Dry powder in a business fund refers to the amount of capital that is readily available for investment but has not yet been deployed. This reserved cash or liquid assets enable a fund to quickly seize new opportunities or respond to market changes without needing to raise additional capital. Venture capital firms and private equity funds commonly maintain dry powder to ensure agility in competitive markets. This reserve of dry powder can significantly impact a fund's strategy and growth potential, allowing it to invest in promising startups or distressed assets. By keeping a substantial amount of unallocated capital, funds manage risk and maintain flexibility. The size of dry powder often indicates a fund's financial health and its capacity to support portfolio companies during economic downturns.

Table of Comparison

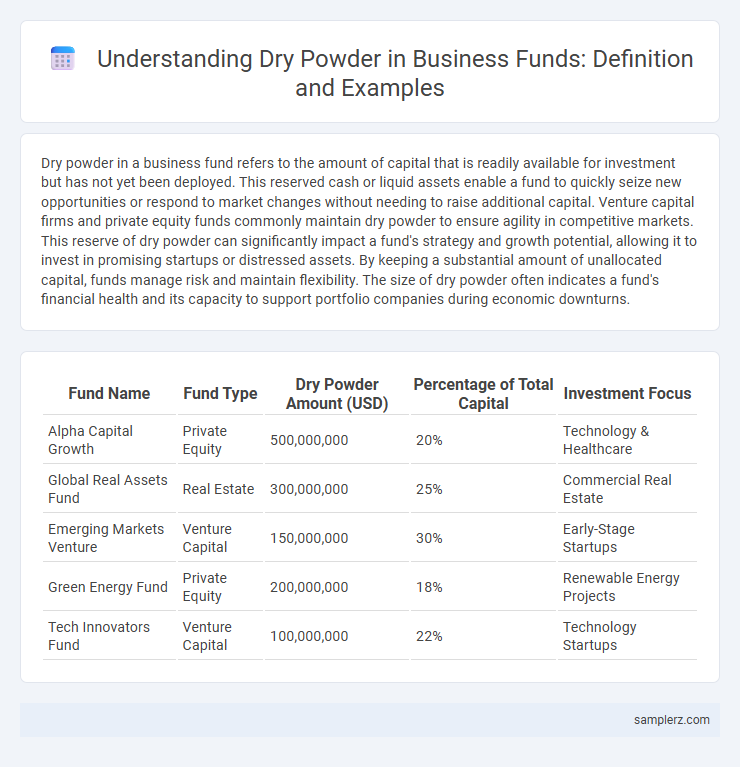

| Fund Name | Fund Type | Dry Powder Amount (USD) | Percentage of Total Capital | Investment Focus |

|---|---|---|---|---|

| Alpha Capital Growth | Private Equity | 500,000,000 | 20% | Technology & Healthcare |

| Global Real Assets Fund | Real Estate | 300,000,000 | 25% | Commercial Real Estate |

| Emerging Markets Venture | Venture Capital | 150,000,000 | 30% | Early-Stage Startups |

| Green Energy Fund | Private Equity | 200,000,000 | 18% | Renewable Energy Projects |

| Tech Innovators Fund | Venture Capital | 100,000,000 | 22% | Technology Startups |

Understanding Dry Powder in Fund Management

Dry powder in fund management refers to the capital reserves that private equity firms or investment funds hold in cash or easily liquidated assets, ready to be deployed for new investments or to capitalize on market opportunities. Maintaining an optimal level of dry powder is crucial for funds to quickly respond to favorable deals without needing to liquidate existing holdings under unfavorable conditions. Efficiently managing dry powder enhances a fund's flexibility, risk management, and ability to generate higher returns through timely capital allocation.

Key Examples of Dry Powder in Private Equity

Key examples of dry powder in private equity include unallocated capital commitments from limited partners, which firms hold ready for future investments or acquisitions. This reserve enables private equity firms to act swiftly on high-value deals without the need for immediate capital calls. Maintaining substantial dry powder supports strategic flexibility and competitive advantage in dynamic market conditions.

