Sweat equity in business ownership refers to the non-monetary investment individuals contribute through labor, skills, and time to increase a company's value. For example, a startup founder who works long hours developing a product without receiving a salary accumulates sweat equity, which translates into ownership stakes. This form of equity is crucial for companies with limited cash flow but high growth potential, enabling owners to build value through effort instead of capital. In many small businesses, partners or employees receive sweat equity as compensation for their contributions instead of immediate pay. A software developer joining an early-stage tech company may accept sweat equity shares, granting them partial ownership tied to their ongoing work performance. Tracking the value and percentage of sweat equity requires clear agreements, ensuring fair recognition of labor-based contributions alongside financial investments.

Table of Comparison

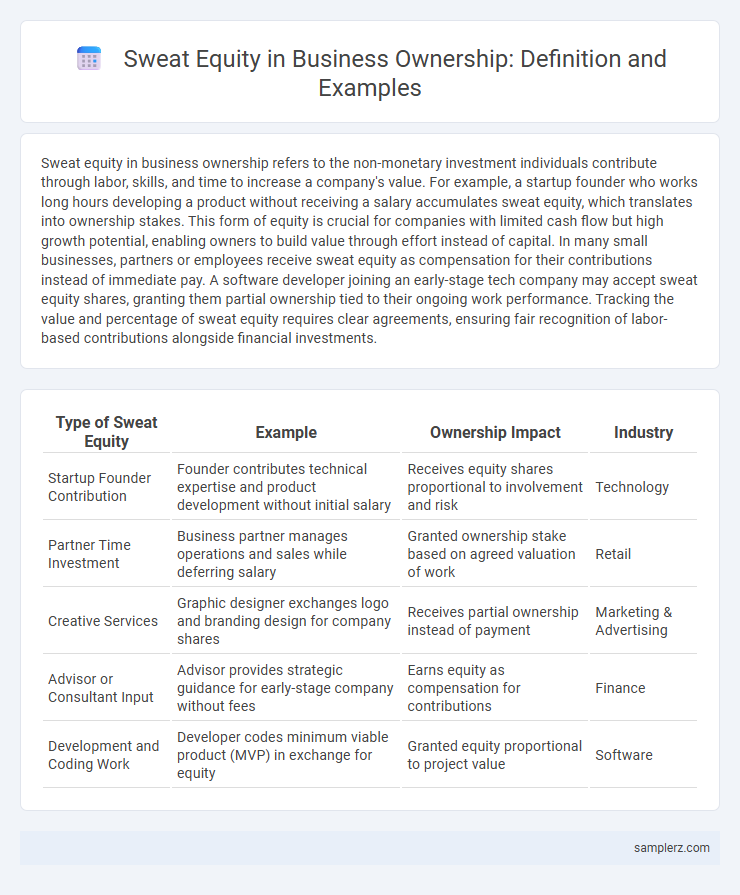

| Type of Sweat Equity | Example | Ownership Impact | Industry |

|---|---|---|---|

| Startup Founder Contribution | Founder contributes technical expertise and product development without initial salary | Receives equity shares proportional to involvement and risk | Technology |

| Partner Time Investment | Business partner manages operations and sales while deferring salary | Granted ownership stake based on agreed valuation of work | Retail |

| Creative Services | Graphic designer exchanges logo and branding design for company shares | Receives partial ownership instead of payment | Marketing & Advertising |

| Advisor or Consultant Input | Advisor provides strategic guidance for early-stage company without fees | Earns equity as compensation for contributions | Finance |

| Development and Coding Work | Developer codes minimum viable product (MVP) in exchange for equity | Granted equity proportional to project value | Software |

Defining Sweat Equity in Business Ownership

Sweat equity in business ownership refers to the non-monetary investment an individual contributes through time, effort, and expertise to build a company's value. This form of equity often translates into ownership stakes for founders or early employees who prioritize hands-on work over initial capital input. Examples include a co-founder designing the product or an employee leading marketing campaigns, both increasing the company's worth through their dedicated contributions.

Classic Sweat Equity Examples in Startups

Classic sweat equity examples in startups include founders who invest substantial time and effort to develop a product or secure early customers, instead of contributing cash capital. Key early employees often receive sweat equity shares as compensation for their critical roles in scaling the company during its initial growth phase. This non-monetary equity incentivizes commitment and aligns long-term interests between founders, employees, and investors.

Case Study: Founders Trading Labor for Shares

Sweat equity in business ownership often manifests when founders trade their labor and expertise for company shares rather than cash compensation. A notable case study is the early days of tech startups like Airbnb, where founders Brian Chesky and Joe Gebbia invested significant time and effort in product development and market validation in exchange for substantial equity stakes. This model incentivizes commitment and aligns long-term interests by granting ownership proportional to the founders' tangible contributions rather than initial capital investment.

Employee Sweat Equity: Stock Options and Vesting

Employee sweat equity typically involves stock options granted as part of compensation packages, allowing employees to acquire ownership stakes over time through a vesting schedule. Vesting periods, often spanning four years with a one-year cliff, encourage long-term commitment by gradually converting stock options into actual shares. This mechanism aligns employee interests with company growth, fostering retention and incentivizing performance in startup environments.

Real Estate Partnerships and Sweat Equity Contributions

In real estate partnerships, sweat equity contributions often involve partners providing hands-on project management, property renovations, or tenant relations instead of capital investment. This form of ownership allows contributors to earn a stake proportional to the value of their labor, enhancing asset value without immediate cash expenditure. Real estate sweat equity aligns interests by incentivizing operational involvement and improving overall property performance.

Sweat Equity in Family-Owned Businesses

Sweat equity in family-owned businesses often manifests when family members contribute labor and expertise instead of capital, enhancing the company's value without immediate financial investment. For instance, a younger generation taking an active role in operations or management increases ownership stakes by adding operational efficiencies and strategic growth. This non-monetary contribution strengthens ownership equity while preserving cash flow and aligning family interests with business success.

Tech Startups: Engineers Earning Stake Through Development

Tech startups often grant engineers sweat equity as ownership stakes in exchange for their critical role in product development and innovation. This arrangement aligns employee incentives with company success and typically involves stock options or restricted shares that vest over time. Sweat equity enables startups to attract top talent while conserving cash during early stages of growth.

Sweat Equity Deals in Small Business Partnerships

Sweat equity deals in small business partnerships often involve partners contributing their time, skills, and effort instead of capital to earn ownership stakes, exemplified by a co-founder managing operations and product development without a salary while gaining equity. These arrangements align incentives by rewarding active participation and can reduce initial cash outlays, making them attractive for startups with limited funding. Clear agreements detailing the valuation of sweat equity and performance milestones help protect all parties and ensure fair distribution of ownership.

Using Sweat Equity to Attract Key Talent

Offering sweat equity to key employees aligns their interests with the company's success, fostering commitment and motivation. Founders often allocate 5-10% ownership stakes to attract talent without immediate cash expenses, especially in startups. This ownership model incentivizes performance and long-term growth, enhancing team retention and business valuation.

Legal Considerations of Sweat Equity in Ownership

Sweat equity in business ownership refers to the non-monetary investment made by founders or partners through their time, effort, and expertise, often in exchange for equity stakes. Legal considerations include clearly defined agreements outlining the valuation of sweat equity, vesting schedules to protect all parties, and compliance with local corporate and tax laws to prevent disputes and ensure proper documentation. Proper legal frameworks ensure that sweat equity is recognized as a valid form of ownership, providing protection against dilution and clarifying rights and responsibilities.

example of sweat equity in ownership Infographic

samplerz.com

samplerz.com