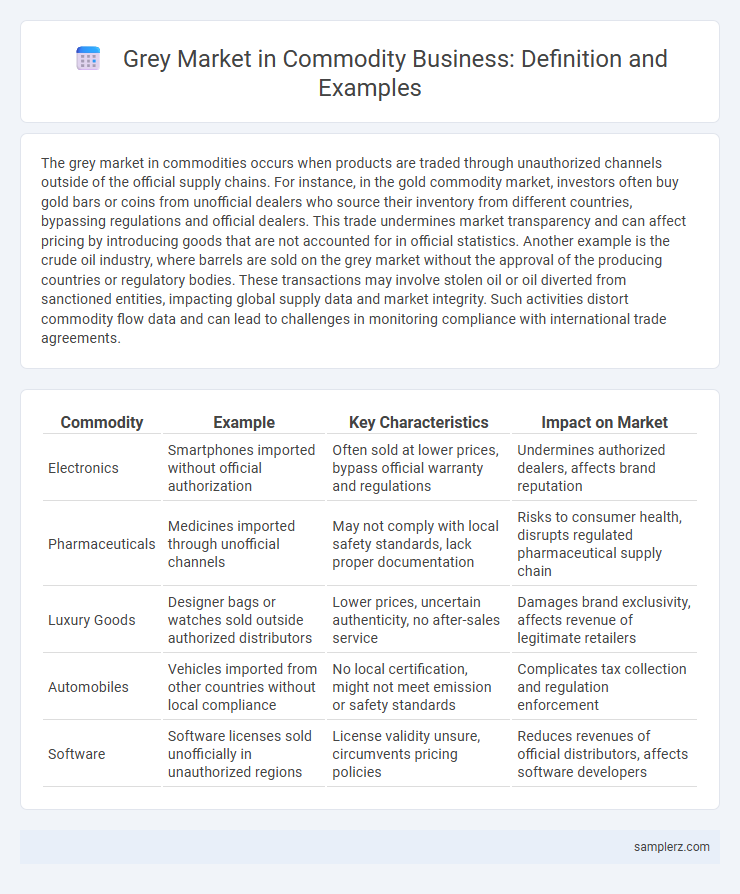

The grey market in commodities occurs when products are traded through unauthorized channels outside of the official supply chains. For instance, in the gold commodity market, investors often buy gold bars or coins from unofficial dealers who source their inventory from different countries, bypassing regulations and official dealers. This trade undermines market transparency and can affect pricing by introducing goods that are not accounted for in official statistics. Another example is the crude oil industry, where barrels are sold on the grey market without the approval of the producing countries or regulatory bodies. These transactions may involve stolen oil or oil diverted from sanctioned entities, impacting global supply data and market integrity. Such activities distort commodity flow data and can lead to challenges in monitoring compliance with international trade agreements.

Table of Comparison

| Commodity | Example | Key Characteristics | Impact on Market |

|---|---|---|---|

| Electronics | Smartphones imported without official authorization | Often sold at lower prices, bypass official warranty and regulations | Undermines authorized dealers, affects brand reputation |

| Pharmaceuticals | Medicines imported through unofficial channels | May not comply with local safety standards, lack proper documentation | Risks to consumer health, disrupts regulated pharmaceutical supply chain |

| Luxury Goods | Designer bags or watches sold outside authorized distributors | Lower prices, uncertain authenticity, no after-sales service | Damages brand exclusivity, affects revenue of legitimate retailers |

| Automobiles | Vehicles imported from other countries without local compliance | No local certification, might not meet emission or safety standards | Complicates tax collection and regulation enforcement |

| Software | Software licenses sold unofficially in unauthorized regions | License validity unsure, circumvents pricing policies | Reduces revenues of official distributors, affects software developers |

Understanding Grey Markets in Commodity Trading

Grey markets in commodity trading occur when goods such as oil, metals, or agricultural products are sold through unauthorized channels, bypassing official distribution networks. These markets often result in price discrepancies and regulatory challenges, impacting supply chain transparency and market stability. Traders engaged in grey market activities exploit variations in international pricing and trade restrictions to gain competitive advantages.

