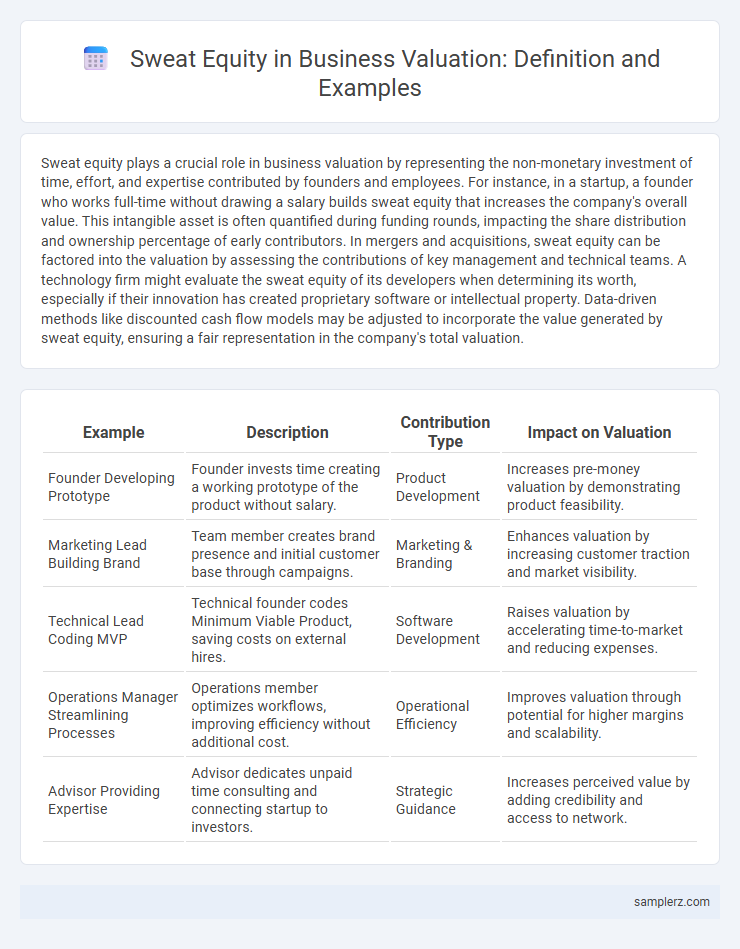

| Example | Description | Contribution Type | Impact on Valuation |

|---|---|---|---|

| Founder Developing Prototype | Founder invests time creating a working prototype of the product without salary. | Product Development | Increases pre-money valuation by demonstrating product feasibility. |

| Marketing Lead Building Brand | Team member creates brand presence and initial customer base through campaigns. | Marketing & Branding | Enhances valuation by increasing customer traction and market visibility. |

| Technical Lead Coding MVP | Technical founder codes Minimum Viable Product, saving costs on external hires. | Software Development | Raises valuation by accelerating time-to-market and reducing expenses. |

| Operations Manager Streamlining Processes | Operations member optimizes workflows, improving efficiency without additional cost. | Operational Efficiency | Improves valuation through potential for higher margins and scalability. |

| Advisor Providing Expertise | Advisor dedicates unpaid time consulting and connecting startup to investors. | Strategic Guidance | Increases perceived value by adding credibility and access to network. |

Understanding Sweat Equity in Business Valuation

Sweat equity represents the non-monetary investment of time, effort, and expertise that founders or employees contribute to a business, significantly impacting its valuation. For example, a startup founder who develops a prototype or secures key partnerships without immediate compensation accumulates sweat equity that increases the company's worth. Accurately valuing sweat equity requires assessing the market value of equivalent services and understanding its role in driving growth and competitive advantage.

Real-Life Examples of Sweat Equity Deals

Sweat equity in business valuation is exemplified by startups where founders contribute time and expertise in exchange for ownership, such as early-stage tech companies like Airbnb and Uber, which valued founder contributions as key assets. In small businesses, sweat equity often manifests when partners invest labor instead of capital, reflected in adjusted ownership percentages influencing valuation during buyouts or funding rounds. These real-life cases underscore the importance of quantifying non-monetary inputs to accurately assess company worth and shareholder equity.

