A blind pool in investment funds refers to a type of investment vehicle where capital is raised without disclosing specific details about the underlying assets or projects at the time of fundraising. Investors commit capital based on the reputation and expertise of the fund managers rather than pre-identified investments, which introduces a degree of uncertainty and reliance on management decisions. This structure is common in private equity and venture capital funds, where managers seek flexibility to identify and acquire opportunities post-fundraising. Blind pools can offer substantial returns by allowing experienced fund managers to capitalize on market opportunities without constraints. Data indicates that successful blind pool funds often outperform traditional funds by agilely deploying capital into emerging sectors or undervalued assets. However, the lack of initial transparency requires investors to conduct thorough due diligence on management teams and their track records before committing capital.

Table of Comparison

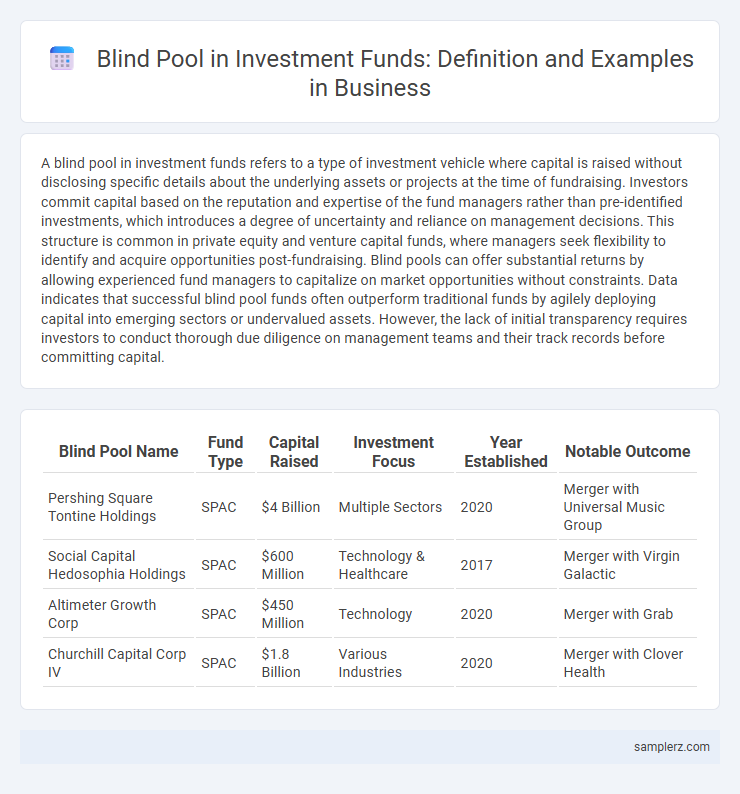

| Blind Pool Name | Fund Type | Capital Raised | Investment Focus | Year Established | Notable Outcome |

|---|---|---|---|---|---|

| Pershing Square Tontine Holdings | SPAC | $4 Billion | Multiple Sectors | 2020 | Merger with Universal Music Group |

| Social Capital Hedosophia Holdings | SPAC | $600 Million | Technology & Healthcare | 2017 | Merger with Virgin Galactic |

| Altimeter Growth Corp | SPAC | $450 Million | Technology | 2020 | Merger with Grab |

| Churchill Capital Corp IV | SPAC | $1.8 Billion | Various Industries | 2020 | Merger with Clover Health |

Introduction to Blind Pool Investment Funds

Blind pool investment funds raise capital from investors without specifying exact acquisition targets, allowing fund managers flexibility to deploy funds across various opportunities. These funds rely heavily on the reputation and track record of the management team to build investor trust before investments are identified. Prominent examples include search funds and certain private equity vehicles that prioritize strategic agility over predefined asset commitments.

Key Characteristics of Blind Pools

A blind pool investment fund raises capital from investors without disclosing specific acquisition targets, emphasizing trust in the fund manager's expertise and strategy. Key characteristics include high reliance on the sponsor's reputation, flexible investment mandates allowing broad asset class or geographic investment, and increased risk due to limited transparency on future investments. These funds often attract institutional investors seeking diversification and potential high returns despite inherent uncertainties.

