In finance, a haircut refers to the percentage reduction applied to the market value of an asset when it is used as collateral for a loan. For instance, if a bond worth $100,000 has a 20% haircut, its collateral value is considered $80,000. This reduction protects lenders by accounting for potential decreases in the asset's market value during the loan period. Haircuts are commonly used in securities lending, repurchase agreements, and margin trading to mitigate credit risk. The size of the haircut depends on factors such as asset volatility, liquidity, and credit quality. Financial institutions rely on haircut policies to ensure adequate collateral coverage and maintain market stability.

Table of Comparison

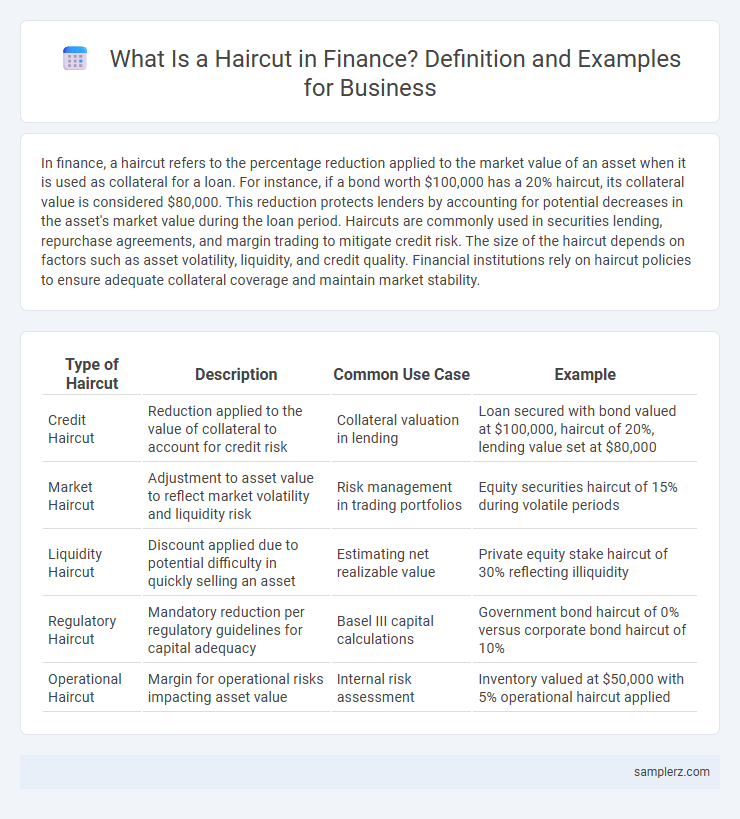

| Type of Haircut | Description | Common Use Case | Example |

|---|---|---|---|

| Credit Haircut | Reduction applied to the value of collateral to account for credit risk | Collateral valuation in lending | Loan secured with bond valued at $100,000, haircut of 20%, lending value set at $80,000 |

| Market Haircut | Adjustment to asset value to reflect market volatility and liquidity risk | Risk management in trading portfolios | Equity securities haircut of 15% during volatile periods |

| Liquidity Haircut | Discount applied due to potential difficulty in quickly selling an asset | Estimating net realizable value | Private equity stake haircut of 30% reflecting illiquidity |

| Regulatory Haircut | Mandatory reduction per regulatory guidelines for capital adequacy | Basel III capital calculations | Government bond haircut of 0% versus corporate bond haircut of 10% |

| Operational Haircut | Margin for operational risks impacting asset value | Internal risk assessment | Inventory valued at $50,000 with 5% operational haircut applied |

Understanding Haircuts in Financial Transactions

Haircuts in financial transactions refer to the percentage reduction applied to the market value of an asset when used as collateral, reflecting risk and potential market volatility. For example, if a bond valued at $100 million is subject to a 10% haircut, its collateral value is considered $90 million, protecting lenders against price declines. This mechanism ensures loan security and maintains stability in repurchase agreements, securities lending, and margin financing.

