A bridge loan in financing serves as a short-term funding solution that provides immediate capital to businesses awaiting long-term financing. This type of loan bridges the gap between the need for cash flow and the availability of permanent funds, often used in real estate acquisitions, mergers, or working capital shortages. Bridge financing typically involves higher interest rates due to its short duration and quick approval process. Businesses utilize bridge loans to cover operational expenses or secure crucial assets before securing permanent financing. The loans are usually backed by collateral such as property or inventory, ensuring lenders have security against the risk. Data shows that companies in transition phases, such as expanding or restructuring, frequently rely on bridge loans to maintain liquidity and business continuity.

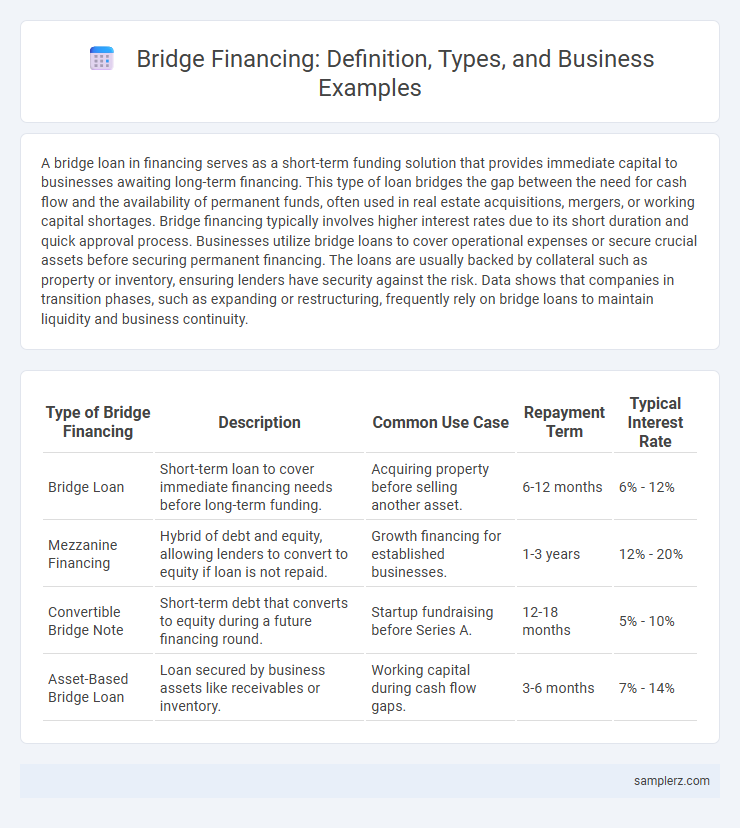

Table of Comparison

| Type of Bridge Financing | Description | Common Use Case | Repayment Term | Typical Interest Rate |

|---|---|---|---|---|

| Bridge Loan | Short-term loan to cover immediate financing needs before long-term funding. | Acquiring property before selling another asset. | 6-12 months | 6% - 12% |

| Mezzanine Financing | Hybrid of debt and equity, allowing lenders to convert to equity if loan is not repaid. | Growth financing for established businesses. | 1-3 years | 12% - 20% |

| Convertible Bridge Note | Short-term debt that converts to equity during a future financing round. | Startup fundraising before Series A. | 12-18 months | 5% - 10% |

| Asset-Based Bridge Loan | Loan secured by business assets like receivables or inventory. | Working capital during cash flow gaps. | 3-6 months | 7% - 14% |

Understanding Bridge Financing in Business

Bridge financing serves as short-term capital that fills gaps between funding rounds or cash flow shortages, enabling businesses to maintain operations or seize immediate opportunities. This type of financing often takes the form of bridge loans, convertible notes, or mezzanine debt, providing quick access to funds before securing long-term investment. Companies commonly utilize bridge financing during mergers, acquisitions, or pending large funding closures to smooth financial transitions and ensure business continuity.

Key Examples of Bridge Financing Solutions

Bridge financing solutions include short-term loans, mezzanine financing, and convertible debt designed to cover immediate capital needs before securing long-term funding. Real estate developers frequently use bridge loans to acquire properties while awaiting permanent mortgage approval. Startups often rely on convertible notes as bridge financing to accelerate growth ahead of venture capital rounds.

How Startups Use Bridge Loans

Startups frequently use bridge loans to secure temporary capital during funding gaps, enabling continued operations while awaiting larger investments or revenue milestones. These short-term loans often feature higher interest rates and flexible repayment terms tailored to startup cash flow uncertainties. Bridge financing provides crucial liquidity that supports product development, market expansion, and operational costs before a subsequent equity round or long-term financing closes.

Bridge Financing in Mergers and Acquisitions

Bridge financing in mergers and acquisitions provides short-term capital to companies awaiting long-term financing or the completion of a transaction. This type of funding ensures liquidity and maintains operational stability during the transition period between deal announcement and final closing. Commonly utilized by private equity firms and corporate buyers, bridge loans facilitate timely acquisitions by bridging gaps in financing or due diligence delays.

Real Estate Bridge Loan Case Studies

Real estate bridge loans provide short-term financing solutions that help investors or developers secure properties quickly before obtaining permanent funding. Case studies highlight scenarios where bridge loans enabled timely acquisition of undervalued assets, facilitating renovations and subsequent resale at a profit. These loans typically cover 6 to 12 months, with interest rates ranging from 8% to 12%, offering flexibility and speed compared to traditional mortgage financing.

Bridge Financing for Cash Flow Gaps

Bridge financing provides short-term capital to cover cash flow gaps, ensuring businesses meet operational expenses without disrupting ongoing projects. This type of funding is especially critical during periods between receivables and payables, allowing companies to maintain liquidity and avoid missed opportunities. Common examples include using bridge loans to finance inventory purchases or payroll while awaiting long-term financing or customer payments.

Private Equity and Bridge Financing Examples

Bridge financing in private equity often involves short-term loans provided to secure acquisitions before long-term funding is arranged. One example includes a private equity firm using bridge loans to quickly capitalize on an undervalued target company, ensuring deal closure prior to finalizing a leveraged buyout. These bridge loans typically carry higher interest rates but provide critical liquidity to maintain competitive positioning in fast-paced deal environments.

Successful IPO Bridge Financing Stories

Successful IPO bridge financing stories often highlight companies like Airbnb, which secured a $1 billion bridge loan in 2020 to bolster liquidity ahead of its 2020 IPO. Another example is Uber, which utilized a strategic bridge loan of $1 billion in 2019 to navigate market uncertainties prior to its public listing. These instances demonstrate how bridge financing can provide critical capital that ensures operational stability and investor confidence during the transition to becoming publicly traded companies.

Risks Illustrated by Bridge Financing Scenarios

Bridge financing often exposes businesses to high-interest rates that can strain cash flow during transitional periods. If the expected long-term funding falls through, companies may face liquidity crises or forced asset sales. Misjudging repayment timelines in bridge loans can escalate financial instability and damage creditworthiness.

Lessons Learned from Bridge Financing Examples

Bridge financing examples reveal crucial lessons about liquidity management and risk mitigation, emphasizing the importance of clearly defined repayment terms to avoid default. Companies utilizing bridge loans often learn to balance short-term capital needs against long-term financial stability, highlighting the need for accurate cash flow forecasting. These cases underscore the value of negotiating favorable interest rates and maintaining lender relationships to ensure seamless transitions to permanent financing.

example of bridge in financing Infographic

samplerz.com

samplerz.com