Key Characteristics of Grey Market Commodity Transactions

Grey market commodity transactions often involve the unauthorized import or export of goods, bypassing official distribution channels and regulatory oversight. Key characteristics include price disparities due to tax evasion, absence of manufacturer warranties, and increased risk of counterfeit or substandard products. These transactions commonly arise in high-demand commodities such as electronics, pharmaceuticals, and agricultural products, impacting market fairness and supply chain integrity.

Common Commodities Frequently Traded on Grey Markets

Common commodities frequently traded on grey markets include electronics, pharmaceuticals, and luxury goods. These items often bypass official distribution channels, leading to significant price discrepancies and potential quality risks for consumers. Grey market trading of commodities like gold and petroleum also affects supply chains and regulatory oversight in global markets.

Real-World Examples of Grey Market Sales in the Oil Industry

Grey market sales in the oil industry often occur through unauthorized resellers trading crude oil or refined products outside official channels, bypassing regulatory oversight. For instance, certain regions witness the sale of subsidized fuel intended for domestic consumption being diverted to neighboring countries at discounted rates, undermining local markets. These transactions impact global oil supply chains, creating pricing distortions and challenging enforcement of trade regulations.

Grey Market Activity in the Agricultural Commodity Sector

Grey market activity in the agricultural commodity sector often involves the trade of unregulated or unofficial export and import of staple goods like wheat, corn, and rice. These transactions bypass official channels, leading to price distortions, supply chain inefficiencies, and potential violations of trade policies. Such activity impacts market transparency and can undermine the stability of commodity prices in global agricultural markets.

Impact of Grey Market Metals Trading on Global Prices

Grey market metals trading, involving the unauthorized sale of commodities like gold, silver, and copper, disrupts global prices by introducing unregulated supply flows that bypass official exchanges. This illicit activity undermines price transparency, leading to increased volatility and distorted market signals that affect legitimate producers and investors. Consequently, global metal prices often fail to reflect true supply-demand dynamics, complicating risk assessment and strategic planning for businesses worldwide.

The Role of Parallel Importing in Commodity Grey Markets

Parallel importing in commodity grey markets involves the unauthorized import of genuine products through non-official channels, bypassing official distributors and price controls. This practice affects sectors such as electronics, pharmaceuticals, and luxury goods by enabling access to lower-priced commodities without manufacturer approval. Parallel importing disrupts traditional supply chains, impacts brand pricing strategies, and challenges regulatory frameworks governing international trade.

Case Study: Grey Market Sugar Trade in Emerging Economies

The grey market sugar trade in emerging economies exemplifies how unregulated cross-border transactions bypass official tariffs and quality controls, resulting in significant price discrepancies and supply chain distortions. In countries like India and Brazil, grey market activities account for an estimated 15-20% of total sugar trade volume, undermining producers' profits and government tax revenues. This case highlights the challenges in enforcing trade regulations amid high demand volatility and domestic production shortfalls.

Legal Implications of Participating in Grey Market Commodity Deals

Participating in grey market commodity deals often involves trading goods outside official distribution channels, leading to potential violations of import-export regulations and intellectual property laws. Companies engaged in such transactions face risks of legal penalties, including fines and litigation, which can damage reputations and financial standing. Regulatory authorities increasingly scrutinize grey market activities to enforce compliance with trade laws and protect legitimate market operations.

Strategies Businesses Use to Detect and Prevent Grey Market Commodities

Businesses implement advanced tracking technologies such as RFID and blockchain to monitor the supply chain and ensure commodity authenticity. Using data analytics and market surveillance, companies identify unusual sales patterns indicative of grey market activities. Collaborating with authorized distributors and enforcing strict contract compliance further helps prevent unauthorized commodity distribution.

example of grey market in commodity Infographic

samplerz.com

samplerz.com