Notable Examples of Blind Pool Funds

Notable examples of blind pool funds include Pershing Square Tontine Holdings, which raised $4 billion without disclosing specific investment targets, and Churchill Capital Corp IV, a special purpose acquisition company (SPAC) that garnered significant attention for its blank-check approach. These funds typically attract investors by leveraging the reputation of experienced managers rather than concrete asset details. Blind pool structures are favored in private equity and SPACs where flexibility in capital allocation is essential for seizing varied investment opportunities.

Historical Blind Pool Success Stories

Historical blind pool success stories include the Apollo Global Management fund, which raised capital without disclosing initial target investments but subsequently delivered substantial returns by acquiring distressed assets during the 2008 financial crisis. Another notable example is KKR's first fund in the 1970s, which started as a blind pool and went on to pioneer leveraged buyouts, generating outsized gains for its investors. These examples demonstrate how blind pools can attract capital through strong sponsor reputations and strategic investment execution despite initial asset ambiguity.

Risks Associated with Blind Pool Investments

Blind pool investments present significant risks due to the lack of transparency regarding specific assets or projects at the time of capital commitment, increasing the uncertainty for investors. The fund manager's discretionary power can lead to potential misallocation of funds, lack of diversification, and difficulties in assessing the true value and risk profile of the underlying investments. Investors face liquidity challenges and the risk of capital loss if the manager's strategy underperforms or market conditions deteriorate, making blind pools inherently riskier than traditional targeted investment vehicles.

Investor Considerations in Blind Pool Funds

Investors in blind pool funds face significant uncertainty as capital is committed without specific asset identification, emphasizing the importance of thorough due diligence on the fund manager's track record and investment strategy. Transparent communication regarding risk tolerance, fee structure, and exit strategies is critical for aligning investor expectations with fund performance potential. Understanding the regulatory framework and governance mechanisms helps mitigate risks associated with the lack of initial asset disclosure in blind pool investments.

Case Study: High-Profile Blind Pool Fund Launch

The high-profile blind pool investment fund launched by XYZ Capital raised $500 million without disclosing specific asset acquisitions upfront, relying on investor confidence in the management team's expertise. This approach enabled swift capital deployment into emerging technology startups, aligning with the fund's strategic vision while managing risk through diversified sector exposure. The case highlighted how transparency in management credentials and prior success can drive investor interest despite inherent uncertainties in blind pool structures.

Regulatory Perspective on Blind Pool Offerings

Blind pool offerings, common in private equity and venture capital, involve raising capital without disclosing specific investment targets, posing regulatory challenges under securities laws. The U.S. Securities and Exchange Commission (SEC) mandates comprehensive disclosures in the offering documents to mitigate investor risks and prevent fraud, emphasizing transparency about fund managers' experience and investment strategies. Compliance with Regulation D exemptions requires fund sponsors to balance confidentiality with sufficient information to satisfy anti-fraud provisions and investor protection standards.

Comparing Blind Pools to Traditional Funds

Blind pools, a type of investment fund, differ significantly from traditional funds by raising capital from investors without initially disclosing specific investments, which increases uncertainty and risk. Traditional funds typically outline targeted assets or sectors before fundraising, allowing investors to evaluate opportunities upfront and make informed decisions. The blind pool's appeal lies in fund managers' expertise and track record, relying heavily on trust compared to the transparency emphasized in conventional funds.

Future Trends in Blind Pool Fund Investing

Blind pool funds, where investors commit capital without knowing specific investment targets, are gaining traction in emerging sectors like renewable energy and artificial intelligence. These funds capitalize on future trends by allowing fund managers flexibility to deploy capital in high-growth opportunities such as green technology startups and AI infrastructure development. Increased investor appetite for blind pools reflects confidence in managers' expertise to navigate evolving markets and deliver superior returns.

example of blind pool in investment fund Infographic

samplerz.com

samplerz.com