Cost of Goods Sold (COGS) in accounting refers to the direct costs attributable to the production of the goods sold by a company. This includes expenses such as raw materials, labor used in manufacturing, and manufacturing overhead. For example, a furniture company's COGS would include the cost of wood, nails, varnish, and wages paid to the workers assembling the furniture. In retail businesses, COGS typically consists of the purchase price of the inventory sold during the accounting period. For instance, a clothing store's COGS might capture the wholesale price of garments sold, shipping fees, and packaging costs. Accurate tracking of COGS is essential for calculating gross profit and assessing the overall profitability of the business.

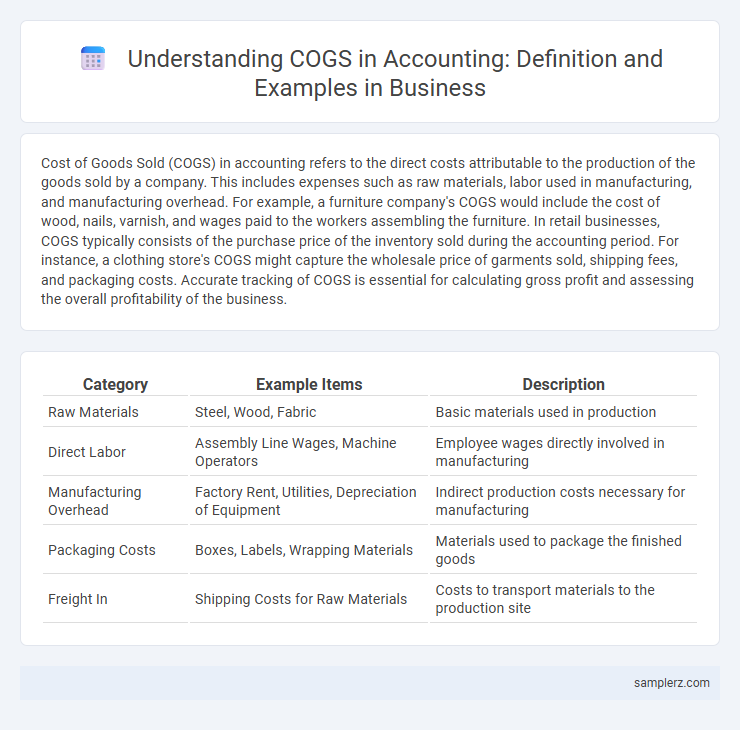

Table of Comparison

| Category | Example Items | Description |

|---|---|---|

| Raw Materials | Steel, Wood, Fabric | Basic materials used in production |

| Direct Labor | Assembly Line Wages, Machine Operators | Employee wages directly involved in manufacturing |

| Manufacturing Overhead | Factory Rent, Utilities, Depreciation of Equipment | Indirect production costs necessary for manufacturing |

| Packaging Costs | Boxes, Labels, Wrapping Materials | Materials used to package the finished goods |

| Freight In | Shipping Costs for Raw Materials | Costs to transport materials to the production site |

Understanding COGS: A Fundamental in Accounting

Cost of Goods Sold (COGS) in accounting represents the direct costs attributable to the production of goods sold by a business, including raw materials, labor, and manufacturing overhead. Accurately calculating COGS is essential for determining gross profit and assessing business profitability. Understanding COGS enables companies to manage expenses effectively and make informed pricing decisions.

Key Components Typically Included in COGS

Cost of Goods Sold (COGS) in accounting typically includes direct materials, direct labor, and manufacturing overhead costs directly tied to product production. Key components encompass raw materials, wages of production employees, and factory utilities or depreciation. These elements collectively represent the expenses necessary to create finished goods sold during the accounting period.

Examples of Direct Materials in COGS

Examples of direct materials in Cost of Goods Sold (COGS) include raw materials such as steel used in manufacturing automobiles, wood utilized in furniture production, and fabric applied in garment making. These materials are directly traceable to the finished product and represent a significant portion of the production costs. Accurate tracking of these direct materials is essential for precise inventory valuation and cost management in accounting.

Direct Labor Costs Considered in COGS

Direct labor costs considered in COGS include wages paid to employees directly involved in manufacturing products or delivering services. These costs encompass salaries, overtime pay, benefits, and payroll taxes for production workers who transform raw materials into finished goods. Accurate allocation of direct labor expenses ensures precise calculation of gross profit and overall financial performance.

Manufacturing Overhead and Its Role in COGS

Manufacturing overhead includes indirect costs such as factory rent, utilities, and equipment depreciation that are essential for production but not directly tied to specific units. These overhead costs are allocated to COGS to accurately reflect the total expenses involved in manufacturing finished goods. Properly accounting for manufacturing overhead ensures precise product costing and profitability analysis.

Service Businesses: COGS Example Breakdown

In service businesses, Cost of Goods Sold (COGS) primarily includes direct labor expenses, subcontractor fees, and materials used in delivering services. For example, a consulting firm's COGS may encompass consultant salaries, specialized software licenses, and travel costs directly related to client projects. Tracking these components accurately helps service businesses measure gross profit and manage operational efficiency effectively.

Retail Industry: COGS Calculation Example

In the retail industry, Cost of Goods Sold (COGS) includes the purchase price of inventory, shipping fees, and storage costs associated with the products sold. For example, if a retailer buys 1,000 units at $50 each, incurs $2,000 in shipping, and $1,000 in warehouse expenses, the total COGS would be $53,000. Accurately calculating COGS helps retailers determine gross profit and manage pricing strategies effectively.

COGS in Manufacturing: Step-by-Step Example

In manufacturing, COGS (Cost of Goods Sold) includes direct materials, direct labor, and manufacturing overhead used to produce finished goods. For example, calculating COGS involves summing the beginning inventory of raw materials, adding purchases, and subtracting ending inventory, then adding direct labor costs and allocated overhead expenses. This step-by-step process ensures accurate matching of production costs with revenue for precise financial reporting.

COGS Reporting: Example Entries in Financial Statements

Cost of Goods Sold (COGS) in accounting includes direct expenses such as raw materials, labor, and manufacturing overhead directly attributable to product production. In financial statements, COGS is recorded on the income statement as a debit entry, reducing gross profit, with corresponding credit to inventory accounts. For example, purchasing raw materials increases inventory (debit), and upon sale, COGS is recognized (debit) while inventory is reduced (credit), accurately reflecting the cost of products sold.

Common Mistakes When Calculating COGS

Common mistakes when calculating Cost of Goods Sold (COGS) include failing to accurately account for inventory changes, such as not properly including beginning and ending inventory values. Businesses often overlook direct labor costs and manufacturing overhead, leading to underestimated COGS and distorted gross profit margins. Misclassifying expenses like marketing or administrative costs as COGS can also result in inaccurate financial reporting and tax issues.

example of COGS in accounting Infographic

samplerz.com

samplerz.com