A leveraged buyout (LBO) is a common strategy used in business takeovers where a company is acquired primarily with borrowed funds, using the assets of the target company as collateral. One notable example is the 2007 acquisition of TXU Corporation by Kohlberg Kravis Roberts (KKR), Texas Pacific Group, and Goldman Sachs. This transaction, valued at approximately $45 billion, stands as one of the largest LBOs in history, showcasing how significant debt financing can facilitate a massive corporate takeover. In an LBO, private equity firms seek to improve the acquired company's operational efficiency and eventually sell it at a profit. The TXU deal involved leveraging the utility's steady cash flows to service the debt while restructuring the business. Data from this case highlight the critical role of high leverage in enabling large-scale acquisitions and the risks associated with significant debt loads during economic downturns.

Table of Comparison

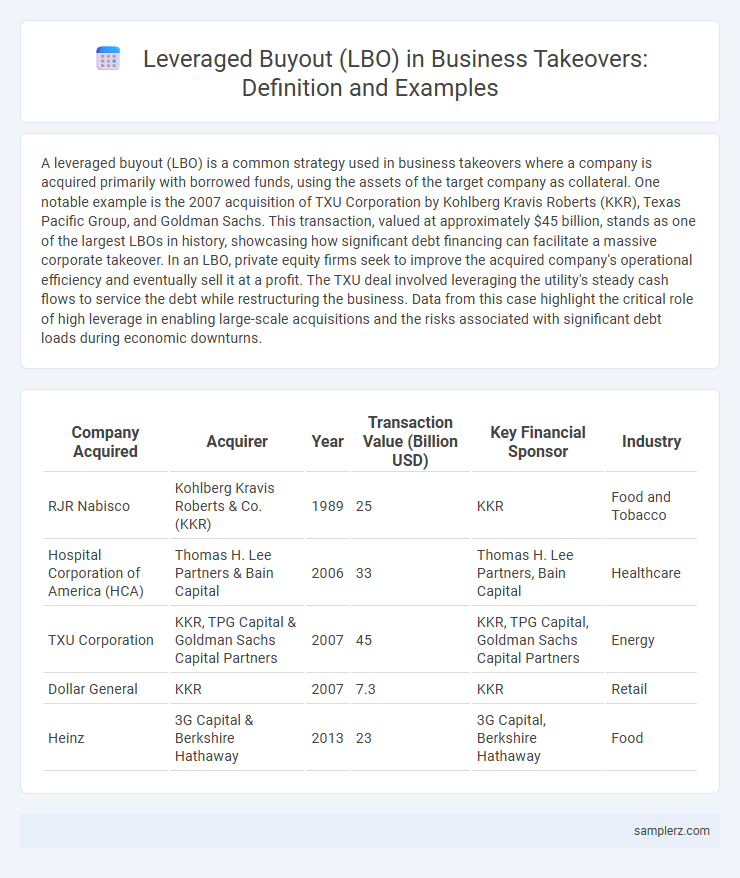

| Company Acquired | Acquirer | Year | Transaction Value (Billion USD) | Key Financial Sponsor | Industry |

|---|---|---|---|---|---|

| RJR Nabisco | Kohlberg Kravis Roberts & Co. (KKR) | 1989 | 25 | KKR | Food and Tobacco |

| Hospital Corporation of America (HCA) | Thomas H. Lee Partners & Bain Capital | 2006 | 33 | Thomas H. Lee Partners, Bain Capital | Healthcare |

| TXU Corporation | KKR, TPG Capital & Goldman Sachs Capital Partners | 2007 | 45 | KKR, TPG Capital, Goldman Sachs Capital Partners | Energy |

| Dollar General | KKR | 2007 | 7.3 | KKR | Retail |

| Heinz | 3G Capital & Berkshire Hathaway | 2013 | 23 | 3G Capital, Berkshire Hathaway | Food |

Introduction to Leveraged Buyouts in Business Takeovers

Leveraged buyouts (LBOs) are a common strategy in business takeovers, where a company is acquired primarily using borrowed funds secured by the target company's assets. A notable example is the 1989 acquisition of RJR Nabisco by Kohlberg Kravis Roberts & Co. (KKR), which involved over $25 billion in debt financing, exemplifying the scale and impact of leveraged buyouts. LBOs enable investors to control companies with limited equity, relying heavily on debt to maximize potential returns while managing financial risk.