How Hedge Funds Maintain Dry Powder Reserves

Hedge funds maintain dry powder reserves by strategically allocating a portion of their capital to highly liquid assets such as cash, Treasury bills, and short-term government bonds, ensuring immediate availability for opportunistic investments. This liquidity management allows hedge funds to act swiftly during market dislocations or undervalued asset opportunities without the need to liquidate long-term holdings. Maintaining dry powder enhances risk-adjusted returns by providing flexibility to capitalize on market inefficiencies and distressed asset acquisitions.

Dry Powder Strategy: Case Studies from Venture Capital

Dry powder in venture capital refers to the unallocated capital that funds hold in reserve to seize future investment opportunities or support portfolio companies during downturns. Sequoia Capital strategically maintains significant dry powder, enabling it to back startups through multiple funding rounds and capitalize on market disruptions. This dry powder strategy allows venture firms to exercise flexibility, respond rapidly to emerging trends, and sustain competitive advantage in highly volatile markets.

Real-Life Scenarios: Dry Powder Deployment in M&A

Private equity firms often hold significant dry powder--unallocated capital reserved for strategic acquisitions--in order to swiftly capitalize on merger and acquisition (M&A) opportunities when market conditions are favorable. For example, during economic downturns, funds deploy dry powder to acquire undervalued companies, enabling accelerated growth post-recovery. This targeted deployment of dry powder enhances deal competitiveness and drives portfolio value creation by seizing time-sensitive investment opportunities in volatile markets.

Institutional Investors and Dry Powder Allocation

Institutional investors typically hold significant dry powder in private equity and venture capital funds, often allocating 20-30% of their total assets under management as reserve capital to seize opportunistic investments. This dry powder enables timely deployments during market dislocations or periods of asset mispricing, enhancing portfolio flexibility and risk management. Effective dry powder allocation strategies help institutional investors maximize returns and maintain liquidity without disrupting broader investment mandates.

Dry Powder Utilization in Times of Market Downturn

Dry powder in funds refers to the reserved capital that private equity and venture capital firms hold to capitalize on investment opportunities during market downturns. During economic slumps, effective dry powder utilization enables funds to acquire undervalued assets, support portfolio companies facing liquidity challenges, and position for future growth. Strategic deployment of dry powder enhances long-term returns by leveraging market dislocations and maintaining investment agility.

Notable Funds with Significant Dry Powder Holdings

Notable funds such as Blackstone Group, KKR, and Carlyle Group maintain substantial dry powder reserves exceeding $100 billion collectively, enabling rapid deployment for strategic acquisitions. These private equity giants leverage dry powder to capitalize on market dislocations and distressed asset opportunities, preserving financial flexibility. High dry powder levels indicate strong investor commitments and robust fundraising capabilities, positioning these funds for competitive advantages in deal sourcing and execution.

Impact of Dry Powder on Fund Performance

Dry powder, the unallocated capital that private equity and venture capital funds hold in reserve, significantly impacts fund performance by enabling managers to quickly capitalize on investment opportunities and optimize portfolio allocation. High levels of dry powder can indicate strong fundraising capabilities but may also pressure fund managers to deploy capital rapidly, potentially leading to suboptimal investment choices. Effective dry powder management balances having enough liquidity for strategic acquisitions while avoiding prolonged periods of underutilization that can dilute returns and hinder overall fund performance.

Lessons Learned from Dry Powder Management

Effective dry powder management in private equity funds demonstrates the importance of strategic capital allocation to seize market opportunities without succumbing to overexposure. Maintaining an optimal reserve, typically 20-30% of total committed capital, enables funds to support portfolio companies during downturns and capitalize on distressed asset acquisitions. Transparent communication with limited partners about dry powder strategies enhances confidence and fosters long-term investment success.

example of dry powder in fund Infographic

samplerz.com

samplerz.com