A white knight in business refers to a friendly investor or company that acquires a target firm to prevent a hostile takeover by an unfriendly bidder. In 2008, Microsoft acted as a white knight when it invested $240 million in Facebook, helping the social media company avoid potential hostile moves by other tech giants. This strategic investment enabled Facebook to continue its growth trajectory without pressure from aggressive competitors. Another example of a white knight is when Warren Buffett's Berkshire Hathaway stepped in to rescue Goldman Sachs during the 2008 financial crisis. By purchasing preferred shares worth $5 billion, Berkshire Hathaway stabilized Goldman Sachs, offering a lifeline during a period of widespread market uncertainty. This intervention protected Goldman Sachs from potential hostile acquisitions and maintained confidence among its stakeholders.

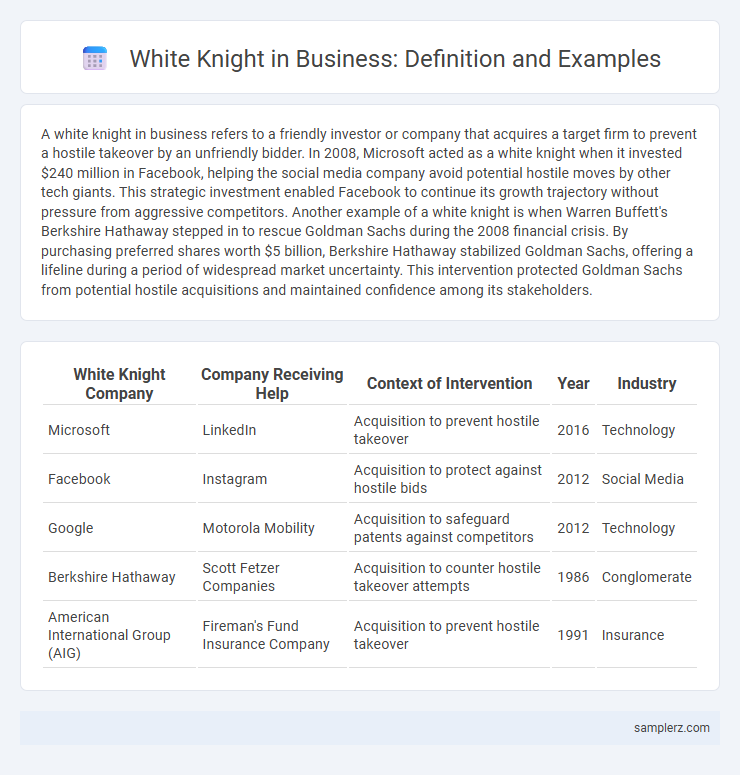

Table of Comparison

| White Knight Company | Company Receiving Help | Context of Intervention | Year | Industry |

|---|---|---|---|---|

| Microsoft | Acquisition to prevent hostile takeover | 2016 | Technology | |

| Acquisition to protect against hostile bids | 2012 | Social Media | ||

| Motorola Mobility | Acquisition to safeguard patents against competitors | 2012 | Technology | |

| Berkshire Hathaway | Scott Fetzer Companies | Acquisition to counter hostile takeover attempts | 1986 | Conglomerate |

| American International Group (AIG) | Fireman's Fund Insurance Company | Acquisition to prevent hostile takeover | 1991 | Insurance |

Definition of a White Knight in Business

A white knight in business refers to a friendly investor or company that acquires a target firm facing a hostile takeover attempt, providing a preferable alternative to the aggressor. This strategic rescue helps preserve the target company's management, culture, and operational autonomy. White knights often pay a premium price to protect the target's interests and uphold shareholder value.

Historical Overview of White Knight Strategies

White knight strategies emerged prominently during the 1980s merger and acquisition wave, serving as a defensive tactic where a friendly company acquires a target firm to prevent hostile takeovers. A notable example includes Sanofi's acquisition of Aventis, where Novartis acted as the white knight to protect Aventis from Siemens' hostile bid. These interventions helped maintain corporate independence and shareholder value during aggressive acquisition attempts.

Classic Examples of White Knight Interventions

Classic examples of white knight interventions in business include Warren Buffett's Berkshire Hathaway stepping in to save companies like Salomon Brothers during financial distress. Another notable case is when KKR acted as a white knight for RJR Nabisco to prevent a hostile takeover during its leveraged buyout battle. These interventions exemplify how white knights protect target companies from aggressive acquirers while preserving shareholder value.

White Knight vs. Hostile Takeover: Key Differences

A white knight in business refers to a friendly investor or company that acquires a target firm to prevent a hostile takeover by an unfriendly bidder. Unlike a hostile takeover, where the acquiring company pursues control against the wishes of the target's management, a white knight's offer is welcomed and often preserves the existing leadership and corporate culture. Major examples include when Walt Disney acted as a white knight for Pixar, preventing hostile advances from other potential acquirers.

Notable White Knight Cases in Corporate History

Notable white knight cases in corporate history include when Warren Buffett stepped in to save Salomon Brothers from hostile takeover in 1987, preserving its independence and value. Another prominent example is Microsoft's acquisition of LinkedIn in 2016, which helped LinkedIn avoid a hostile bid that could have undervalued the company. These interventions by friendly investors or companies typically prevent hostile takeovers and protect shareholder interests.

Role of White Knights in Mergers and Acquisitions

White knights in mergers and acquisitions play a crucial role by providing a friendly acquisition option to companies facing hostile takeovers, helping preserve the target company's management and corporate strategy. For example, in 2008, Warren Buffett's Berkshire Hathaway acted as a white knight by investing in Goldman Sachs during the financial crisis, offering financial stability without taking control. This intervention often safeguards shareholder value and ensures smoother transaction processes by aligning with the target company's interests.

Successful Outcomes of White Knight Rescue Deals

White knight rescue deals have demonstrated substantial success in preserving company value and preventing hostile takeovers, as seen in the 2015 Salesforce acquisition of Demandware, which safeguarded Demandware's strategic direction while enabling growth. These interventions often lead to enhanced shareholder confidence, exemplified by the 2008 scenario when Warren Buffett's Berkshire Hathaway invested in Goldman Sachs, stabilizing the firm's financial position during the crisis. Such deals typically result in improved market stability and long-term operational benefits for the targeted companies.

Risks and Challenges for White Knights

White knights in business face significant risks, including overvaluation of the target company leading to financial losses and potential cultural clashes during post-merger integration. They may also encounter challenges like regulatory scrutiny that can delay or derail takeover bids, and resistance from existing management or shareholders wary of the white knight's intentions. Strategic misalignment and unforeseen liabilities of the target company further complicate the acquisition process, increasing the risk of value destruction.

White Knight Impact on Shareholder Value

A prominent example of a white knight in business is when a friendly company acquires a target firm facing a hostile takeover, preserving management and strategic direction. This intervention often stabilizes the target's stock price and can enhance long-term shareholder value by preventing undervalued forced sales. Shareholders typically benefit from improved market perceptions and sustained operational performance following the white knight's involvement.

Recent White Knight Moves in Global Business

SoftBank's $20 billion investment in WeWork in 2023 acted as a white knight move, rescuing the company from bankruptcy and enabling its restructuring efforts. In 2022, Microsoft's acquisition of Activision Blizzard for $69 billion served as a white knight intervention, stabilizing the struggling gaming giant amidst regulatory and financial challenges. Tesla's $1.5 billion capital injection into struggling renewable startups in early 2024 exemplifies white knight behavior, supporting industry innovation while preventing potential market failures.

example of white knight in business Infographic

samplerz.com

samplerz.com