A pink sheet in trading refers to a financial security that is traded over-the-counter (OTC) and not listed on major stock exchanges like the NYSE or NASDAQ. These stocks are typically issued by smaller or less established companies that do not meet the listing requirements of larger exchanges. Pink sheet trading is facilitated through the OTC Markets Group, where quotes are published on a daily basis. Investors often consider pink sheet stocks riskier due to the lack of stringent reporting regulations and lower liquidity compared to exchange-listed stocks. These securities sometimes represent emerging companies, distressed entities, or foreign firms seeking U.S. investors. Data on pink sheet stocks is accessible through various OTC market platforms, allowing traders to monitor price movements and trading volumes despite limited transparency.

Table of Comparison

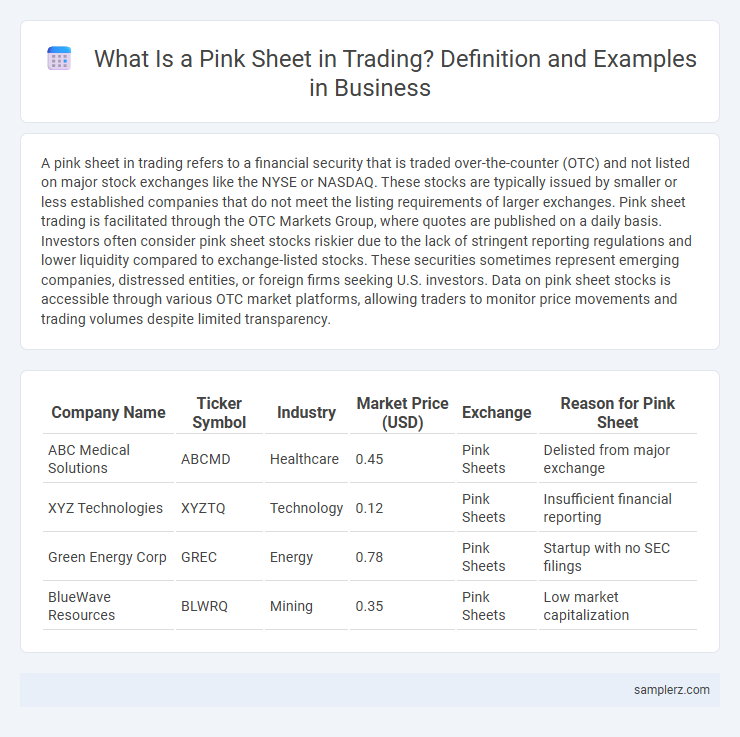

| Company Name | Ticker Symbol | Industry | Market Price (USD) | Exchange | Reason for Pink Sheet |

|---|---|---|---|---|---|

| ABC Medical Solutions | ABCMD | Healthcare | 0.45 | Pink Sheets | Delisted from major exchange |

| XYZ Technologies | XYZTQ | Technology | 0.12 | Pink Sheets | Insufficient financial reporting |

| Green Energy Corp | GREC | Energy | 0.78 | Pink Sheets | Startup with no SEC filings |

| BlueWave Resources | BLWRQ | Mining | 0.35 | Pink Sheets | Low market capitalization |

Understanding Pink Sheets in Business Trading

Pink Sheets represent over-the-counter (OTC) securities traded through a decentralized system, primarily involving small or micro-cap companies with less stringent reporting requirements. Investors engage with Pink Sheets to access stocks not listed on major exchanges like the NYSE or NASDAQ, often facing higher risks due to limited transparency and liquidity. Understanding these market nuances aids businesses in strategic investment decisions within OTC trading environments.

Key Features of Pink Sheet Stocks

Pink sheet stocks are traded over-the-counter (OTC) and lack formal exchange listing, often featuring low liquidity and high volatility. These stocks typically have limited regulatory oversight, leading to less transparency and higher risk of price manipulation. Investors should note the absence of standardized financial reporting and the prevalence of smaller, often speculative companies in the pink sheets market.

Notable Examples of Pink Sheet Companies

Notable examples of pink sheet companies include small-cap firms like Overstock.com, a pioneer in online retail, and MedMen Enterprises, a prominent cannabis retailer. These companies are traded over-the-counter (OTC) and often lack full SEC reporting requirements, reflecting their smaller size or early-stage status. Pink sheet listings provide investors with access to unique opportunities in emerging sectors and niche markets outside traditional exchanges.

Pink Sheet Market Structure Explained

The Pink Sheet market structure consists of over-the-counter (OTC) stocks traded via quotation services rather than formal exchanges, often involving smaller, less liquid companies. These stocks are typically not required to meet the stringent reporting standards of major exchanges, attracting investors seeking limited regulatory oversight but higher risk. Understanding the Pink Sheet market's decentralized framework is essential for navigating its unique trading dynamics and price discovery mechanisms.

How Pink Sheets Differ from Major Exchanges

Pink Sheets represent a marketplace where over-the-counter (OTC) stocks are traded, often involving smaller or less-liquid companies that do not meet the listing requirements of major exchanges like the NYSE or NASDAQ. Unlike the stringent regulatory standards and reporting obligations of major exchanges, Pink Sheets offer a less structured environment, resulting in higher risks and potential price volatility for investors. Pricing transparency and liquidity are typically lower in Pink Sheet trading compared to the more regulated and liquid markets of prominent exchanges, impacting investor confidence and trade execution.

Risks and Opportunities in Pink Sheet Trading

Pink sheet trading carries inherent risks including low liquidity, minimal regulatory oversight, and high volatility, which can lead to significant losses for investors. However, these stocks also offer unique opportunities such as access to emerging companies, potential for substantial price appreciation, and the ability to enter markets with less competition. Careful research and risk management are essential to capitalize on the high-reward environment of pink sheet securities.

Regulatory Environment for Pink Sheet Securities

Pink sheet securities trade on over-the-counter (OTC) markets where regulatory oversight by the Securities and Exchange Commission (SEC) is less stringent compared to major exchanges like NYSE or NASDAQ. These securities, often issued by smaller or financially distressed companies, are not required to file detailed financial reports under the Securities Exchange Act of 1934, increasing the risk for investors. Brokers and dealers facilitating pink sheet trades must comply with SEC regulations against fraud and manipulation, yet the limited disclosure requirements create a more opaque regulatory environment.

Case Studies: Success Stories from Pink Sheets

Several companies, such as Overstock.com and El Pollo Loco, successfully transitioned from pink sheets to major exchanges, showcasing significant growth and increased investor confidence. These success stories highlight how strategic management and transparency can transform pink sheet listings into reputable and profitable ventures. Case studies reveal that leveraging the pink sheets as a stepping stone allows firms to build market traction before uplisting to NASDAQ or NYSE.

Common Sectors Represented on Pink Sheets

Pink sheets typically feature companies from sectors such as biotechnology, mining, technology startups, and small-cap financial services. Many of these firms trade on pink sheets due to their early-stage development or inability to meet major exchange requirements. Common examples include emerging biotech firms, resource exploration companies, and niche financial service providers.

Steps to Trade Pink Sheet Stocks Safely

Trading pink sheet stocks requires thorough research on the company's financial health and market reputation to avoid scams and volatile price swings. Investors should use limit orders to control trade prices and maintain strict stop-loss levels to minimize potential losses. Monitoring SEC filings and staying updated with news related to these stocks enhances informed decision-making and risk management.

example of pink sheet in trading Infographic

samplerz.com

samplerz.com