Dry powder in private equity refers to the capital that investment firms have raised but have not yet deployed in acquisitions or portfolio investments. This reserve of cash enables firms to quickly capitalize on attractive investment opportunities or market downturns without needing to secure immediate additional funding. Managing dry powder effectively is crucial for private equity firms to maintain liquidity and strategic flexibility in competitive deal environments. Data shows that the average dry powder held by global private equity firms exceeds $1 trillion, highlighting the sector's substantial available capital for new investments. Firms with significant dry powder can leverage market volatility to acquire undervalued assets, increasing potential returns for investors. Tracking changes in dry powder levels provides insight into private equity market sentiment and anticipated deal activity trends.

Table of Comparison

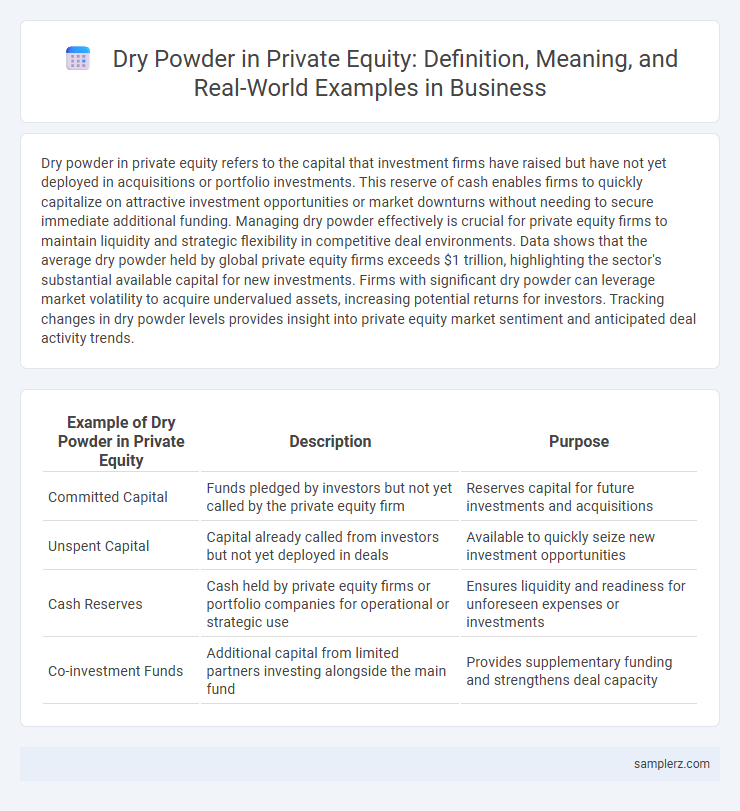

| Example of Dry Powder in Private Equity | Description | Purpose |

|---|---|---|

| Committed Capital | Funds pledged by investors but not yet called by the private equity firm | Reserves capital for future investments and acquisitions |

| Unspent Capital | Capital already called from investors but not yet deployed in deals | Available to quickly seize new investment opportunities |

| Cash Reserves | Cash held by private equity firms or portfolio companies for operational or strategic use | Ensures liquidity and readiness for unforeseen expenses or investments |

| Co-investment Funds | Additional capital from limited partners investing alongside the main fund | Provides supplementary funding and strengthens deal capacity |

Introduction to Dry Powder in Private Equity

Dry powder in private equity refers to the capital that investors have committed but not yet deployed in acquisitions or investments. This reserved cash allows firms to quickly act on market opportunities or cushion against economic downturns, enhancing flexibility in deal-making. High levels of dry powder often indicate strong potential for future investments and strategic growth within private equity portfolios.

Defining Dry Powder: Key Concepts

Dry powder in private equity refers to the capital reserves that firms have committed but not yet deployed for investments, often held in liquid or near-liquid forms. This available capital provides flexibility to seize new opportunities and manage portfolio risks without immediate fundraising. Understanding dry powder is crucial for assessing a firm's capacity to make acquisitions, respond to market shifts, and maintain strategic agility.

Importance of Dry Powder for Private Equity Firms

Dry powder refers to the unallocated capital that private equity firms hold in reserve for future investments, enabling them to act swiftly on attractive opportunities. Maintaining substantial dry powder is critical for private equity firms to navigate market volatility, capitalize on distressed assets, and support portfolio companies during economic downturns. This financial flexibility allows firms to enhance returns, strengthen competitive positioning, and sustain long-term growth.

Classic Examples of Dry Powder in Action

Private equity firms like Blackstone and Carlyle Group often hold significant dry powder, with reserves exceeding $100 billion collectively, enabling rapid acquisitions during market downturns. For instance, Blackstone deployed $18 billion of dry powder to acquire Equity Office Properties in 2007, exemplifying strategic capital use. This reserve capital allows firms to capitalize on distressed assets and undervalued companies, optimizing returns when market conditions shift.

Notable Case Studies: Deploying Dry Powder

Notable case studies in private equity highlight strategic deployment of dry powder, such as Blackstone's $26 billion buyout of Refinitiv in 2019, exemplifying efficient capital utilization amid market volatility. Carlyle Group's timely investment exceeding $10 billion in healthcare platforms during the COVID-19 pandemic further showcases dry powder's role in capturing sector-specific growth opportunities. These examples underline private equity firms' capacity to leverage reserved capital for high-impact acquisitions and value creation.

Dry Powder and Investment Readiness

Dry powder in private equity refers to the capital reserves that investment firms maintain to capitalize on new acquisition opportunities without delay, ensuring swift deployment when market conditions are favorable. Maintaining adequate dry powder enhances investment readiness by enabling private equity firms to act decisively during competitive bids or distressed asset purchases. Effective management of dry powder directly impacts a firm's ability to balance portfolio diversification and seize high-potential investments promptly.

Sources of Dry Powder in Private Equity

Sources of dry powder in private equity primarily include unallocated committed capital from limited partners, capital recycling through portfolio company exits, and retained earnings from realized investments. Institutional investors such as pension funds, endowments, and sovereign wealth funds contribute significant capital commitments that remain uninvested, representing the bulk of dry powder. Secondary market transactions and fund extensions also play a crucial role in replenishing dry powder, enabling private equity firms to deploy capital efficiently.

Impact of Economic Cycles on Dry Powder Levels

Private equity firms accumulate dry powder, the uninvested capital, to capitalize on investment opportunities during economic downturns when valuations are lower. During recessionary cycles, dry powder levels often increase as fundraising continues but deployment slows due to heightened risk aversion. Conversely, in economic expansions, deployment accelerates, reducing dry powder as firms actively invest in growth-stage companies.

Strategies for Managing Dry Powder Effectively

Effective management of dry powder in private equity involves strategically timing capital deployment to capitalize on market dislocations and attractive valuation opportunities. Firms implement rigorous pipeline management and scenario analysis to balance investment pace with fund lifecycle constraints. Maintaining disciplined exit strategies enhances liquidity, enabling redeployment of dry powder in high-conviction deals while optimizing overall portfolio returns.

Future Trends: The Role of Dry Powder in Private Equity

Dry powder in private equity, referring to the uninvested capital ready for deployment, is anticipated to play a pivotal role in accelerating deal activity amid evolving market conditions. As global economic uncertainty persists, private equity firms are strategically accumulating dry powder to capitalize on distressed assets and emerging technology sectors. Increased allocations toward dry powder signal a proactive stance in leveraging future investment opportunities and driving value creation across diverse portfolios.

example of dry powder in private equity Infographic

samplerz.com

samplerz.com