Common Types of Haircuts in Lending

Common types of haircuts in lending include market value haircuts, where collateral is discounted based on its current market price to mitigate risk, and liquidity haircuts, applied when assets have limited marketability and may require heavy discounts. Another prevalent example is credit risk haircuts, which account for the borrower's creditworthiness by reducing the loan-to-value ratio to avoid potential default losses. These haircuts ensure lenders maintain adequate protection against market volatility and borrower risk in financial transactions.

Haircuts in Collateralized Borrowing Explained

Haircuts in collateralized borrowing refer to the percentage reduction applied to the market value of an asset used as collateral to account for risk and price volatility. For example, if a bond valued at $100,000 has a 10% haircut, the lender will accept it as collateral worth only $90,000, ensuring a buffer against potential declines in the asset's value. This practice mitigates credit risk and protects lenders from borrower default or market fluctuations.

Real-World Examples of Haircuts in Repo Agreements

In repo agreements, haircuts typically range from 2% to 10% depending on the asset's volatility and liquidity, such as a 5% haircut applied to U.S. Treasury securities versus a 10% haircut for corporate bonds. During the 2008 financial crisis, haircuts on mortgage-backed securities surged dramatically, sometimes exceeding 20%, reflecting heightened risk and diminished market confidence. Central banks often adjust haircut levels to stabilize financial markets, exemplified by the Federal Reserve's dynamic haircut policies on various collateral during periods of economic stress.

Haircuts in Securities-Based Lending

Haircuts in securities-based lending represent the percentage reduction applied to the market value of collateral to mitigate credit risk, often ranging from 10% to 50% depending on asset volatility. For instance, if a borrower pledges stock valued at $100,000 with a 30% haircut, the lender considers only $70,000 as collateral for loan purposes. This risk adjustment ensures lender protection against market fluctuations and potential default by borrowers.

The Role of Haircuts During Financial Crises

Haircuts in finance represent the percentage reduction applied to the value of collateral during lending or repo transactions, providing a buffer against market volatility and default risk. During financial crises, haircuts typically increase sharply to reflect heightened uncertainty and asset price declines, helping to mitigate systemic risk and protect lenders. This mechanism plays a critical role in maintaining liquidity and stabilizing financial markets by ensuring that collateral valuations remain prudent under distressed conditions.

How Regulators Determine Haircut Levels

Regulators determine haircut levels by assessing the risk profile of the underlying asset, its market volatility, and liquidity conditions to protect financial institutions from potential losses. They use stress testing and historical price fluctuations to set conservative discount rates on collateral values, ensuring adequate capital buffers. This approach helps maintain systemic stability by mitigating counterparty credit risk during market downturns.

Impact of Haircuts on Credit Risk Management

Haircuts in finance refer to the percentage reduction applied to the market value of an asset when used as collateral, directly influencing the level of credit risk exposure for lenders. A higher haircut reduces the lender's risk by requiring more collateral to cover potential losses, thereby enhancing the effectiveness of credit risk management strategies. This adjustment helps financial institutions maintain capital adequacy and mitigate default risk during market volatility.

Haircuts in Cryptocurrency and Digital Asset Finance

Haircuts in cryptocurrency finance refer to the percentage reduction applied to the market value of digital assets when used as collateral to mitigate volatility risks. For example, a Bitcoin holding valued at $100,000 might receive a 30% haircut, resulting in a collateral value of $70,000 to protect lenders from sudden price drops. This practice is crucial in digital asset finance to maintain liquidity and minimize counterparty risk during lending or margin trading activities.

Best Practices for Managing Haircuts in Corporate Finance

Implementing clear protocols for assessing haircut values ensures consistent risk management in corporate finance, particularly when valuing collateral or adjusting asset prices during lending. Frequent market analysis and stress testing of haircut strategies help maintain capital adequacy and optimize liquidity under volatile conditions. Leveraging automated valuation tools and maintaining transparent communication with stakeholders enhance accuracy and build trust in haircut adjustments.

example of haircut in finance Infographic

samplerz.com

samplerz.com