Startup Valuation: The Role of Sweat Equity

Sweat equity significantly impacts startup valuation by quantifying the non-monetary contributions founders bring through their time, effort, and expertise, which often compensate for limited initial capital. Investors factor sweat equity into valuation models by assigning a monetary value to the founders' technical skills, business development efforts, and strategic planning, thereby increasing the startup's perceived worth. Accurate assessment of sweat equity helps balance ownership distribution and aligns incentives, fostering sustainable growth and attracting further investment.

Case Study: Sweat Equity Among Co-Founders

In the startup ecosystem, sweat equity represents the non-monetary investment founders contribute through time and effort, significantly impacting company valuation. A notable case study involves Airbnb, where early co-founders invested extensive hours developing the platform, which was recognized in their equity shares before major funding rounds. This form of equity allocation aligns incentives and reflects the intrinsic value of founder contributions beyond initial capital.

Impact of Sweat Equity on Investor Negotiations

Sweat equity significantly influences investor negotiations by increasing the perceived value of a startup through the founders' non-monetary contributions such as time, expertise, and effort. This form of equity can lead to more favorable valuation terms by demonstrating commitment and reducing initial capital requirements, which reassures investors of the team's dedication and potential for growth. Incorporating sweat equity into valuation models enhances negotiation leverage, often resulting in better equity splits and more aligned investor-founder expectations.

Sweat Equity vs. Financial Capital Contributions

Sweat equity represents the non-monetary investment of time and effort by founders or employees, significantly impacting startup valuation alongside financial capital contributions. Unlike direct monetary input, sweat equity reflects intangible value such as expertise, innovation, and business development, often quantified through equity shares to align interests. Valuing sweat equity accurately is crucial in early-stage startups to balance ownership stakes and incentivize long-term commitment without immediate financial outlay.

Legal Agreements for Sweat Equity Allocation

Legal agreements for sweat equity allocation often include detailed contracts specifying the percentage of ownership granted in exchange for non-monetary contributions such as time and expertise. These agreements typically outline vesting schedules, performance milestones, and dispute resolution mechanisms to protect both founders and investors during valuation. Clear documentation ensures accurate valuation by quantifying sweat equity's impact on company equity distribution and future financial projections.

Sweat Equity in Employee Stock Option Plans

Sweat equity in Employee Stock Option Plans (ESOPs) reflects the non-monetary investment employees contribute through their time and expertise, influencing a company's valuation by recognizing their role in growth and innovation. Companies allocate stock options to reward employee performance, incentivizing retention and aligning interests with shareholders, which can enhance overall market perception. This form of sweat equity quantifies employee contributions as ownership stakes, often leading to increased motivation and long-term value creation.

Valuing Non-Monetary Contributions in Startups

Sweat equity in startup valuation reflects the non-monetary contributions founders and early employees make through time, expertise, and effort, often quantified by assigning a fair market value to their roles and tasks. Valuing these contributions requires thorough documentation of hours worked, comparable salary benchmarks, and impact assessments on company milestones to ensure accurate equity distribution. This approach helps align incentives, maintain fairness, and attract future investors by demonstrating commitment beyond financial capital.

Challenges and Solutions in Sweat Equity Valuation

Challenges in sweat equity valuation often arise from quantifying intangible contributions such as time, expertise, and effort without direct market comparables, leading to disputes in ownership percentages. Solutions include implementing clear contractual agreements with predefined valuation criteria, employing third-party appraisers experienced in startup ecosystems, and using milestone-based vesting schedules to align sweat equity with achievable performance metrics. Accurate sweat equity valuation enhances investor confidence and ensures fair distribution of ownership among founders and contributors.

example of sweat equity in valuation Infographic

samplerz.com

samplerz.com