Dual-class share structures are a corporate governance mechanism where companies issue two types of shares: one class grants superior voting rights, while the other class typically offers limited or no voting power. This system allows founders and key executives to maintain control over strategic decisions despite holding a minority of economic shares. Prominent examples include Alphabet Inc., Google's parent company, where Class B shares carry ten votes each, distinct from the single vote allocated to Class A shares. Investors must carefully evaluate dual-class shares since they can influence shareholder influence and company management. Companies adopting this structure often argue it protects long-term vision and innovation from short-term market pressures. However, some critics highlight potential risks of reduced accountability and governance imbalance, making the dual-class system a critical focal point in corporate governance discussions.

Table of Comparison

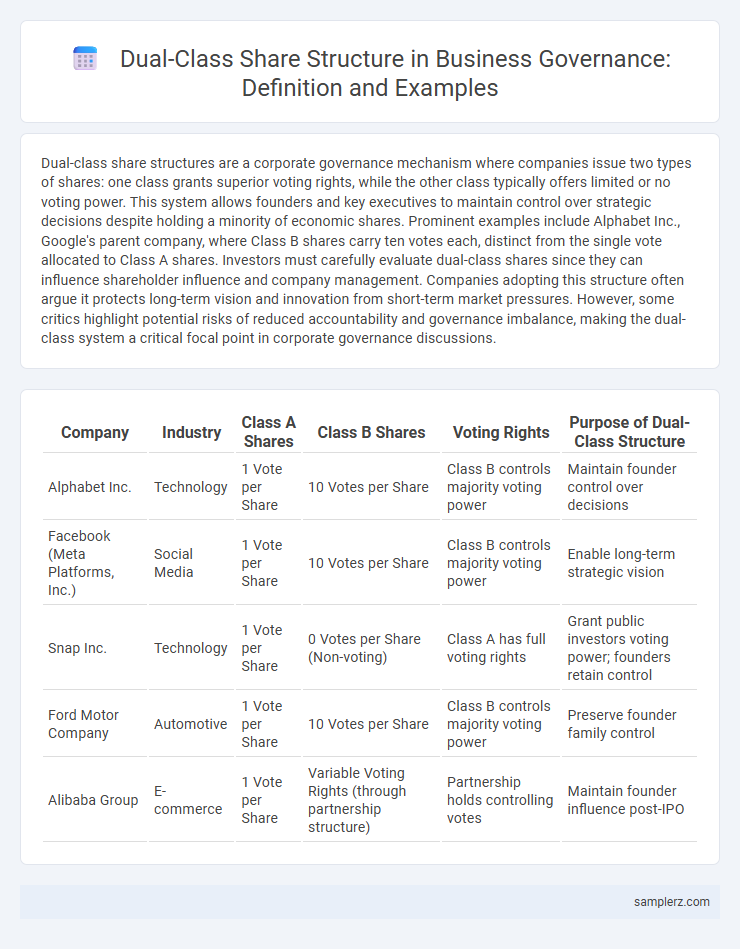

| Company | Industry | Class A Shares | Class B Shares | Voting Rights | Purpose of Dual-Class Structure |

|---|---|---|---|---|---|

| Alphabet Inc. | Technology | 1 Vote per Share | 10 Votes per Share | Class B controls majority voting power | Maintain founder control over decisions |

| Facebook (Meta Platforms, Inc.) | Social Media | 1 Vote per Share | 10 Votes per Share | Class B controls majority voting power | Enable long-term strategic vision |

| Snap Inc. | Technology | 1 Vote per Share | 0 Votes per Share (Non-voting) | Class A has full voting rights | Grant public investors voting power; founders retain control |

| Ford Motor Company | Automotive | 1 Vote per Share | 10 Votes per Share | Class B controls majority voting power | Preserve founder family control |

| Alibaba Group | E-commerce | 1 Vote per Share | Variable Voting Rights (through partnership structure) | Partnership holds controlling votes | Maintain founder influence post-IPO |

Introduction to Dual-Class Share Structures

Dual-class share structures grant different voting rights to classes of shares, often allowing founders to retain control while raising capital. A notable example is Alphabet Inc., where Class B shares hold ten votes per share, enabling founders to influence corporate governance significantly. Such arrangements balance founder control with public investment but raise concerns about shareholder democracy and accountability.

