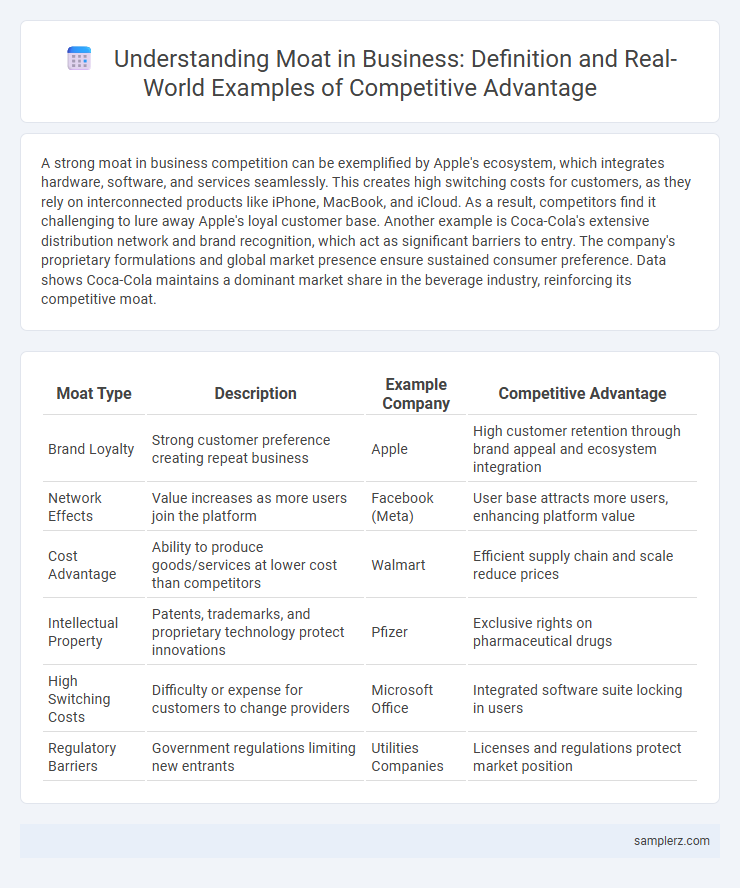

A strong moat in business competition can be exemplified by Apple's ecosystem, which integrates hardware, software, and services seamlessly. This creates high switching costs for customers, as they rely on interconnected products like iPhone, MacBook, and iCloud. As a result, competitors find it challenging to lure away Apple's loyal customer base. Another example is Coca-Cola's extensive distribution network and brand recognition, which act as significant barriers to entry. The company's proprietary formulations and global market presence ensure sustained consumer preference. Data shows Coca-Cola maintains a dominant market share in the beverage industry, reinforcing its competitive moat.

Table of Comparison

| Moat Type | Description | Example Company | Competitive Advantage |

|---|---|---|---|

| Brand Loyalty | Strong customer preference creating repeat business | Apple | High customer retention through brand appeal and ecosystem integration |

| Network Effects | Value increases as more users join the platform | Facebook (Meta) | User base attracts more users, enhancing platform value |

| Cost Advantage | Ability to produce goods/services at lower cost than competitors | Walmart | Efficient supply chain and scale reduce prices |

| Intellectual Property | Patents, trademarks, and proprietary technology protect innovations | Pfizer | Exclusive rights on pharmaceutical drugs |

| High Switching Costs | Difficulty or expense for customers to change providers | Microsoft Office | Integrated software suite locking in users |

| Regulatory Barriers | Government regulations limiting new entrants | Utilities Companies | Licenses and regulations protect market position |

Understanding the Concept of Moat in Business Competition

A moat in business competition refers to a company's sustainable competitive advantage that protects it from rivals, such as strong brand recognition, proprietary technology, or exclusive access to resources. For example, Coca-Cola's extensive distribution network and iconic brand create high entry barriers for competitors. This concept ensures long-term profitability by maintaining market dominance through unique assets that are difficult to replicate.

Key Types of Competitive Moats

Strong brand identity creates a durable competitive moat by increasing customer loyalty and enabling premium pricing. Proprietary technology or patents protect market share by preventing competitors from replicating products or services. Cost advantages, such as economies of scale or unique supply chain efficiencies, allow companies to underprice rivals while maintaining profitability.

Brand Loyalty as a Powerful Competitive Moat

Brand loyalty serves as a powerful competitive moat by creating a consistent customer base resistant to competitor offerings, which drives steady revenue and market share. Companies like Apple leverage strong brand loyalty through innovative products and exceptional customer experiences, reinforcing consumer preference despite premium pricing. This emotional connection and trust make it difficult for competitors to disrupt or replicate the established brand equity.

Economies of Scale: A Barrier to Entry

Large corporations like Amazon leverage economies of scale to lower their per-unit costs significantly, creating a substantial barrier to entry for smaller competitors. This cost advantage enables them to offer competitive pricing and invest heavily in technology and infrastructure, reinforcing their market dominance. Such scale-driven efficiencies deter new entrants by making it difficult to match both price and service levels without incurring losses.

Network Effects Creating Strong Business Moats

Network effects create strong business moats by increasing value as more users join a platform, exemplified by companies like Facebook and LinkedIn. This user growth enhances customer retention and deters competitors due to the high switching costs and vast, interconnected user bases. Such network-driven advantages solidify market dominance and foster sustainable competitive barriers.

Cost Advantages: Sustaining Market Leadership

Cost advantages serve as a crucial competitive moat by enabling companies to maintain market leadership through lower production expenses and economies of scale. Firms like Walmart leverage bulk purchasing and efficient supply chain management to offer lower prices, deterring new entrants and preserving profitability. Sustaining these cost advantages requires continuous innovation in operations and investment in cost-reducing technologies.

Intellectual Property as a Defensive Moat

Intellectual property serves as a powerful defensive moat by legally protecting innovations, designs, and brand identity, preventing competitors from replicating unique products or services. Patents, trademarks, and copyrights create barriers to entry that secure market exclusivity and enhance long-term profitability. Companies like Apple and Pfizer leverage extensive patent portfolios to maintain competitive advantages and safeguard their technological advancements.

Regulatory and Legal Protections as Moat Examples

Regulatory and legal protections create formidable moats by imposing barriers to entry that limit competition, such as exclusive patents, government licenses, and stringent compliance standards. Companies like pharmaceutical firms leverage patents to safeguard drug formulas, preventing rivals from producing generics for extended periods. These protections ensure sustained market dominance and revenue stability by legally restricting competitors.

Exclusive Access to Resources: Competitive Edge Strategies

Exclusive access to rare raw materials like De Beers' control over diamonds exemplifies a powerful competitive moat, enabling sustained market dominance and high profit margins. Companies with proprietary technology patents, such as pharmaceutical firms holding exclusive drug formulas, maintain long-term advantages by blocking competitors from replicating their products. Securing exclusive partnerships or supply chains, as seen in tech giants' agreements for scarce semiconductor chips, further strengthens barriers to entry and reinforces market position.

Case Studies: Companies with Unbreakable Moats

Amazon's dominance in e-commerce exemplifies a competitive moat driven by its vast logistics network, extensive product selection, and customer loyalty through Prime membership. Apple's ecosystem, integrating hardware, software, and services, creates high switching costs that protect its market position. Meanwhile, Coca-Cola's brand equity and global distribution channels serve as formidable barriers, sustaining its leadership in the beverage industry.

example of moat in competition Infographic

samplerz.com

samplerz.com