Key Characteristics of Leveraged Buyouts

Leveraged buyouts (LBOs) in business acquisitions typically involve acquiring a company using a significant amount of borrowed funds secured by the target's assets. Key characteristics include a high debt-to-equity ratio, management often retaining ownership stakes, and aggressive cost-cutting measures to enhance cash flow for debt repayment. These transactions usually target undervalued companies with strong cash flow potential to service substantial leverage effectively.

Notable Leveraged Buyout Examples in Corporate History

One of the most notable leveraged buyouts (LBOs) in corporate history is the 1989 acquisition of RJR Nabisco by Kohlberg Kravis Roberts & Co. (KKR) for $31.1 billion, a deal that exemplified the scale and complexity of LBOs during the era. Another significant example includes the 2007 buyout of TXU Corporation by a consortium led by KKR, TPG Capital, and Goldman Sachs, valued at $45 billion and known as the largest LBO at that time. These transactions highlight how private equity firms use high debt levels to acquire companies, aiming to improve efficiency and profitability before eventual resale.

Case Study: The RJR Nabisco Leveraged Buyout

The RJR Nabisco leveraged buyout in 1989 remains one of the most iconic examples of a takeover using debt financing, with the deal valued at $25 billion, marking it the largest LBO in history at the time. Kohlberg Kravis Roberts & Co. (KKR) utilized significant leverage to acquire the food and tobacco conglomerate, emphasizing the strategic use of borrowed capital to facilitate the takeover. This case study highlights the complexities and aggressive financial structuring typical of late 20th-century leveraged buyouts in the corporate acquisition landscape.

Analysis of Dell’s Leveraged Buyout Journey

Dell's leveraged buyout in 2013, valued at approximately $24.4 billion, marked one of the largest tech buyouts, orchestrated by founder Michael Dell and private equity firm Silver Lake Partners. The deal strategically utilized significant debt financing to transition Dell from a publicly traded company to a private entity, enabling operational restructuring away from short-term market pressures. This LBO exemplified the use of leverage to facilitate corporate transformation while aiming to unlock long-term shareholder value through strategic innovation and market repositioning.

Kraft Foods and the Heinz Acquisition: A Classic LBO Example

The acquisition of Heinz by Kraft Foods in 2015 exemplifies a classic leveraged buyout (LBO), where the consortium led by 3G Capital and Berkshire Hathaway financed the $49 billion deal primarily through debt. This strategic LBO enabled restructuring and cost-cutting measures that enhanced operational efficiency and shareholder value. The Kraft Heinz merger stands as a benchmark for how substantial debt leverage can facilitate transformative takeovers in the food industry.

Blackstone’s Hilton Worldwide Takeover: Leveraged Buyout Insights

Blackstone's leveraged buyout of Hilton Worldwide in 2007, valued at approximately $26 billion, stands as one of the largest and most influential takeovers in the hospitality industry. The private equity firm utilized significant debt financing to acquire Hilton, enabling operational restructurings and global expansion that ultimately increased Hilton's market valuation multiple times over. This transaction illustrates how leveraged buyouts can strategically transform industry giants by optimizing capital structure and driving long-term value creation.

Impact of LBOs on Acquired Companies

Leveraged buyouts (LBOs) often lead to significant restructurings in acquired companies, as the high debt levels require improved operational efficiencies and cost reductions. Companies like Hilton Worldwide experienced enhanced strategic focus and asset optimization following their LBO, though some firms face challenges with cash flow constraints and reduced financial flexibility. The increased leverage can drive growth-oriented initiatives but also heightens the risk of bankruptcy if performance targets are not met.

Financial Strategies Behind Successful Leveraged Buyouts

A notable example of a leveraged buyout is the acquisition of RJR Nabisco by Kohlberg Kravis Roberts (KKR) in 1989, where financial strategies centered on maximizing debt financing to amplify returns. The use of high-yield bonds and asset-based lending allowed KKR to leverage the company's assets, creating a capital structure that balanced risk while enabling significant value extraction. This approach highlights the importance of precise debt structuring, cash flow projections, and operational improvements in executing successful leveraged buyouts in competitive takeover scenarios.

Lessons Learned from Famous Leveraged Buyouts

The leveraged buyout (LBO) of RJR Nabisco in 1989 highlighted critical lessons in risk management and valuation accuracy, as the deal's high debt load stressed the company's cash flow capacity. The acquisition of TXU Energy in 2007 emphasized the importance of thorough due diligence, revealing market volatility risks that can impact expected returns. These cases underscore the necessity of balancing aggressive leverage with realistic growth projections to sustain long-term profitability in takeover transactions.

example of leveraged buyout in takeover Infographic

samplerz.com

samplerz.com