Key Features of Dual-Class Share Arrangements

Dual-class share arrangements feature two classes of shares, typically differentiated by voting power and dividend rights, enabling founders and insiders to retain control while raising capital. Class A shares often carry limited voting rights, whereas Class B shares grant enhanced voting power, sometimes up to ten votes per share, ensuring decision-making authority remains concentrated. This structure supports long-term strategic planning by insulating management from short-term market pressures and hostile takeovers.

Notable Companies with Dual-Class Shares

Notable companies utilizing dual-class shares for governance include Alphabet Inc., Facebook (Meta Platforms), and Berkshire Hathaway, where founders retain significant control through high-vote shares despite holding a minority of total equity. This structure allows key insiders to drive long-term strategic decisions without disenfranchising public shareholders economically. Dual-class share systems are prevalent in tech and media sectors, balancing capital access with concentrated voting power for visionary leadership.

Case Study: Alphabet Inc. (Google) Dual-Class Structure

Alphabet Inc., the parent company of Google, employs a dual-class share structure featuring Class A shares with one vote each and Class B shares with ten votes each, granting founders Larry Page and Sergey Brin outsized control. This governance model enables the founders to maintain decision-making authority despite holding a minority equity stake, thereby protecting long-term innovation strategies. The dual-class structure has faced shareholder scrutiny for reducing accountability but remains integral to Alphabet's corporate governance approach.

Case Study: Meta Platforms (Facebook) Share Governance

Meta Platforms employs a dual-class share structure where Class B shares hold 10 votes per share, allowing Mark Zuckerberg to retain majority voting control despite owning a minority economic stake. This governance model empowers Zuckerberg to steer long-term company strategy while limiting external shareholder influence on decisions. Such a structure highlights the balance between founder control and public investment in technology firms.

Impact of Dual-Class Shares on Corporate Governance

Dual-class shares, such as those issued by Alphabet Inc. and Facebook, create voting power imbalances that can concentrate control in the hands of founders and insiders, potentially reducing accountability to ordinary shareholders. This structure often leads to governance challenges, including weaker board oversight and limited influence of minority shareholders on key decisions. Empirical studies link dual-class shares to higher risk of entrenchment but also to greater long-term innovation due to founder control.

Benefits of Dual-Class Shares for Founders

Dual-class shares enable founders to retain control over strategic decisions by holding shares with superior voting rights, protecting their vision from short-term market pressures. This structure attracts long-term investors aligned with the company's mission, ensuring stability in governance and sustained innovation. Companies like Alphabet and Facebook demonstrate how dual-class shares empower founders to drive growth without relinquishing control to public shareholders.

Criticisms and Risks of Dual-Class Share Structures

Dual-class share structures, exemplified by companies such as Alphabet Inc. and Facebook (Meta Platforms), often face criticism for concentrating voting power in the hands of a few insiders, which can undermine shareholder democracy. These governance models risk entrenchment of management, reduce accountability, and may lead to decisions that do not align with the interests of minority shareholders. As a result, institutional investors frequently express concerns over the potential for misalignment between economic ownership and control in firms with dual-class shares.

Regulatory Perspectives on Dual-Class Shares

Dual-class share structures, commonly used by companies like Alphabet Inc. and Facebook (Meta Platforms), create distinct voting rights among shareholders, impacting corporate governance and regulatory scrutiny. Regulatory perspectives vary widely, with jurisdictions such as the United States allowing dual-class shares under strict disclosure requirements, while markets like Canada emphasize shareholder equality and limit such structures. The debate centers on balancing entrepreneur control with investor protection, influencing ongoing reforms and listing standards globally.

Emerging Trends in Dual-Class Share Governance

Dual-class share structures have become increasingly prevalent in governance, especially among technology startups and emerging markets, allowing founders to retain disproportionate voting power while raising capital. Recent trends highlight growing regulatory scrutiny and investor activism aimed at balancing founder control with shareholder rights to enhance transparency and accountability. Innovations such as sunset clauses and enhanced disclosure requirements are emerging as common governance mechanisms to address concerns associated with dual-class shares.

example of dual-class share in governance Infographic

samplerz.com

samplerz.com