Burn in cash flow refers to the rate at which a business spends its available cash to cover operating expenses. For instance, a startup with $500,000 in cash and monthly expenses of $50,000 has a burn rate of 10 months. This metric helps companies understand how long they can sustain operations before needing additional funding. High burn in cash flow can signal financial distress if revenue generation does not meet or exceed expenses. Tracking this data allows business leaders to adjust budgets, control spending, and plan for fundraising or cost-cutting measures. Investors often analyze burn rate to assess the financial health and sustainability of a company.

Table of Comparison

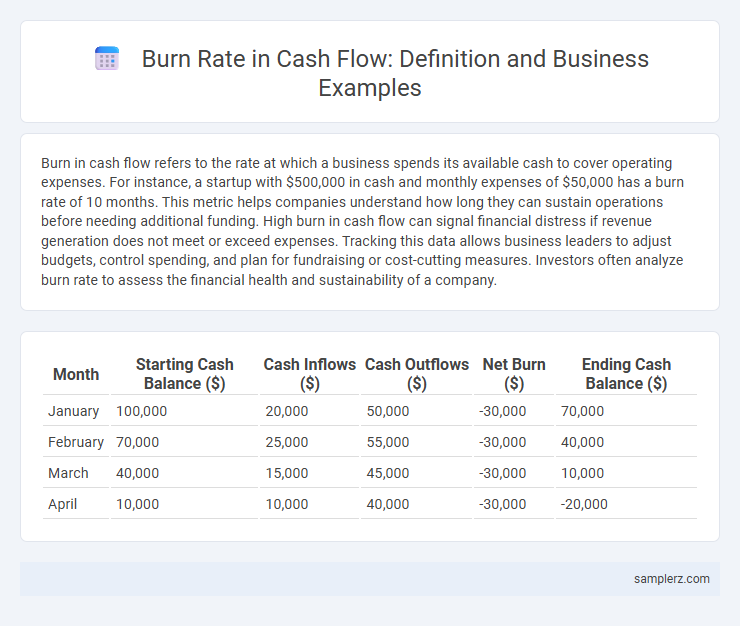

| Month | Starting Cash Balance ($) | Cash Inflows ($) | Cash Outflows ($) | Net Burn ($) | Ending Cash Balance ($) |

|---|---|---|---|---|---|

| January | 100,000 | 20,000 | 50,000 | -30,000 | 70,000 |

| February | 70,000 | 25,000 | 55,000 | -30,000 | 40,000 |

| March | 40,000 | 15,000 | 45,000 | -30,000 | 10,000 |

| April | 10,000 | 10,000 | 40,000 | -30,000 | -20,000 |

Understanding Cash Flow Burn in Business

Cash flow burn in business refers to the rate at which a company consumes its available cash to cover operating expenses, investments, and debts over time. High burn rates, particularly in startups, indicate significant monthly losses that can quickly deplete cash reserves if not managed properly. Monitoring burn rate enables businesses to forecast runway, make informed financial decisions, and implement strategies to optimize cash flow sustainability.

Key Causes of Cash Flow Burn

High operational expenses, such as increased payroll and rising supply costs, are primary key causes of cash flow burn in businesses. Inefficient inventory management leads to excess stock, tying up valuable cash resources that could otherwise support growth. Poor receivables collection processes result in delayed cash inflows, critically impacting the company's liquidity and financial stability.

Real-World Example: Startup Cash Flow Burn

Startup cash flow burn refers to the rate at which a new business depletes its available capital before generating positive cash flow. For example, Uber experienced a significant cash burn during its initial years, investing heavily in market expansion and driver incentives while revenues lagged. This aggressive spending strategy resulted in substantial monthly operating losses but ultimately positioned Uber for rapid growth and market dominance.

Example: Cash Flow Burn in Retail Expansion

Retail expansion often experiences a high cash flow burn due to upfront costs like leasing new store locations, inventory procurement, and employee training. For example, a retailer opening five new outlets might see monthly cash outflows surge by 40% before customer revenue ramps up. This burn rate typically highlights the critical need for sufficient working capital to sustain growth until sales stabilize.

Burn Rate Analysis in Tech Companies

Burn rate analysis in tech companies measures the rate at which a startup consumes its cash reserves to finance operations and growth before generating positive cash flow. Monitoring monthly burn rate helps investors assess financial health, runway duration, and the urgency of securing additional funding. Tech firms often adjust burn rate based on product development cycles, marketing spend, and scaling strategies to optimize capital efficiency.

Cash Flow Burn from Overhead Expenses

Cash flow burn from overhead expenses typically includes fixed costs such as rent, utilities, and salaries that continue regardless of business revenue. For example, a startup paying $20,000 monthly in office rent and $15,000 in employee salaries experiences a cash flow burn rate of $35,000 solely from overhead. Managing these expenses is crucial to extend the runway before securing additional funding or achieving profitability.

Impact of Rapid Growth on Cash Flow Burn

Rapid growth often intensifies cash flow burn as businesses ramp up expenses on inventory, staffing, and infrastructure to meet increased demand. Accelerated revenue does not always translate to immediate cash inflows, causing short-term liquidity constraints that can jeopardize operations. Efficient cash management and forecasting become critical to sustain growth without exhausting financial resources.

Cash Flow Burn Example: Seasonal Businesses

Seasonal businesses often experience significant cash flow burn during off-peak months when revenue declines but fixed expenses like rent and salaries remain constant. For example, a ski resort may generate most of its income in winter, resulting in negative cash flow during summer months that requires careful financial planning or reserve funding. Monitoring burn rates during these periods helps ensure liquidity and operational continuity despite cyclical revenue fluctuations.

Strategies to Manage Cash Flow Burn

Implementing strict expense controls and prioritizing high-impact investments are essential strategies to manage cash flow burn effectively. Regularly monitoring cash flow forecasts enables businesses to identify potential shortfalls early and adjust spending accordingly. Leveraging flexible financing options, such as revolving credit lines or equity injections, can provide critical liquidity during periods of high cash outflow.

Lessons Learned from Cash Flow Burn Cases

Cash flow burn cases reveal crucial lessons for businesses, emphasizing the importance of maintaining a detailed cash flow forecast to anticipate financial shortfalls. Companies that track operating expenses against revenue generation avoid liquidity crises and improve decision-making processes. Implementing stringent expense controls and establishing emergency funding reserves are proven strategies to mitigate the risks associated with rapid cash depletion.

example of burn in cashflow Infographic

samplerz.com

samplerz.com